USD’s powerful signal, Platinum’s critical situation and Gold

Can this signal from the USDX be ignored?

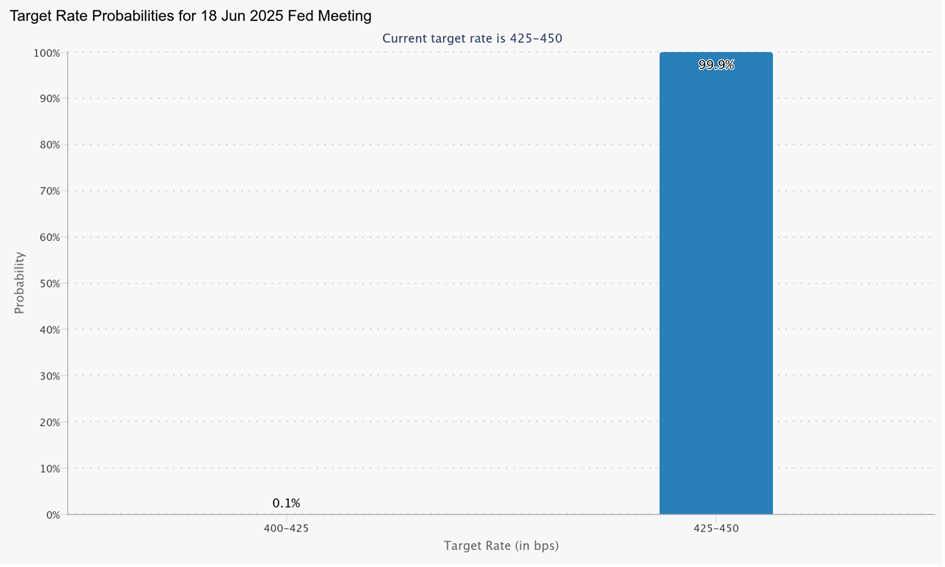

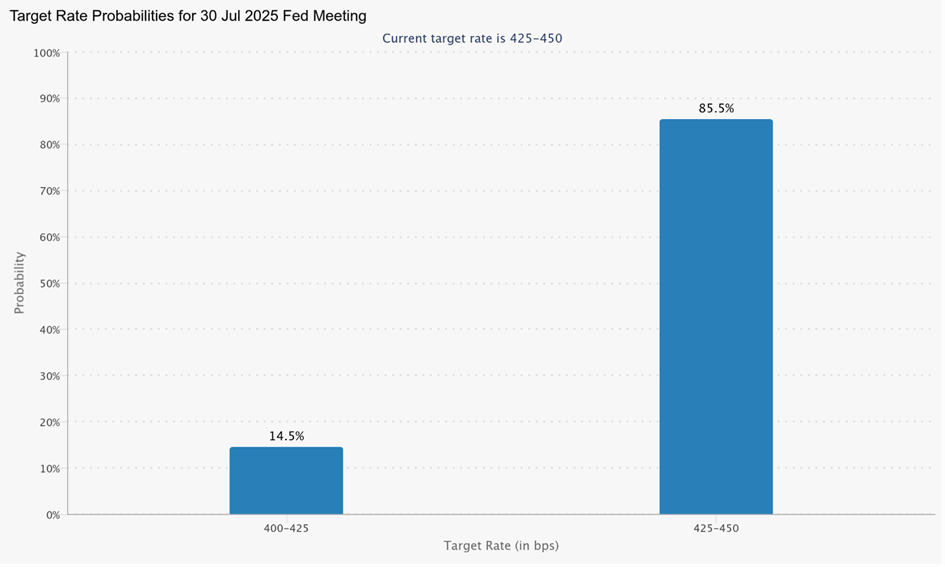

The key context for today’s price moves is the looming interest rate decision from the Fed as well as the press conference, where the markets will try to estimate Fed’s next moves. Pretty much everyone is expecting the Fed to keep the rates where they are (at least that’s what the futures market is indicating), but some people expect the Fed to start cutting rates beginning at the next meeting.

