USD/JPY outlook: Bulls remain intact and look for final close above 200WMA to resume

USD/JPY

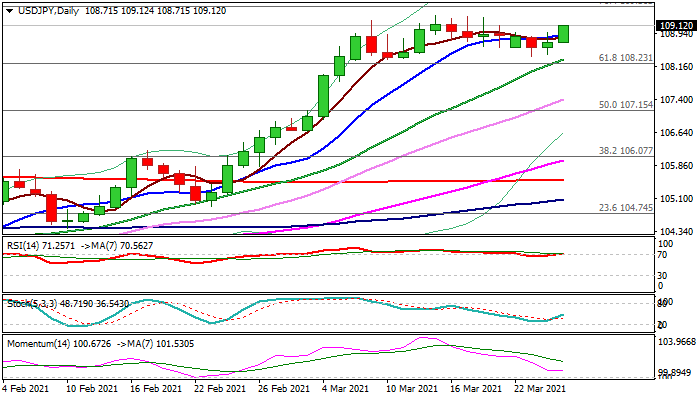

The pair maintains bullish tone and fresh advance above 109 mark (200WMA/Fibo 61.8% of 109.36/108.40 pullback) in early Thursday’s trading signals that shallow correction from new 2021 high (109.36) might be over.

Near-term action remains biased higher as dips were contained above important support at 108.23 (broken Fibo 61.8% of 111.71/102.60, reinforced by rising 20DMA).

Bulls need eventual close above 200WMA (after repeated failures in past two weeks) to signal bullish continuation and extend an uptrend from 102.59 (Jan 6 low).

Break of initial barriers at 109.36/56 (Mar 15 high/Fibo 76.4% of 111.71/102.59) would open way for test of 109.85 (June 5 high) and psychological 110 level.

Daily studies reinforce bullish bias but caution on overbought weeklies and potential third straight failure to close above 200WMA.

Res: 109.36; 109.56; 109.85; 110.00

Sup: 109.00; 108.61; 108.40; 108.23

Interested in USD/JPY technicals? Check out the key levels

Author

Slobodan Drvenica

Windsor Brokers

Industry veteran with over 22 years’ experience, Slobodan Drvenica joined Windsor Brokers in 1995 when he was an active trader for more than 10 years, managing the trading desk and own account departments.