USD/JPY Weekly forecast: A long expected party

- USD/JPY breaks out of seven-month descending channel.

- Trading at 2021 high, returns to the level of early November.

- USD/JPY moves through the 21-day and 100-day moving averages.

- Fibonacci 50% line next important resistance above market.

- FXStreet Forecast poll predicts a resumption of the downtrend

The USD/JPY moved sharply higher this week breaking the upper border of the descending channel that has contained trading for seven months. Aided by better than expected US Durable Goods data on Wednesday and the improving pandemic case and hospital rates the upper border of the channel at 104.00 presented little difficulty. The USD/JPY closed at 104.18 on Wednesday, consolidated on Thursday and resumed the its strong rise on Friday, ending the week at 104.70, its best finish since November 12.

The upward move crossed several technical barriers, the 21-day moving average on Tuesday, the 23.6% Fibonacci on Wednesday, and the 100-day average and 38.2% Fibonacci on Friday.

Japanese data was mostly retrograde or negative. Consumer Confidence in January dropped to 29.6 its lowest level since August. In one positive development deflation eased with Tokyo CPI dropping 0.5% on the year in January less than half the -1.3% rate in December and the -1.2% forecast. Retail Trade fell 0.3% in December and Housing Starts dropped 9% on the year doubling November decline of 3.7%.

USD/JPY outlook

This week's yen weakness belied the notion that the strengthening dollar was primarily a risk-aversion development. Variously ascribed to nervousness over US equity turmoil or fears that the Biden administration's stimulus package will be less than $1.9 trillion, the more sensible view is that declining pandemic rates in the US and the strong business investment spending correctly anticipates a second quarter economic recovery. The Federal Reserve's neutral view of the US economy assisted the dollar by letting US statistics stand on their own without second-guessing by the central bank.

The 50% Fibonacci at 105.29 of the July to January move, combined with resistance at 105.35, is the next substantial barrier. The a weak line at 105.00 and the noted USD/JPY tendency to respect whole yen levels may provide a pause but the break followed by confirmation means that the upside is now open. There is plentiful resistance to 108.00. How quickly or slowly the USD/JPY traverses that area depends on the success and speed of the US economic recovery. For the past eleven months it has been a dollar show, that show will go on.

Japan statistics January 25-January 29

Deflation eased in December, Retail Trade was not as weak as anticipated, and Industrial Production fell less than anticipated but that was the best Japanese data had to offer.

Monday

The Corporate Service Price Index for December, which tracks the prices of services trades among companies, fell 0.4% on a -1.3% forecast and -0.5% in November.

Tuesday

November's Coincident and Leading Economic Indexes were revised to 89 from 89.4 and 96.4 from 94.3 respectively. Retail Trade for December (YoY) fell 0.3%, just ahead of its -0.4% estimate. It rose 0.6% November. Large Retailer Sales for December dropped 3.5% after -3.4%in November.

Thursday

Tokyo CPI (YoY) fell 0.5% in January, less than half the -1.2% forecast and December's -1.3%. Tokyo CPI ex Food and Energy rose 0.2% on a -0.3% prediction and December's 0.4% decline. Industrial Production lost 1.6% (MoM) and 3.2% (YoY) in December after -1.5% and -3.9% prior. The forecasts were -1.5% and -3.5%. The Unemployment Rate was unchanged at in December. The Jobs/Applicants Ratio was stable at 1.06 in December.

Friday

Housing Starts in December fell 9% (YoY) more than double the -3.8% prediction and the -3.7% November result. Starts have fallen for 18 straight months. Construction Orders for December fell 1.3% after -4.7% previous. December's Consumer Confidence dropped to 29.6 from 31.8 in November.