For now, the uncertainty is the name of the game, and the charts clearly show it.

In particular, we can see it in the smallest markets, where a smaller amount of capital can make a significant impact and, thus, where the investment public has a lot to say.

Platinum flashes a caution light

Yes, I mean platinum. Let’s take a look at it before I show you the key news of the day – the USD Index’s strong signal.

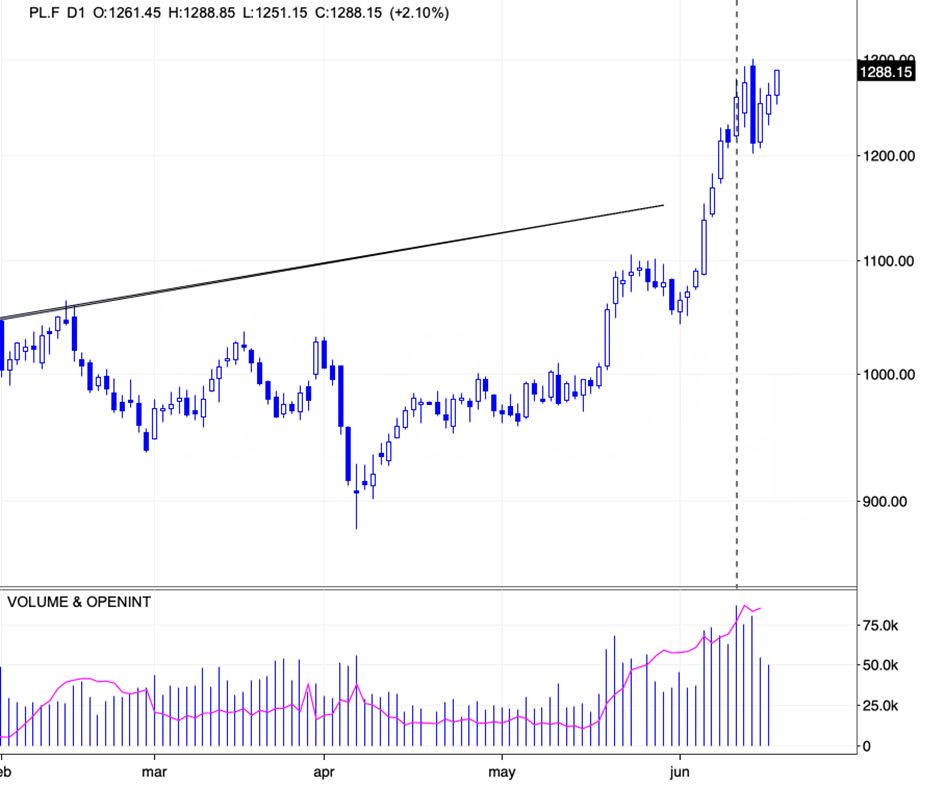

The “little silver” moved very close to its previous high.

Exciting? May be.

Bullish? Not really.

There are three reasons for it:

- The long-term context for this rally makes it very likely that this is a major top. I discussed it in detail last week.

- The shape of this top remains very similar to what we saw at the previous tops in platinum, which I discussed in greater detail on June 12.

- The volume during the recent upswing has been declining, further confirming that this is a double-top, and not the start of another rally.

