USD/JPY Weekly Forecast: In the US its GDP vs inflation

- Bank of Japan may extend relief programs past September.

- Dovish Powell refuses to say when bond purchases will be reduced.

- Treasury yields offer possible counterpoint to Fed monetary policy.

- Rising US inflation can erode real interest rates.

- FXStreet forecast Poll sees no upside potential for USD/JPY

Central bank policy in Japan and the United States captivated headlines this week but the dollar’s long-term position is under increasing threat from the erosion of real interest rates by inflation.

The USD/JPY rose moderately but remained below resistance at 109.30, as offsetting dovish outlooks from the Bank of Japan (BOJ) and the Federal Reserve left the pair without motive.

In Japan, the BOJ kept monetary policy unchanged as universally anticipated. Governor Haruhiko Kuroda said he is prepared to extend the pandemic relief programs beyond the September deadline. He did not expect inflation to reach its 2% target by the time of his retirement in early 2023.

Rising COVID-19 cases and a slow vaccination rollout have brought on a third state of emergency in Tokyo, Osaka and two other prefectures, inhibiting prospects for an economic recovery, though the BOJ did raise its quarterly growth forecast. The USD/JPY saw its largest one-day gain of the week after the BOJ meeting on Tuesday.

In the US, the central bank also left policy unaltered. Fed Chair Jerome Powell refused to speculate when or under what conditions the governors might reduce the $120 billion of monthly asset purchases that have pinned the short end of the Treasury yield curve.

The US economy expanded at a 6.4% annualized rate in the first quarter, slightly more than predicted. Initial Jobless Claims dropped to 553,000 in the latest week, the lowest level of the pandemic era. Inflation was stronger than projected in March with the headline Personal Consumption Expenditure Price Index (PCE) rising 2.3% on the year, outstripping the 1.6% forecast by a wide margin. Core PCE was 1.8% as expected.

The current bout of US inflation is temporary and largely due to the base effect from the steep decline in prices last year during the lockdown, as the Fed has asserted.

But behind the immediate rationale, fast-rising commodity prices, consumer demand and massive spending by the Federal government may be altering the general price structure.

If the basal inflation rate in the US does increase it will undermine the advantage that rising Treasury yields have provided the dollar this year.

American consumer sentiment rose sharply in April. The Conference Board Consumer Confidence Index jumped to 121.7 from 109.0 in March, far ahead of the 113.0 estimate. It was the best reading since February 2020 and the 31.3 increase in the index over two months was the largest in the history of the series which goes back to 1967.

Treasury yields were higher on the week opening at 1.56% on Monday and ending nine basis points to the good at 1.63% on Friday.

In Japan, Retail Trade (sales) rose 5.2% for the year in March, the highest increase since last October and a strong reversal of April’s 1.5% decline. Industrial Production was also much more vibrant than forecast at 4% in March on a 0.0% forecast and 2% decrease in February.

Inflation was again a cause for BOJ concern as annual Tokyo CPI fell 0.6% in April, three times the -0.2% forecast.

USD/JPY outlook

The USD/JPY has been propelled this year by the increase in US interest rates and that advantage will continue to underpin the USD/JPY this week

Though the long-term dollar benefit of higher Treasury yields is under potential threat as rising US inflation reduces the currency's real interest rate margin, for the moment the trade impact on the USD/JPY is limited.

The 10-year Treasury yield has added over 70 basis points since the New Year and 10 this week. In the past month, US CPI has jumped from 1.7% to 2.6% and it is expected to rise further as the base index differential over last year increases.

American economic growth is easily outpacing Japan’s and the pandemic status in the US adds to the dollar’s advantage.

Treasury rates will rise despite the Feds obvious reluctance to sanction such, but the key for yields is inflation. Whether the increase in US inflation is transitory or not will not be known for several months.

If inflation assumes a higher plateau, the impact on real US interest rates–nominal rates minus inflation–could actually reduce the return on US debt in comparison to foreign competitors. This is particularly relevant for Japan where the extremely low or negative inflation rate adds to the return of Japanese Government Bonds (JGB).

For the immediate future, markets will consider US inflation temporary and slowly rising Treasury rates will support the USD/JPY.

Nonfarm Payrolls on Friday should provide the dollar with a good base throughout the week as nearly a million new positions are forecast. Purchasing Managers’ Indexes for April will emphasize the excellent business prospects.

