USD/JPY Price Analysis: Further rangebound likely near-term

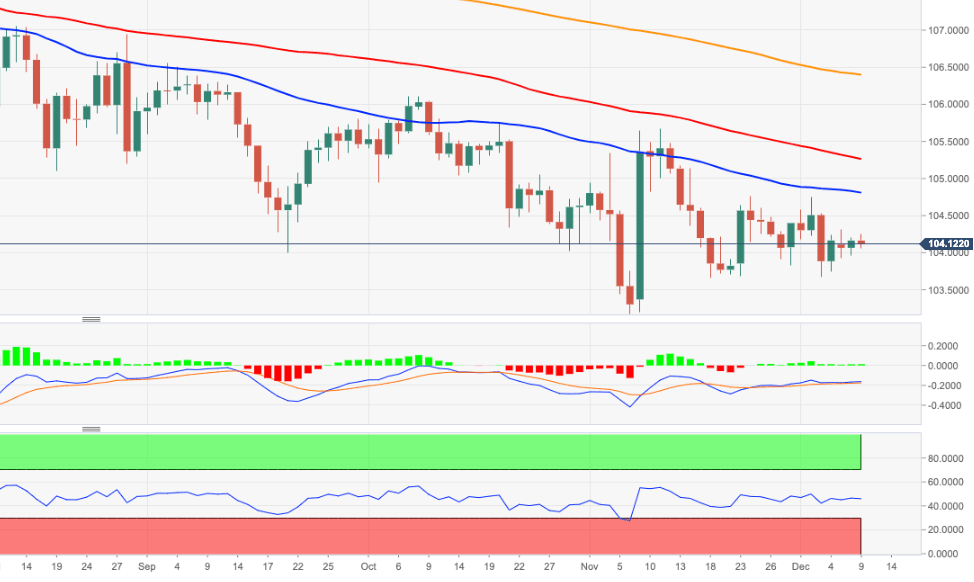

- USD/JPY extends the side-lined trade around 104.00 on Wednesday.

- A break above 104.80 should expose 105.20 ahead of 105.70.

USD/JPY keeps the consolidative mood unchanged for yet another session on Wednesday, always within the 103.70-104.80 range and against the backdrop of alternating risk appetite trends and the generalized bearish view on the dollar.

In fact, the combination of the weaker greenback with the improvement in the risk complex – which in turn favours JPY selling, lend support to the near-term neutral stance of USD/JPY.

In the meantime, the safe haven JPY is expected to closely follow upcoming events from the ECB meeting and the EU Summit as potential sources for near-term bouts of volatility and/or risk aversion, as well as developments from the US political scenario and the Brexit negotiations.

Near-term Outlook

So far, USD/JPY is poised for extra consolidation amidst the absence of a catalyst that could force spot to break the pattern in either direction. A surpass of the 104.80 area – which is reinforced by the 55-day SMA – could lead to a minor hurdle at the 100-day SMA, today at 105.23, ahead of the November’s peak at 105.67 (November 11). On the downside, a breach of the 103.70/65 band carries the potential to spark a visit to the November’s low near 103.15. Supporting further the consolidative mood, the daily RSI continues to navigate in the middle range (around 46.0).

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.