USD keeps struggling

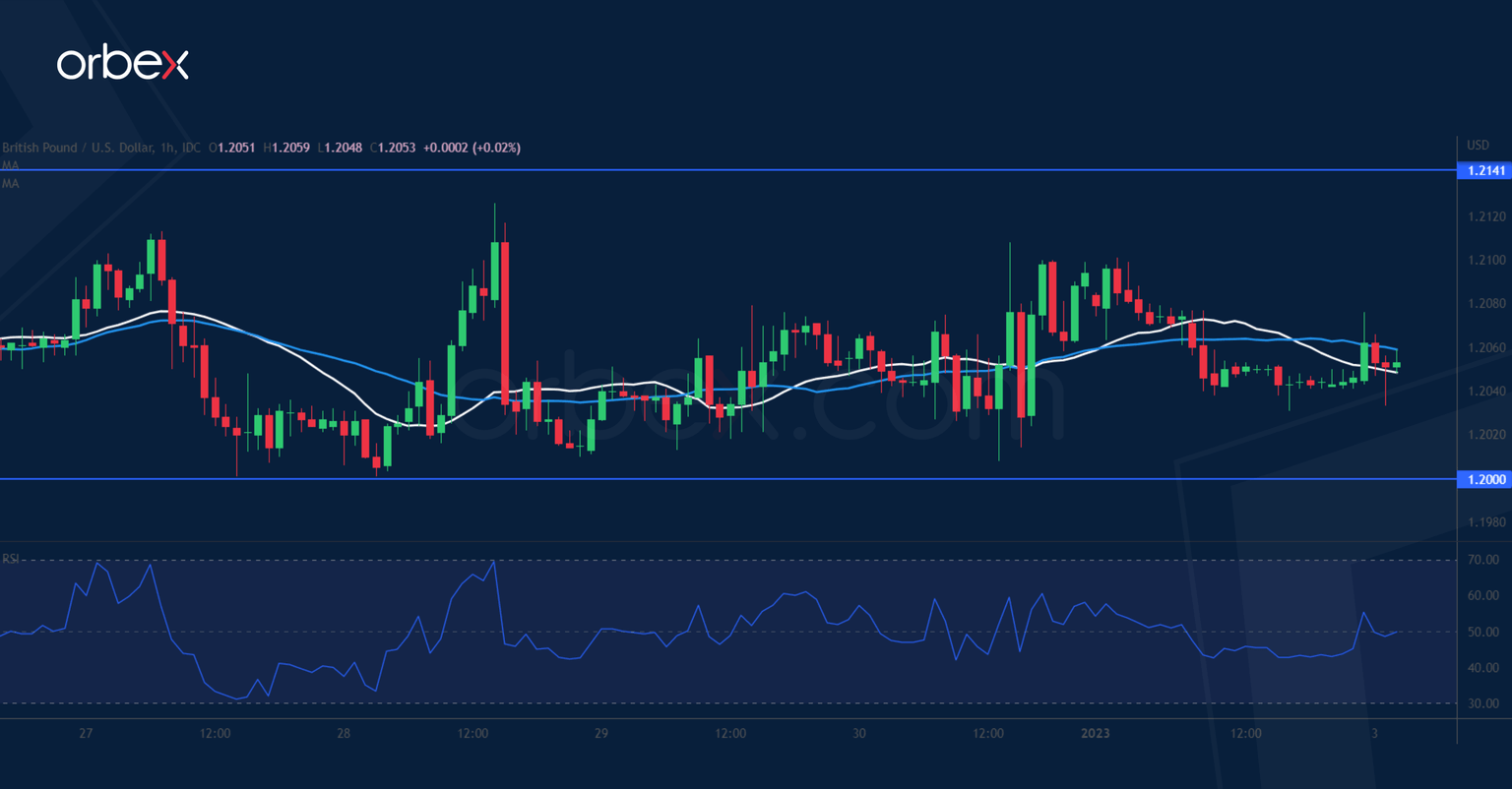

GBP/USD seeks support

The pound underperforms as market participants remain worried about the UK’s economy in 2023. The pair continues to drift lower due to buyers taking profit after a two-month long rally and new sellers getting into the game. The psychological level of 1.2000 sits at the origin of last December’s rally and the sideways action is a sign of little buying. Though the price would remain depressed as long as it is under 1.2140, sentiment may only turn around if the bulls reclaim 1.2280. 1.1900 is a critical level to keep Sterling afloat.