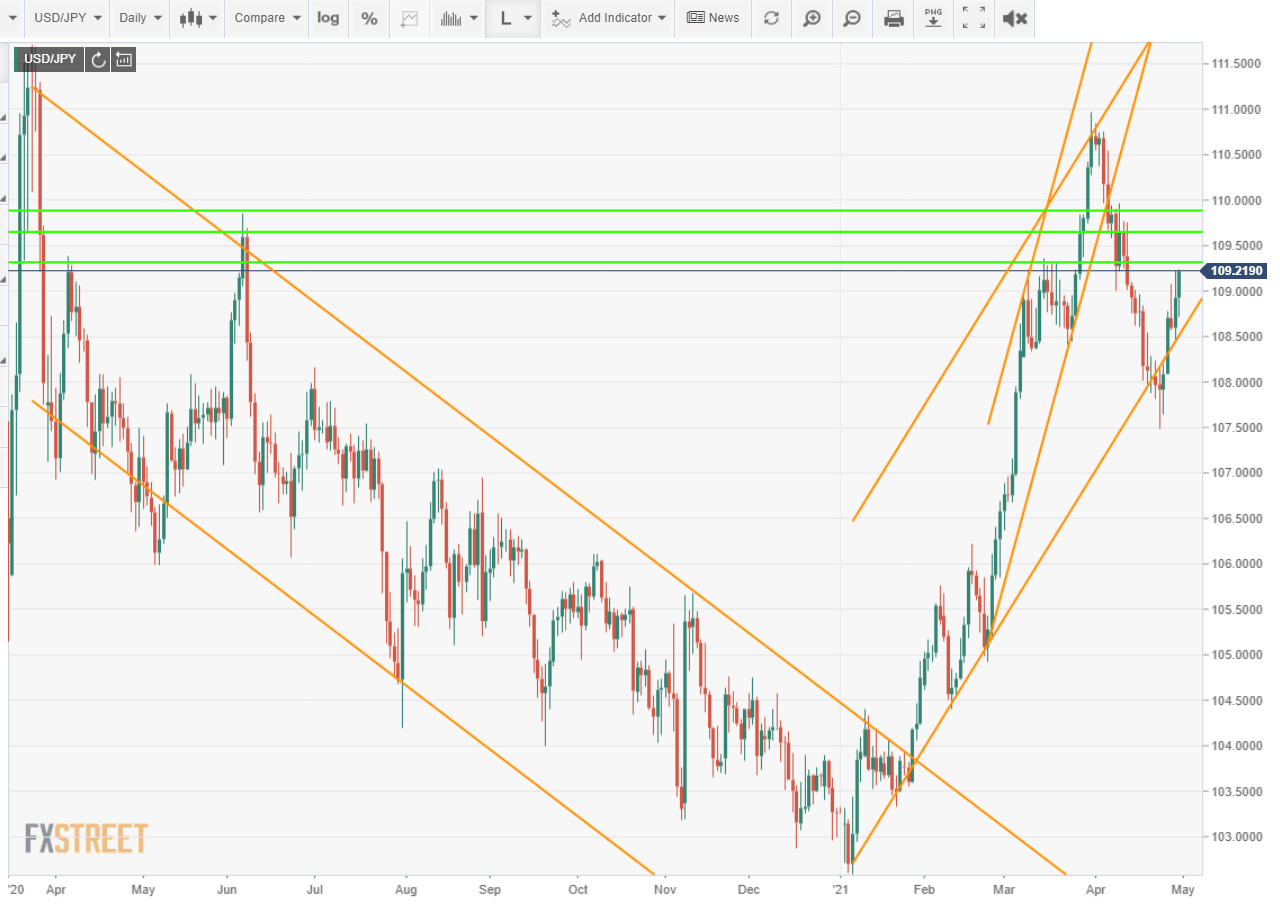

Technically, the resistance at 109.30 is not strong but the USD/JPY should be contained below the March high close of 110.96.

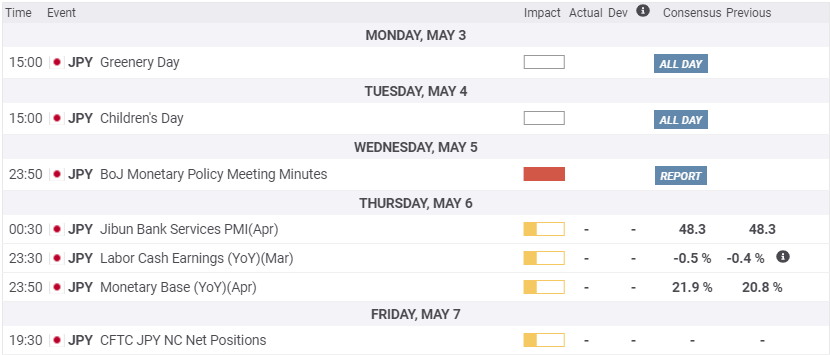

Japan statistics April 26–April 30

The BOJ meeting offered no changes in policy. The possible extension of pandemic relief past September gave the USD/JPY a small boost. Inflation, or rather deflation, is again a problem for the BOJ with Tokyo prices falling for the seventh straight month.

