USD wavers ahead of key speeches by Powell and Biden

The price of crude oil held steady as traders reacted to the falling oil inventories in the United States and the strong trade numbers from China. In a report yesterday, the Energy Information Administration (EIA) said that inventories fell by more than 3.2 million last week. This was a bigger decline than the expected 2.24 million. It was also smaller than the previous week’s decline of more than 8 million barrels and the previous estimate by the American Petroleum Institute (API). The price is also reacting to the bullish short-term outlook by the EIA.

Oil price and the Australian dollar rose after the relatively strong trade numbers from China. In a report earlier today, the country’s statistics bureau said that the overall exports increased by 18.1% in December after rising by 21.1% in the previous month. This increase was better than the estimated 15%. Also, imports increased by 6.5% in December after rising by 4.5% in November. Therefore, the trade surplus increased from $75.40 billion in November to more than $78.17 billion.

The US dollar was little changed today ahead of an important speech by Jerome Powell. He will talk about the US economy and what the Fed plans to do going forward. In speeches delivered this week, some Fed members have talked about the possibility of quantitative easing tapering and higher rates in 2022. Also, the dollar is waiting for a stimulus speech by Joe Biden. He has said that stimulus will be his first priority after he takes office next week.

EUR/USD

The EUR/USD is at an important level as shown on the four-hour chart below. It is trading at 1.2165, which is near the lowest level this week. Also, it is slightly below the 23.6% Fibonacci retracement level. It seems like there is a battle between the bears who want to push it lower and the buyers who want to push it higher. Therefore, a break below this week’s lowest point at 1.2130 will lead to a possibility of further declines to the 38.2% retracement at 1.2060.

GBP/USD

The GBP/USD pair is hovering near its highest level in three years as traders react to the statement by Andrew Bailey on negative rates. On the daily chart, the price is slightly below the upper side of the ascending black channel. The price is also above the short and long-term moving averages and is slightly below the upper side of the Bollinger Bands. Therefore, the pair may continue rising as bulls target the upper side of the channel at 1.3700.

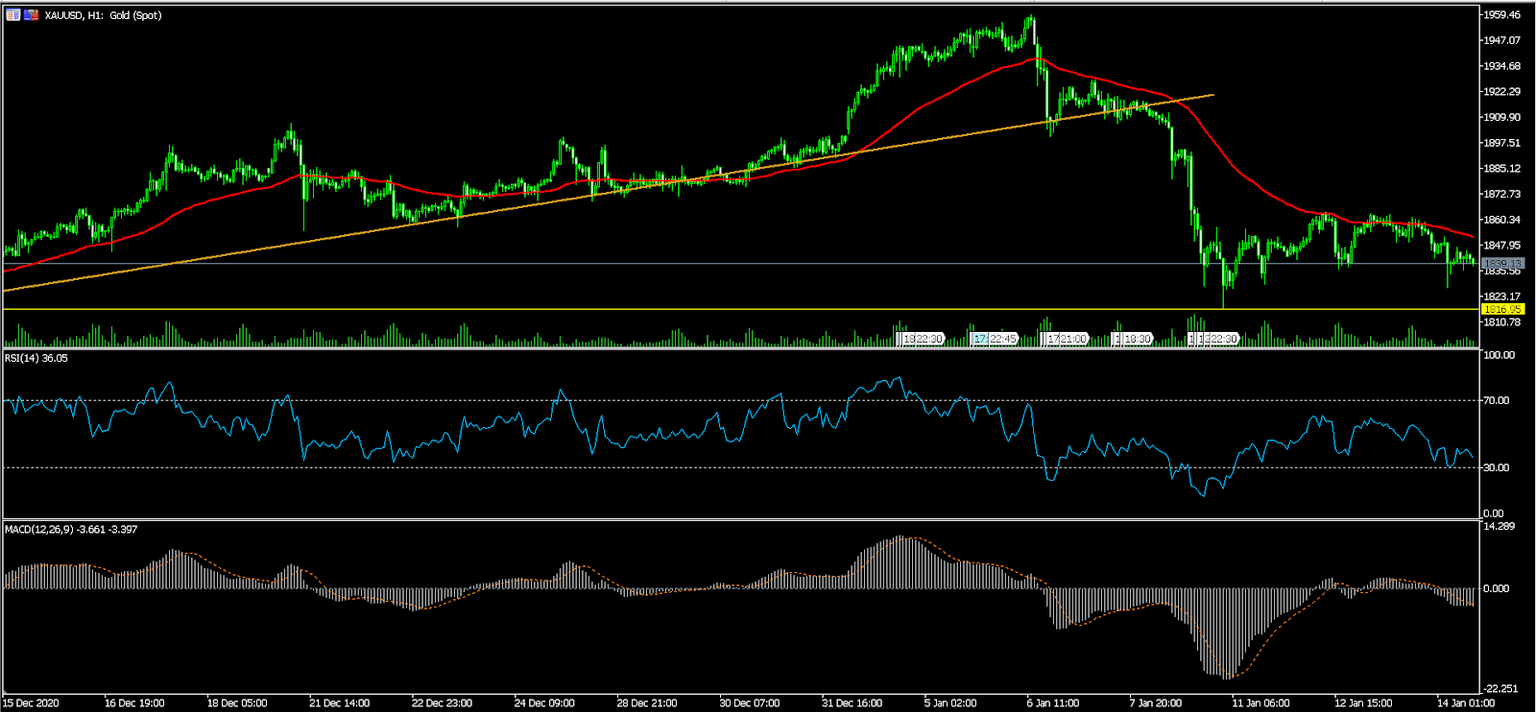

XAU/USD

The XAU/USD pair dropped today as the price of cryptocurrencies rebounded. It is trading at 1,838, which is substantially below yesterday’s high of 1,865. On the hourly chart, the price is slightly below the 25-day exponential moving average. The Relative Strength Index (RSI) and the MACD have also started falling. The pair will likely continue falling as traders aim for the next support at 1,817.

Author

OctaFx Analyst Team

OctaFX

OctaFX is a market-leading forex broker, providing personalised forex brokerage services to customers in over 100 countries worldwide.