USD/JPY Price Forecast: Defends 146.70 confluence amid rising trade tensions

- USD/JPY struggles to capitalize on intraday uptick led by report of additional US tariffs.

- Rising trade tensions and BoJ rate hike bets assist the safe-haven JPY to regain traction.

- Fed rate cut bets drag the USD to a two-week low and further weigh on the currency pair.

The USD/JPY pair witnessed a dramatic turnaround on Thursday and tumbled over 100 pips from the intraday high, around the 147.70 region. The Japanese Yen (JPY) initially weakened against the US Dollar (USD) amid reports that US President Donald Trump could impose an extra 15% tariff on all Japanese imports. The initial market reaction, however, turns out to be short-lived amid the global flight to safety, which benefits the JPY. This, along with some follow-through US Dollar (USD) selling, weighs heavily on the currency pair.

Trump on Wednesday signed an executive order imposing additional 25% tariffs on Indian imports as "punishment" for buying oil from Russia, taking the total tariffs to 50%. This comes on top of Trump's announcement earlier this week that US tariffs on semiconductor and pharmaceutical imports will be imposed within the next week or so and revives concerns about the potential economic fallout from a global trade war. This, in turn, forces investors to take refuge in traditional safe-haven assets and provides a strong boost to the JPY.

Meanwhile, the Bank of Japan (BoJ) revised its inflation forecast at the end of the July meeting last week, and reiterated that it will raise interest rates further if growth and inflation continue to advance in line with its estimates. This keeps the door open for an imminent rate hike by the end of this year and turns out to be another factor underpinning the JPY. The USD, on the other hand, drops to a nearly two-week low in the wake of the growing acceptance that the Federal Reserve (Fed) will resume its rate-cutting cycle at the September policy meeting.

The bets were lifted by the weaker-than-expected US Nonfarm Payrolls (NFP) report released last Friday and Tuesday's disappointing US ISM Services PMI print. Moreover, the Fed is expected to deliver at least two 25-basis-point rate cuts by the end of this year. This keeps the USD bulls on the defensive and exerts additional downward pressure on the USD/JPY pair. However, the prevalent risk-on environment keeps a lid on the safe-haven JPY, which, in turn, assists spot prices to trim a part of intraday losses and climb back above the 147.00 mark in the last hour.

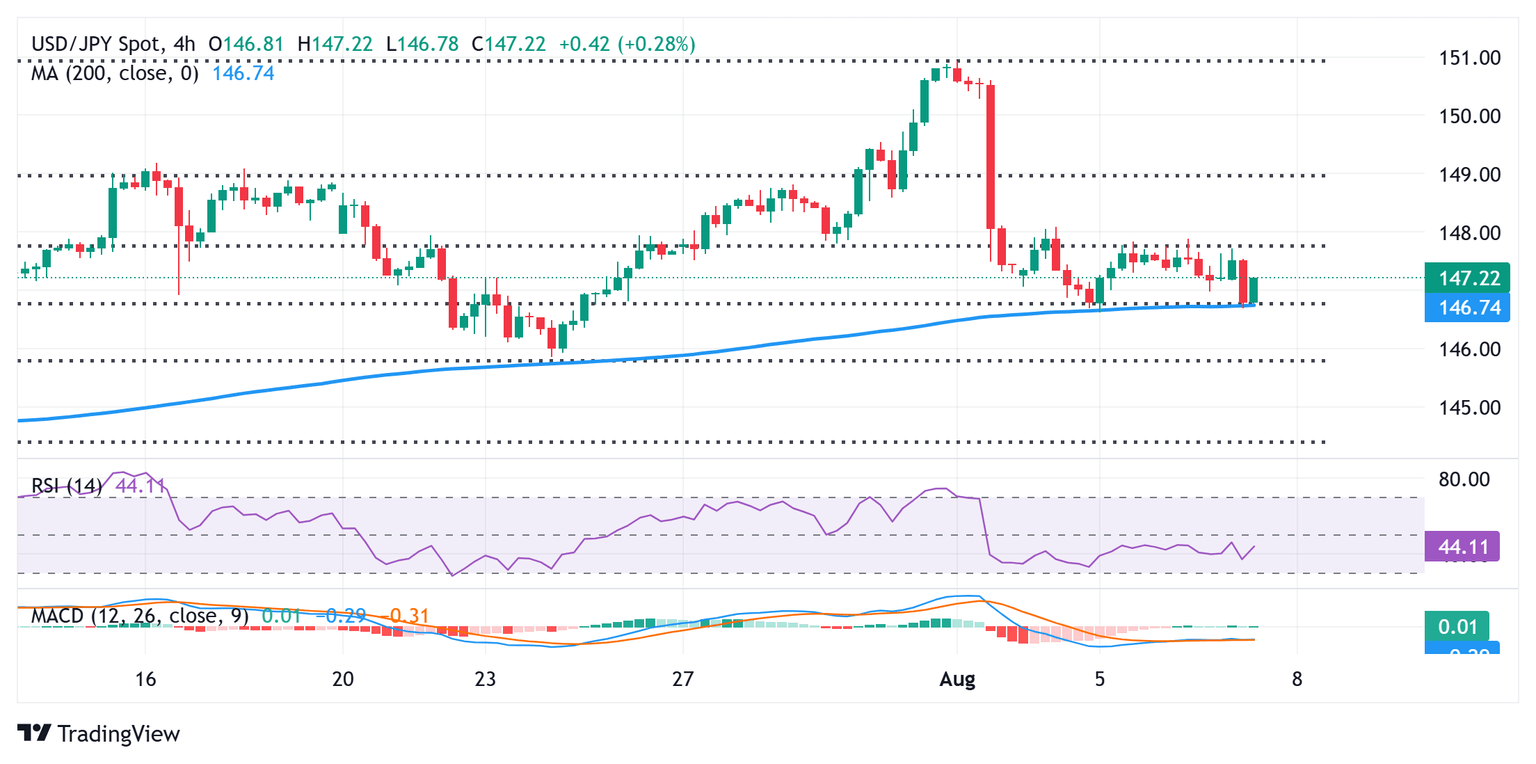

USD/JPY 4-hour chart

Technical outlook

The intraday downfall stalls near the 146.70-146.65 confluence – comprising the 200-period Simple Moving Average (SMA) on the 4-hour chart and the 50% retracement level of the July upswing. The said area might continue to act as an immediate support, which, if broken decisively, will be seen as a fresh trigger for the USD/JPY bears. Given slightly negative oscillators on hourly/daily charts, spot prices might then accelerate the fall towards testing sub-146.00 levels, or the 61.8% Fibo. retracement level. Some follow-through selling below the latter could expose the 145.00 psychological mark.

On the flip side, momentum back above the 147.50 area might continue to face a stiff hurdle near the 147.75-147.80 region, or the 38.2% Fibonacci retracement level. Some follow-through buying beyond the 148.000 mark might shift the bias and lift the USD/JPY pair to the 148.45-148.50 region. The momentum could extend further towards the 149.00 neighborhood, or the 23.6% Fibo. retracement level.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.