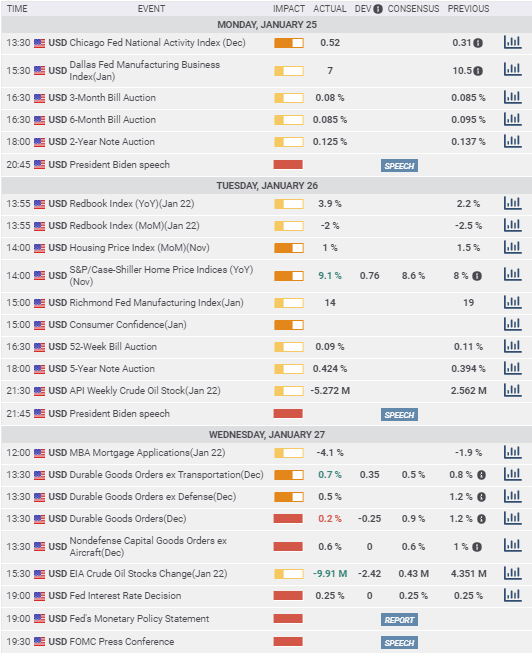

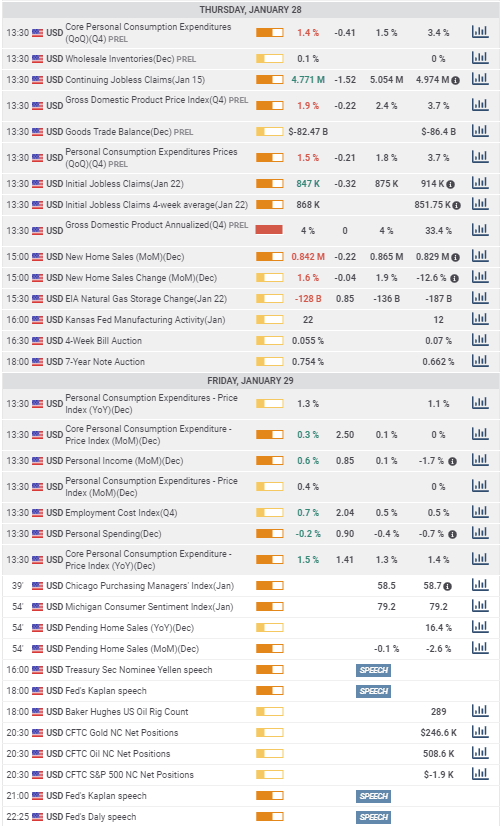

US statistics January 25-January 29

The Fed's neutral stance on US economic prospects may have aided the dollar while Durable Goods Orders provided notice that beneath the pandemic gloss businesses continue to prepare for the future. Fourth quarter GDP came in as expected at 4% and evoked no market reaction..

Tuesday

Conference Board Consumer Confidence Index rose to 89.3 in January from 87.1 in December. The Case-Schiller Home Price Index rose 9.1% in November from 8% in October. The forecast had been 8.6%.

Wednesday

Durable Goods Orders in December rose -0.2% on a 0.9% forecast and November's revised 1.2% increase initially 0.9%. Durable Goods Orders ex Transportation climbed 0.7% on a 0.5% estimate and November's adjusted 0.8% gain, originally 0.4%. Nondefense Capital Goods Orders rose 0.6% as expected in December. November's total was revised to 1% from 0.4%. The Federal Reserve left rates and its bond purchase program unchanged as expected. Chairman Jerome Powell was neutral about US prospects, focusing on the bank's determination to support the economy while noting several times that the best growth plan is an end to the pandemic.

Thursday

Initial Jobless Claims dropped to 847,000 in the January 22 week from 914,000 prior, 875,000 were expected. Continuation Claims fell to 4.771 million, the lowest of the pandemic, from 4.974 million, 5.054 million were forecast. US GDP in the fourth quarter expanded 4.0% as forecast. New Home Sales rose 1.6% to 842,000 annualized in December from 829,000.

Friday

Personal Income in December rose 0.6% on a 0.1% forecast and a revised -1.7% prior, initially -1.1%. Personal Spending fell 0.2% on a -0.4% forecast and November was revised to -0.7% from -0.4%. Core PCE Prices rose 0.3% on the month and 1.5% on the year in December after November's 0.0% and 1.4% readings.

Japan statistics February 1-February 5

Monday

The Jibun Bank manufacturing PMI for January will be revised, first release was 49.7.

Wednesday

Jibun Bank Services PMI is due for revision, initial release was 47.7.

Thursday

Overall Household Spending for December is expected to drop 1.5% after 1.1% prior.

Friday

December's preliminary Coincident and Leading Economic Indexes are due, November's were 89 and 96.4.

US statistics February 1-February 5

Payrolls rule the week. The over or under on the forecast translates directly to the US dollar. The PMIs will set the stage. If they are strong they wil raise expectations for the jobs report.

Monday

The Manufacturing Purchasing Managers' Index (PMI) from the Institute for Supply Management (ISM) is forecast to slip to 60 in January from 60.7 in December. The New Orders Index is projected to drop to 65.7 from 77.6. Construction Spending in December should dip to 0.7% from 0.9%.

Wednesday

ADP Employment Change for January is expected to add 49,000 workers after losing 123,000 in December. The Services PMI is forecast to drop to 57 in January from 57.2 in December.

Thursday

Initial Jobless Claims are forecast to drop to 830,000 in the January 29 week from 847,000. Continuing Claims are expected to fall to 4.25million in the January 22 week from 4.771 million. Factory Orders for December are predicted to rise 1.8% from 1% previous.

Friday

Nonfarm Payrolls should add 85,000 positions in January after losing 140,000 in December. The Unemployment Rate is expected to be unchanged at 6.7%. Average Hourly Earnings are anticipated to rise 0.3% on the month and 5% on the year January after December's 0.8% and 5.1% gains. Average Weekly Hours will be unchanged at 34.7. Consumer Credit in December will expand $12.1 billion following the $15.27 billion increase in November.

USD/JPY technical outlook

The breach of the long-running descent is the major development. Nothwithstanding the myriad resistance lines formed by the seven-month decline in the USD/JPY, the bias has shifted to the upside. Though the break had several important technical elements, it would not have happened if the fundamental aspects were not at least neutral. In fact the improving pandemic in the US and the strong busines investment spending suggest that the view in the front office is positive. As noted above the notion that the rise in the dollar this week is a risk reaction is probably mistaken. As evidence the yen played no risk-haven role of its own.

The Relative Strength Index at 63.56 is, given the technical picture, yet a buy signal. The crossing of the 21-day and 100-day moving averages indicates a trend reversal. The 50% Fibonacci at 105.28 is the next important resistance.

Resistance: 105.28; 105.50; 106;00; 106.25; 106.60

Support: 104.50; 104.25; 103.70; 103.50; 103.15

USD/JPY Forecast Poll

The FXStreet Forecast Poll this week has been somewhat superseded by the strong move higher on Friday. The one-month and one quarter views presuppose the re-entry of the descending channel, which, for the moment, seems unlikely.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Joseph Trevisani

FXStreet

Joseph Trevisani began his thirty-year career in the financial markets at Credit Suisse in New York and Singapore where he worked for 12 years as an interbank currency trader and trading desk manager.