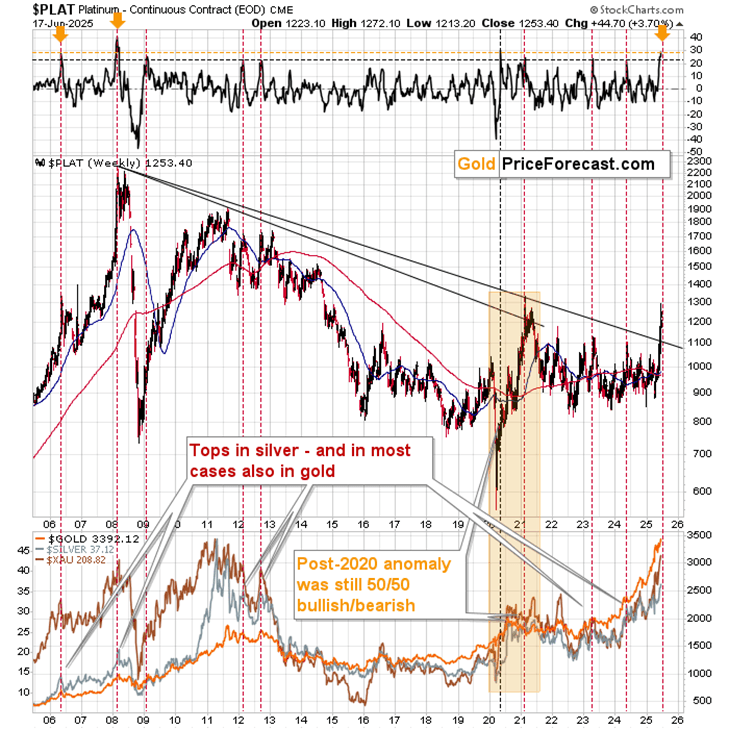

Let’s take a look at platinum from the long-term point of view – updating one of the things from the first point.

The thing is that the platinum-based Rate-of-Change indicator didn’t just move to levels that accompanied big tops – it moved to the level that meant critical ones. The 2006 and 2008 tops were followed by months of declines in gold, silver, and mining stocks. In particular, the 2008 top was “notable” to say the least.

We are in this kind of situation right now.

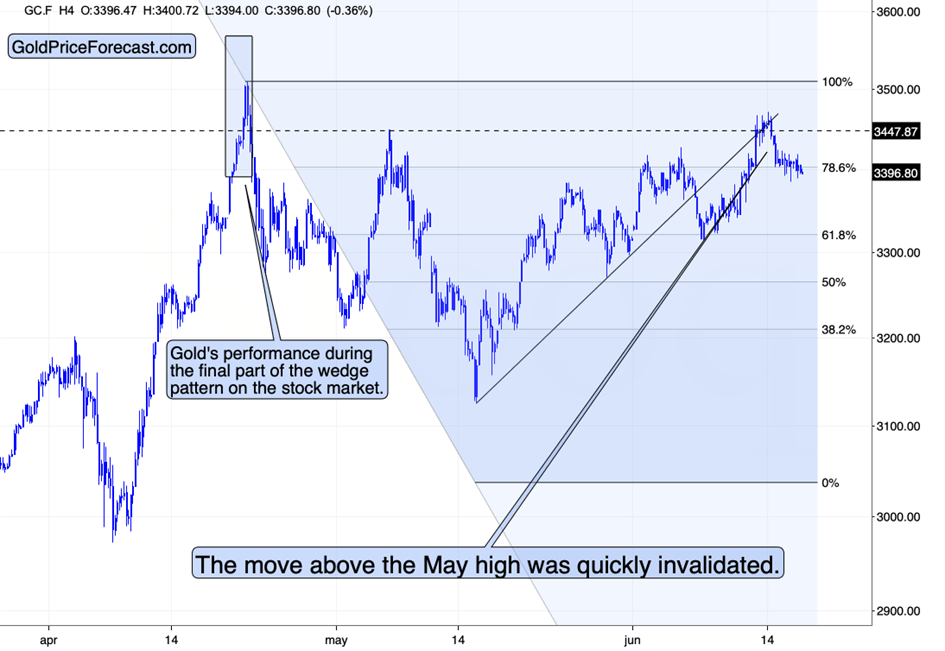

And while platinum is rallying, gold is moving a bit lower.

The yellow metal tried to move back above its early June highs a few times but failed, and right now, it's trading below its 78.6% Fibonacci retracement as well as the psychologically important $3,400 level.

