USD/NOK: Final 5th wave unfolding toward key support [Video]

![USD/NOK: Final 5th wave unfolding toward key support [Video]](https://editorial.fxsstatic.com/images/i/Norway_XtraLarge.png)

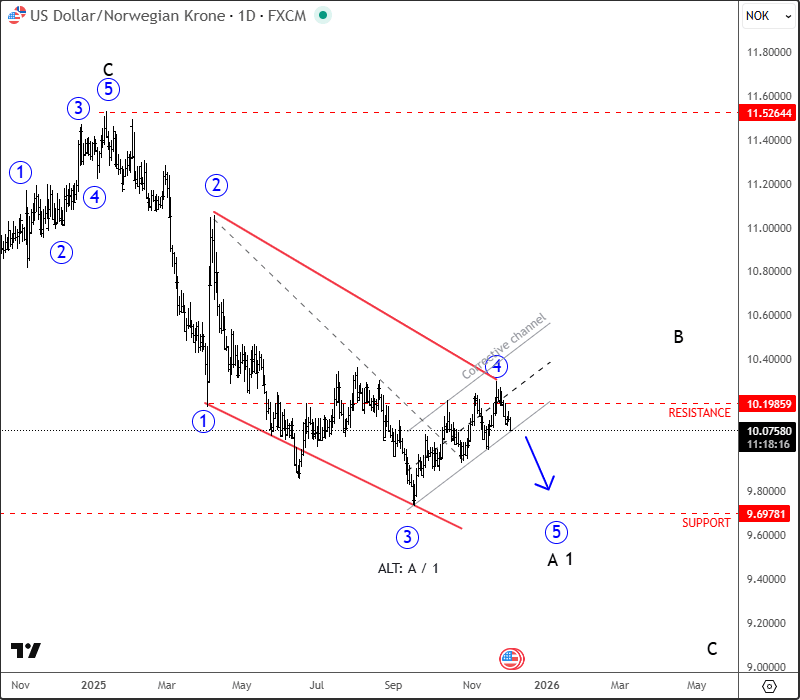

We discussed USD/NOK with our members back on December 03, 2025, where we highlighted the development of a potential final 5th wave.

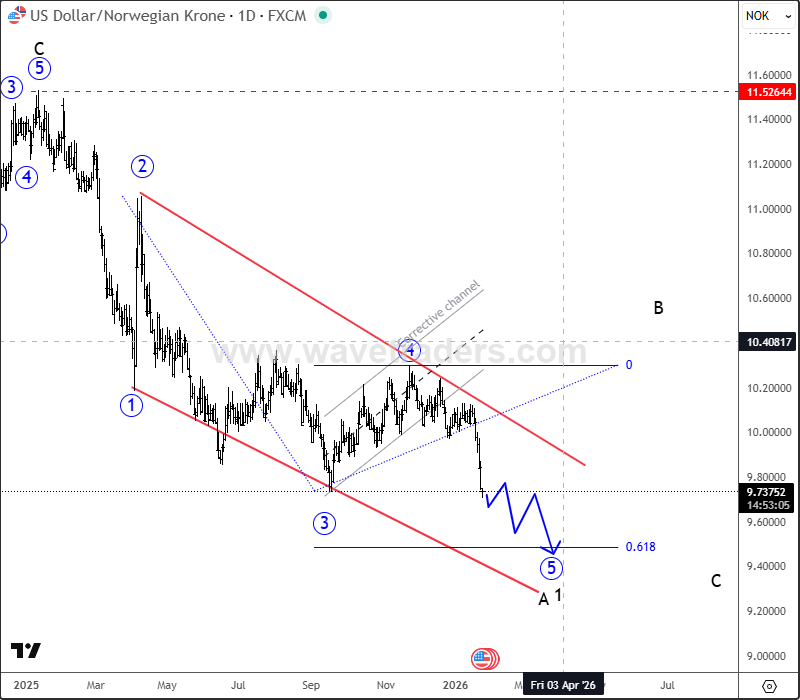

Over the past few months, USDNOK traded within a wave 4 corrective phase. Price action has now turned lower again and is approaching prior lows, signaling the anticipated wave 5 decline. This move can represent the final leg of a larger leading diagonal formation, completing wave A/1. That said, there is still room for additional weakness within wave 5, with downside potential toward the 9.50–9.30 area near the lower diagonal line. This zone may act as temporary support, from where the pair could begin recovering into a higher-degree wave B/2 corrective bounce.

For a detailed view and more analysis like this you can watch below our latest video analysis recorded on January 23:

Get Full Access To Our Premium Elliott Wave Analysis For 14 Days. Click here.

Author

Gregor Horvat

Wavetraders

Experience Grega is based in Slovenia and has been in the Forex market since 2003.