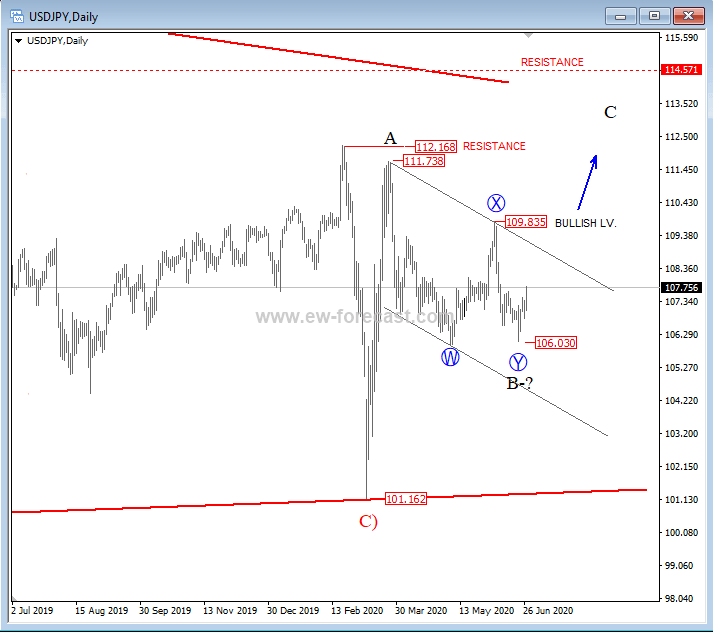

USD/JPY is bullish near-term – Elliott wave analysis

Hello traders,

On the daily chart of USDJPY we see price unfolding a bigger A-B-C move, up from 101.16 level, which can belong to a bigger triangle consolidation. As you can see, wave A found a high at the 111.74 level, from where a three-wave, complex set-back started developing. This set-back is a wave B, and can be near completion, therefore be aware of further upside, above the 109.84 level in days/weeks ahead. That said, we would like to see a rally in five legs of a lesser degree from current 106.03 swing low, which would be first evidence of a completed wave B correction, and that wave C is underway.

USD/JPY, daily

Trade well.

For the first time ever you have a chance to see our charts for 10 days absolutely free, with no obligations or payment. Join our community and look inside of our members area at EW-Forecast. Trade well.

Author

Gregor Horvat

Wavetraders

Experience Grega is based in Slovenia and has been in the Forex market since 2003.