FXStreet

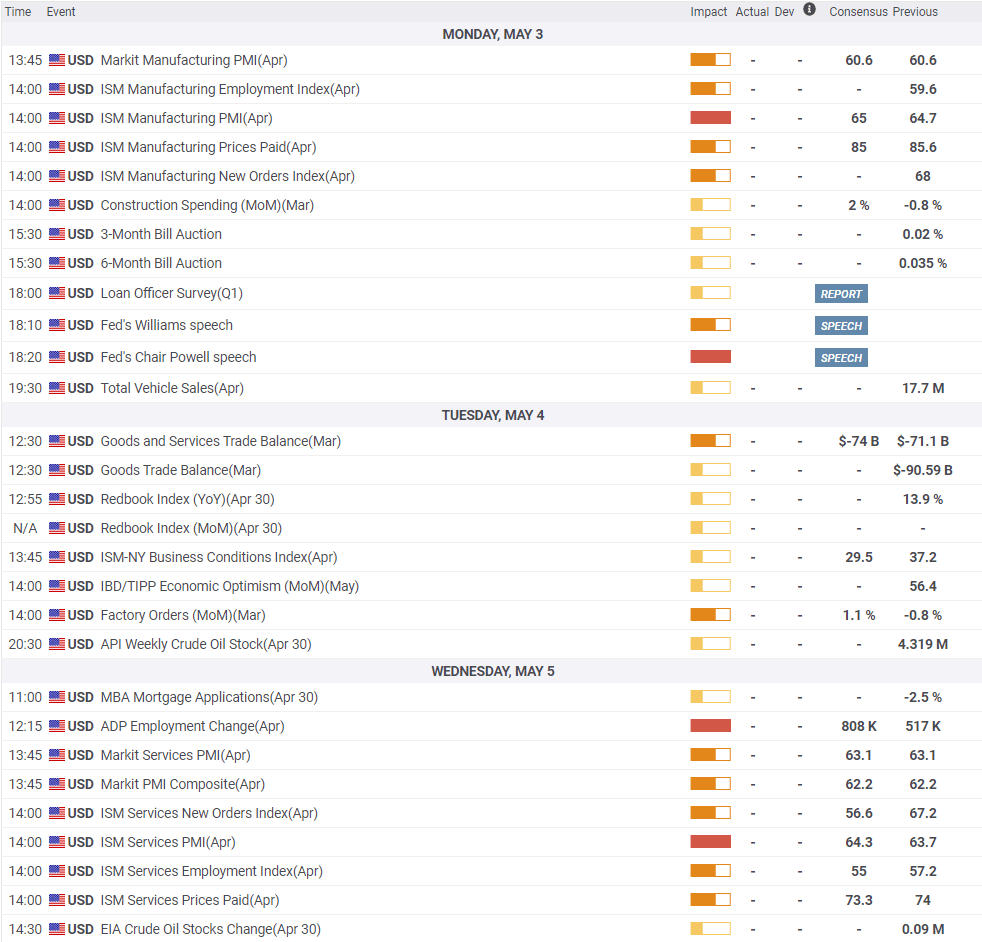

US statistics April 26–April 30

The Fed's pronounced caution put a crimp in the dollar. Otherwise, the stellar US economic performance could have been expected to push Treasury rates and the dollar higher. Fed Chair Jerome Powell's formulation "substantial further progress" for when the FOMC might consider tapering its bond purchases, gave no indication when or under what economic circumstances the bank might act. Mr. Powell repeated the phrase in response to every question from reporters that sought clarification. From his studied performance, it may be deduced that Mr. Powell, and presumably the governors, feel it necessary to avoid any optimism lest that give the Treasury market a reason to drive rates higher.

FXStreet

Japan statistics May 3–May 7

No data market importance this week.

FXStreet

US statistics May 3–May 7

The Institute for Supply Management's Purchasing Managers' Indexes for manufacturing and services should confirm the powerful business support for the expansion. Friday's April payroll report is expected to be another blow-out and anticipation should keep the dollar bid throughout the week.

USD/JPY technical outlook

The USD/JPY's sharp rebound from the 38.2% Fibonacci level of the 2021 gain makes the profit motive of the April decline self-evident. Treasury rates and the strength of the US economic recovery are the important background because any positive fundamental development will overwhelm technical levels.

The head-and-shoulders formation from late March and early April provides the main resistance lines. Support stretches in intervals to 108.00 but then gaps a figure lower. Friday's cross of the 21-day moving average (MA) at 108.96, an unusually fast reversal since the average had changed direction just two weeks ago, adds to support at 109.00. The 100-day and 200-day averages are below support at 107.00. The Relative Strength Index (RSI) at 58.29 crossed neutral this week and is a buy signal.

Resistance: 109.30, 109.65, 109.85, 110.40, 110.75

Support: 109.00, 108.40, 108.00, 107.00

USD/JPY Forecast Poll

The FXStreet Forecast Poll highlights the technical obstacles above the current level of the USD/JPY but undervalues the improving fundamental aspects of the US dollar.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Joseph Trevisani

FXStreet

Joseph Trevisani began his thirty-year career in the financial markets at Credit Suisse in New York and Singapore where he worked for 12 years as an interbank currency trader and trading desk manager.