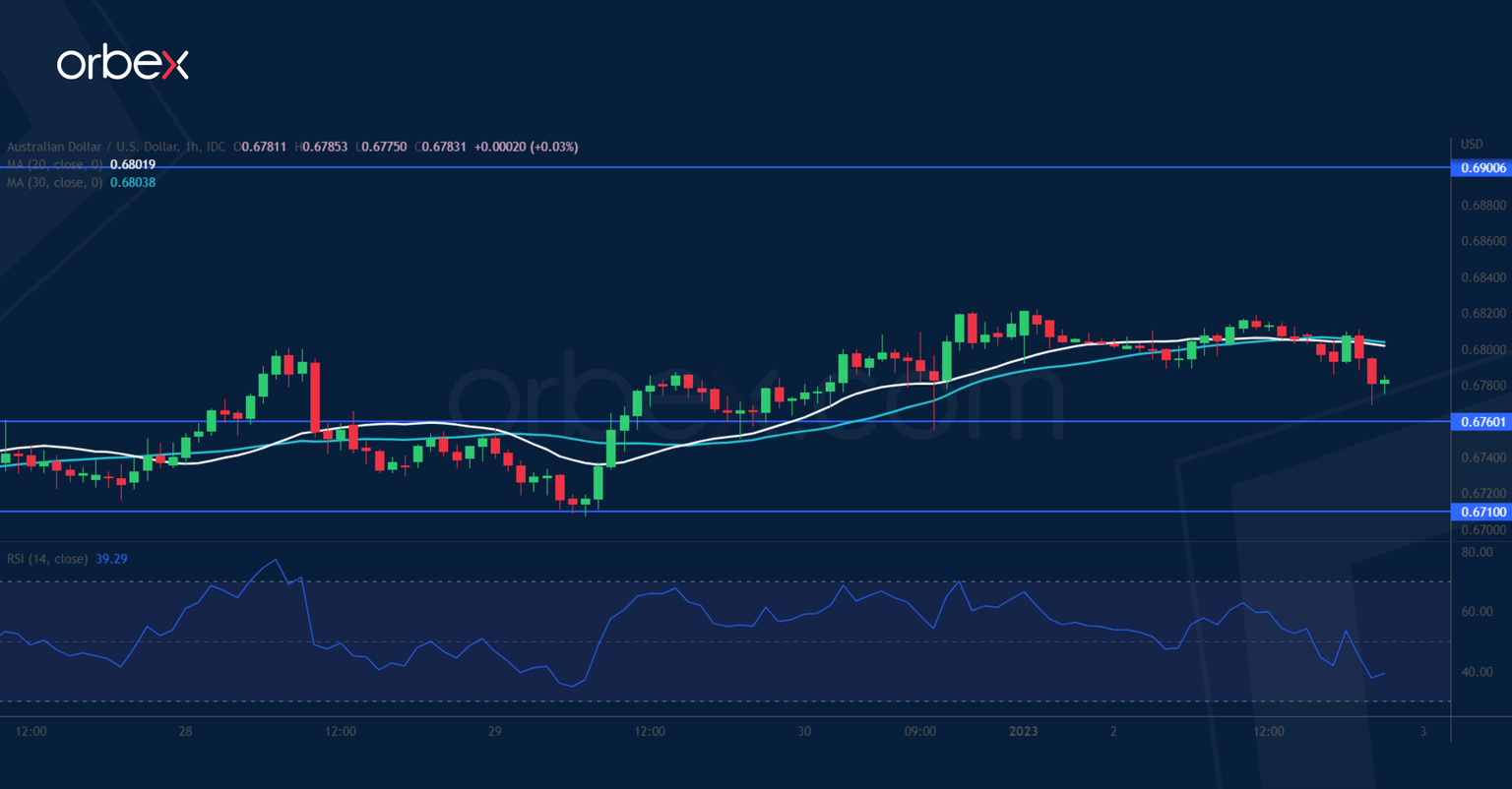

AUD/USD recoups losses

The Australian dollar edges higher as traders shun safe haven assets like the greenback. The pair has clawed back a big chunk of its losses from the liquidation in mid-December. The bulls have shifted their focus to the previous peak at 0.6900. A bullish breakout would extend the aussie’s recovery in the medium-term. In the meantime, they may consolidate their holding above 0.6800 with 0.6760 as the closest support. That would attract more buying interest. 0.6710 is a second layer of defence in case of further hesitation.

