USD/JPY wobbles below 154.00

- USD/JPY gets rejected near 154.00 as Fed supports future rate cuts.

- Technical signals show vulnerability, selling capped above 150.70.

USD/JPY opened the day with soft momentum near 153.35 after failing to close above the 154.00 level on Wednesday. The pullback followed the Fed’s decision to leave interest rates unchanged, while Powell acknowledged the possibility of lower interest rates later in the year should inflation slow. At the same time, he struck a hawkish tone by emphasizing the resilience of the economy and the strength of the labor market, arguing that interest rates are not yet at restrictive levels. He also reiterated that policy decisions will remain data-dependent, which kept the pair largely on the sidelines in the aftermath.

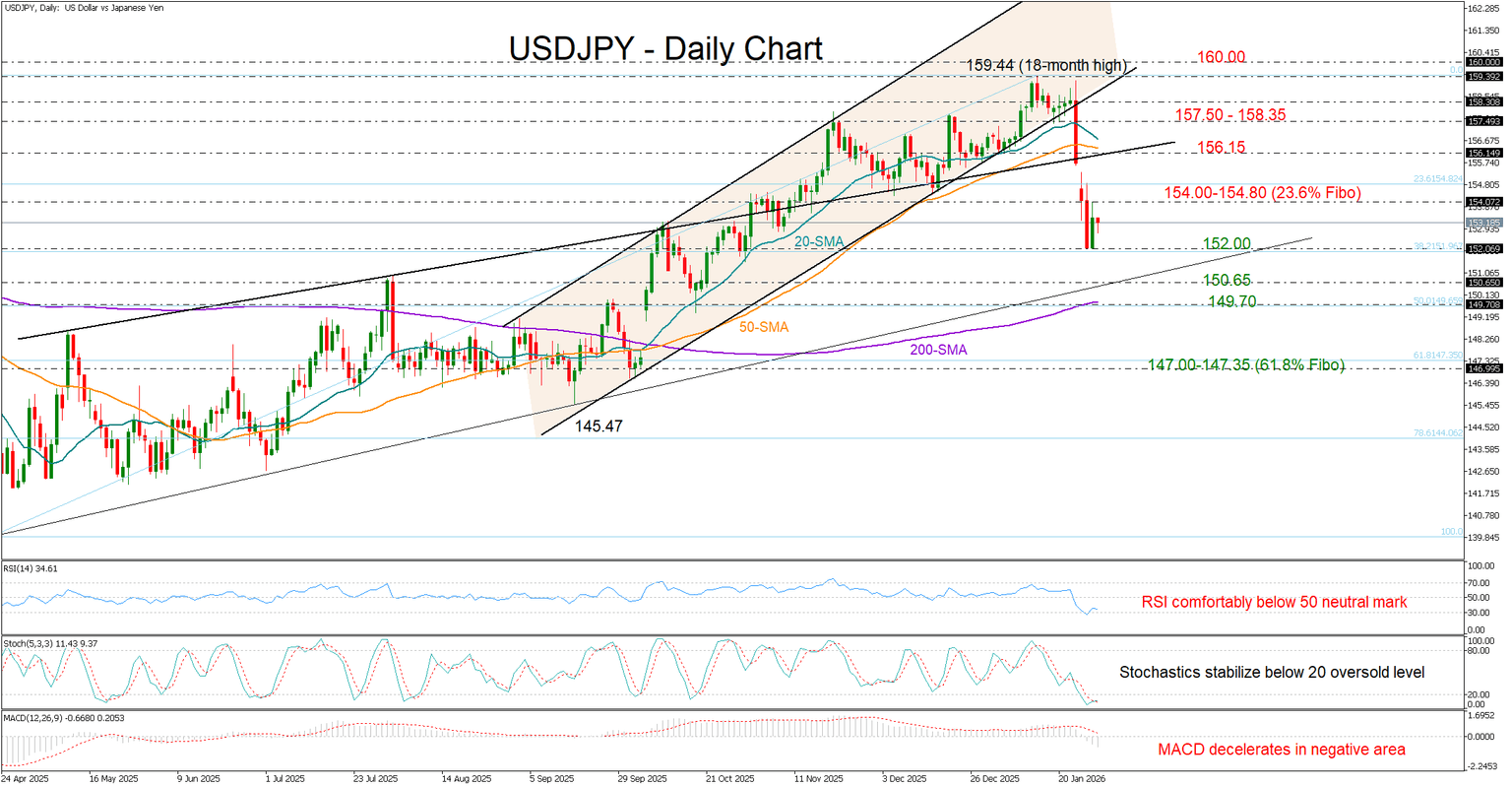

With upside momentum lacking and technical indicators remaining in bearish territory, downside risks appear to outweigh upside potential, keeping the focus on the 152.00 support area. A break below this level could expose the pair to the 150.70 region, where the ascending trendline from April is located. Slightly lower, the 200-day simple moving average (SMA) may attempt to cease the sell-off near the 50% Fibonacci retracement of the April–January upleg around 149.70. Further declines could gather pace towards the 147.00–147.35 area.

In a bullish scenario, if the pair rebounds above the 154.00–154.80 zone, attention would shift to the 20- and 50-day SMAs, which are converging near 156.15. Beyond that, congestion could emerge between 157.50 and 158.35 before the bulls attempt a close above the 18-month high of 159.44 and the psychological 160.00 level.

Overall, USD/JPY continues to trade in a bearish zone. However, with key support levels approaching, sellers may need stronger momentum to attract fresh selling pressure below 150.70.

Author

Christina joined the XM investment research department in May 2017. She holds a master degree in Economics and Business from the Erasmus University Rotterdam with a specialization in International economics.