Fundamentals still favor the USD

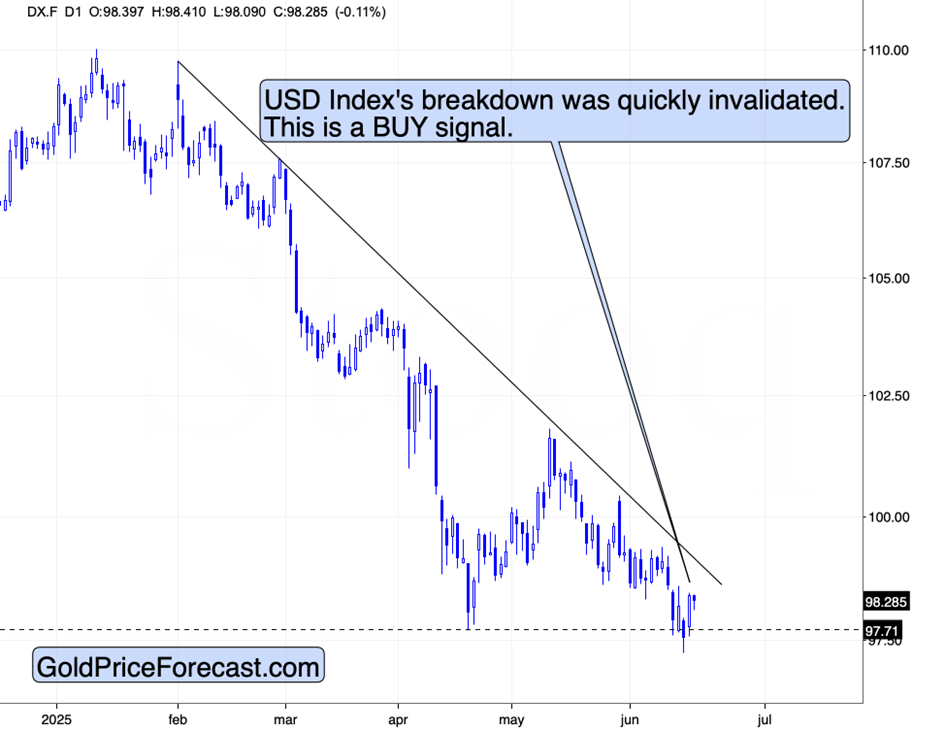

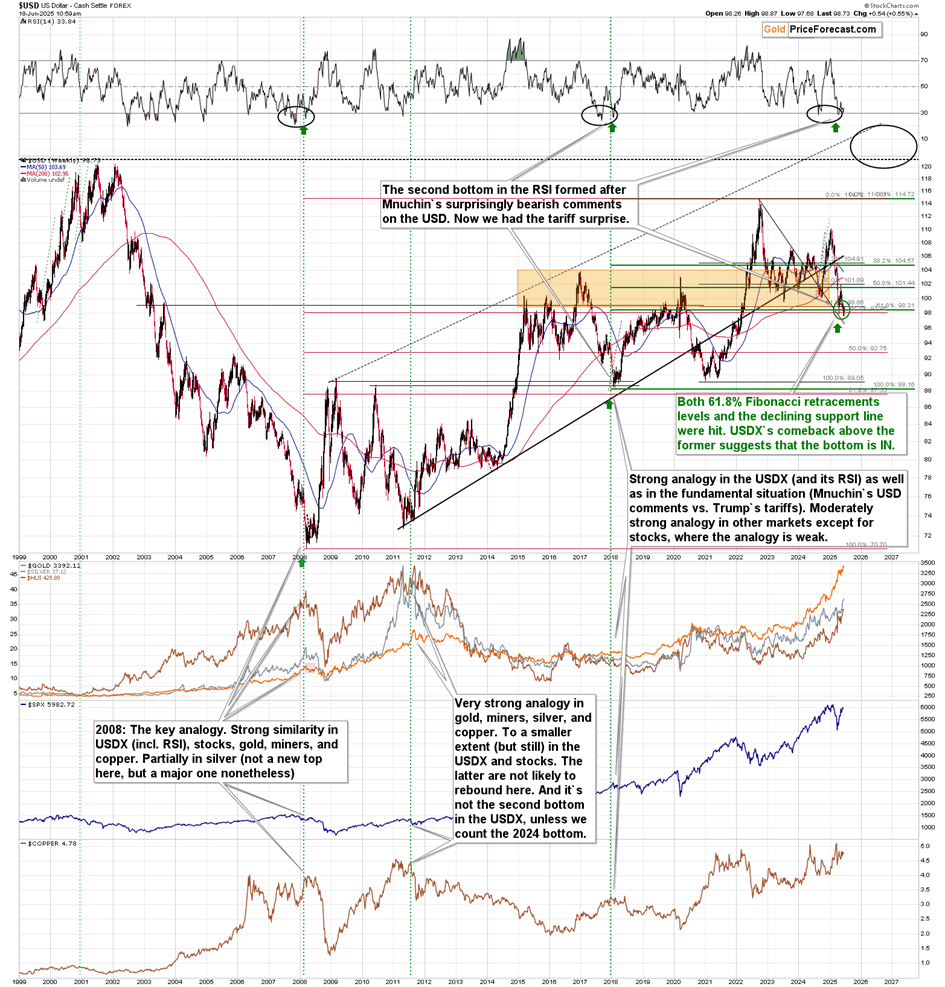

And while the price of gold is declining, the USD Index just flashed a major buy signal despite the overwhelmingly negative sentiment (which confirms the link to 2008).

After a brief move below the April low, the USD soared back up – the breakdown has been clearly invalidated, also in terms of the daily closing prices.

This, plus the very strong long-term support for the USD Index, together create a very promising picture for the U.S. currency, even though most investors will find that hard to believe (just like it was the case at the 2008 bottom).

My previous comment on the above chart remains up-to-date:

“The sentiment… Well, let me just quote a comment from below one of my articles (the emphasis is mine):

“The USD is slumping sharply, feels like that the United States is on the verge of collapse and downfall. Market sentiment is so crazy.”

Is the U.S. collapsing here? Of course, it’s not. Despite the current sentiment, please keep in mind that the USD remains to be world’s reserve currency, the U.S. has the world’s most powerful economy (think about the key global tech and AI players) and the world’s most powerful army. Please also keep in mind that the U.S. tariffs are fundamentally bullish for the U.S. dollar.

And yet, here we are. I’m not sure if many of you remember the USD sentiment at its 2008 bottom. Everyone and their brother thought that the USD was trash. And yet – it soared back with vengeance after this key low.

What happens if the USD declines more? Well, today gold is proving that it can decline even if the USD declines from here, and the same goes for mining stocks.”

The long-term support held.

The short-term breakdown was invalidated.

All this is happening despite the overwhelmingly bearish sentiment, and along with RSI close to 30, proving the extremely oversold conditions.

Honestly, if one is just able not to focus on what other people are feeling right now (the sentiment is “contagious”) and looks at the above facts – it’s clear that it would be difficult to imagine a more bullish setup for the following weeks and months than what we see right now. Will gold, silver, and miners be able to rally despite this buy signal? Right after gold declined even despite lower USD and despite the Israel-Iran military operations? That seems doubtful.

Want free follow-ups to the above article and details not available to 99%+ investors? Sign up to our free newsletter today!

Want free follow-ups to the above article and details not available to 99%+ investors? Sign up to our free newsletter today!

Author

Przemyslaw Radomski, CFA

Sunshine Profits

Przemyslaw Radomski, CFA (PR) is a precious metals investor and analyst who takes advantage of the emotionality on the markets, and invites you to do the same. His company, Sunshine Profits, publishes analytical software that any