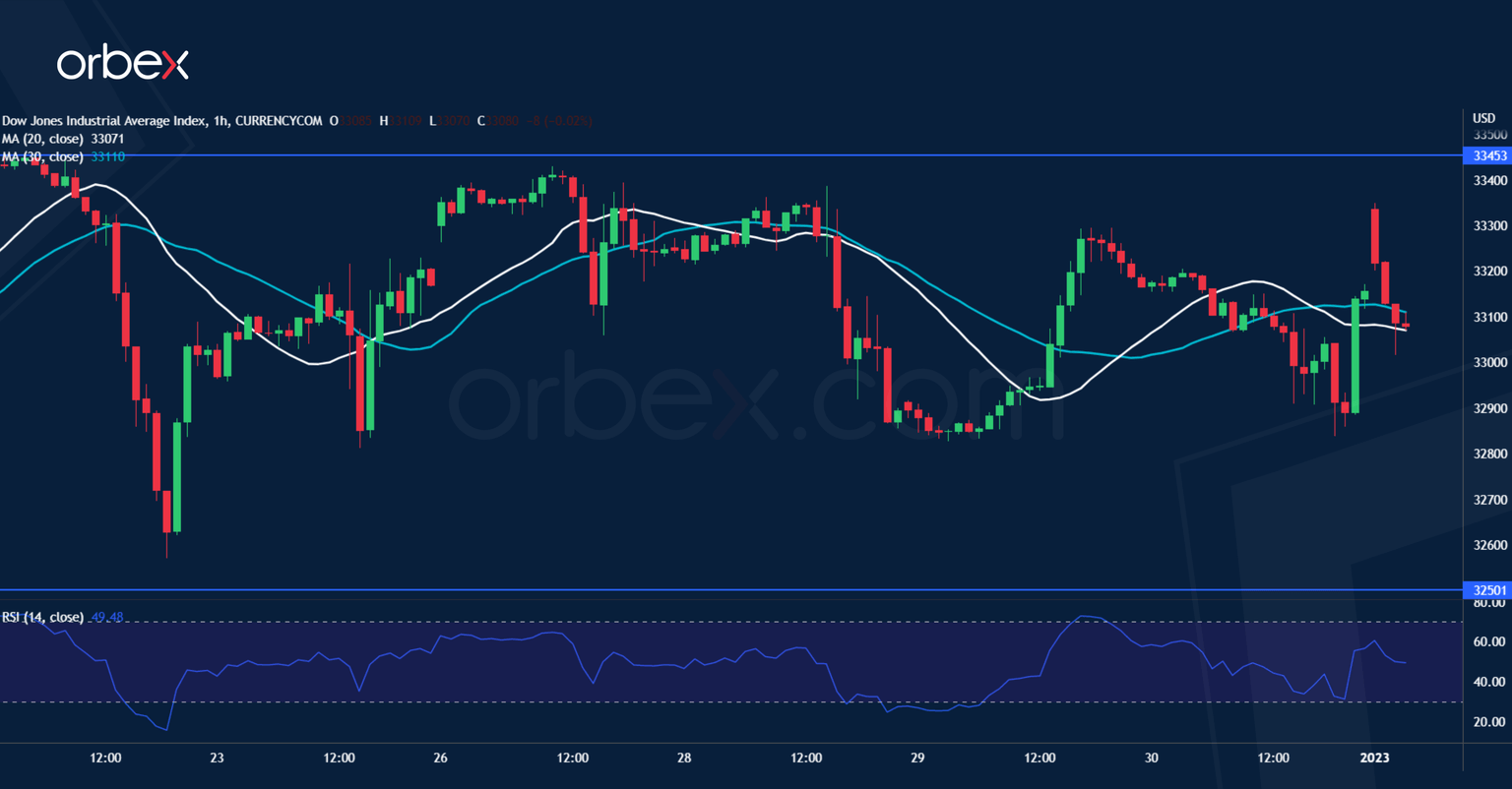

Dow Jones 30 awaits breakout

The Dow Jones ebbs and flows as investors probe risk appetite at the start of the year. The index has been struggling to hold onto the critical floor at 32500. The horizontal consolidation is a sign of a fragile balance and a breakout would heighten volatility due to increased pressure from both sides, shaping a new trading range for the days to come. A close above 33450 may carry the index back to 34100. However, a bearish breakout could trigger a new round of sell-off towards 31500 with more buyers abandoning ship.

Author

Jing Ren

Orbex

Jing-Ren has extensive experience in currency and commodities trading. He began his career in metal sales and trading at Societe Generale in London.