USD/JPY gains ground as market favouring risk appetite

The USD/JPY pair climbed to 148.00 on Wednesday, with the yen relinquishing its earlier gains as a rally in global risk assets dampened demand for the safe-haven currency.

The move followed the release of US inflation data, which bolstered expectations of a Federal Reserve rate cut next month.

In Japan, manufacturing sentiment improved for the second consecutive month in August, supported by a trade agreement with Washington. The US reduced tariffs on Japanese cars and other goods to 15% in exchange for a $550 billion investment package from Tokyo.

Meanwhile, producer price growth slowed to an 11-month low in July, reflecting pressure on domestic firms from higher US tariffs.

Monetary policy uncertainty persists, with Bank of Japan (BoJ) policymakers divided on the timing and pace of future rate hikes. Some officials advocate maintaining an accommodative stance, citing risks to the central bank’s economic forecasts.

Currently, capital markets show little appetite for safe-haven assets, traditionally a role filled by the yen. Doubts over the BoJ’s policy direction further undermine the currency’s appeal.

Technical analysis: USD/JPY

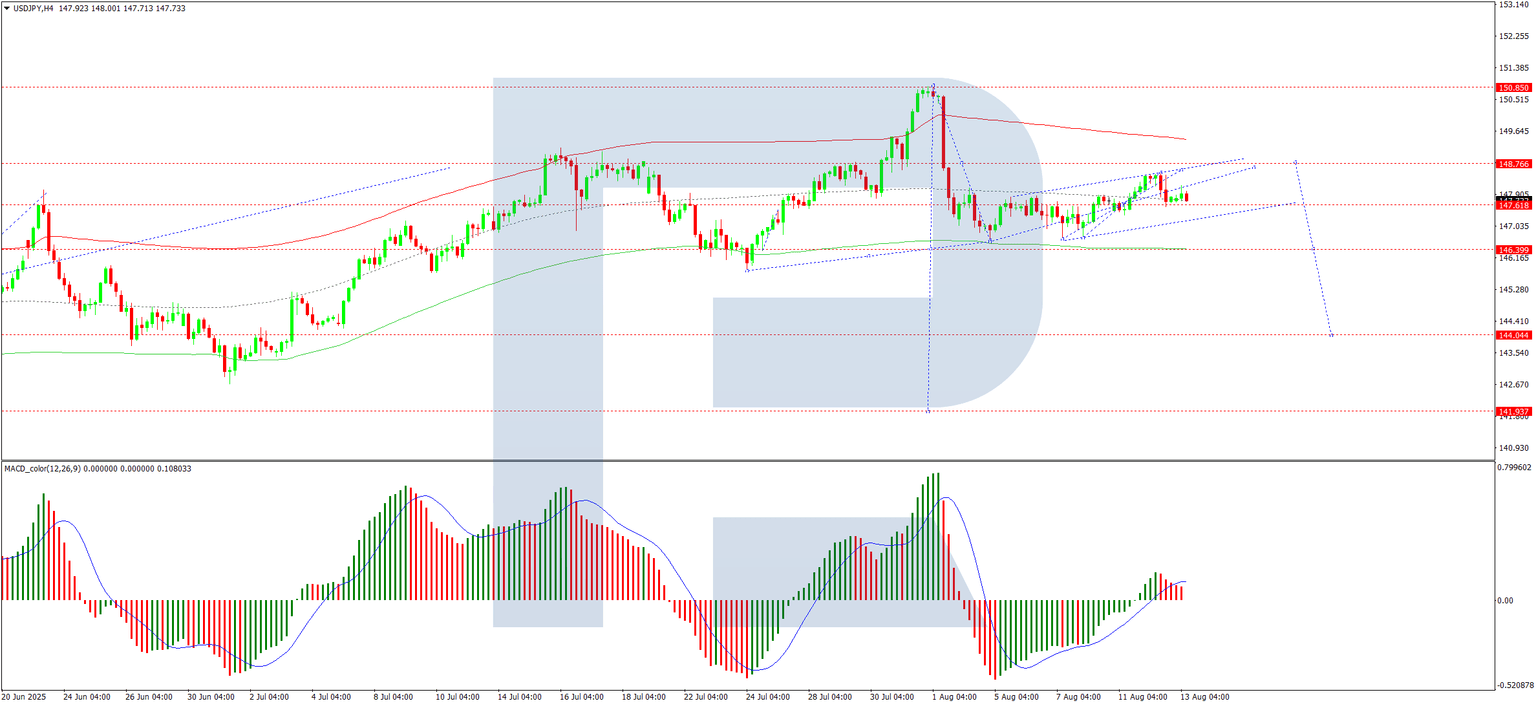

Four-hour chart

The USD/JPY pair continues its corrective wave towards 148.60. A pullback to 147.52 is expected today, after which another upswing to 148.60 may materialise. Once this wave exhausts, a decline towards 146.40 is anticipated. This scenario is technically validated by the MACD indicator, with its signal line above zero and trending upwards.

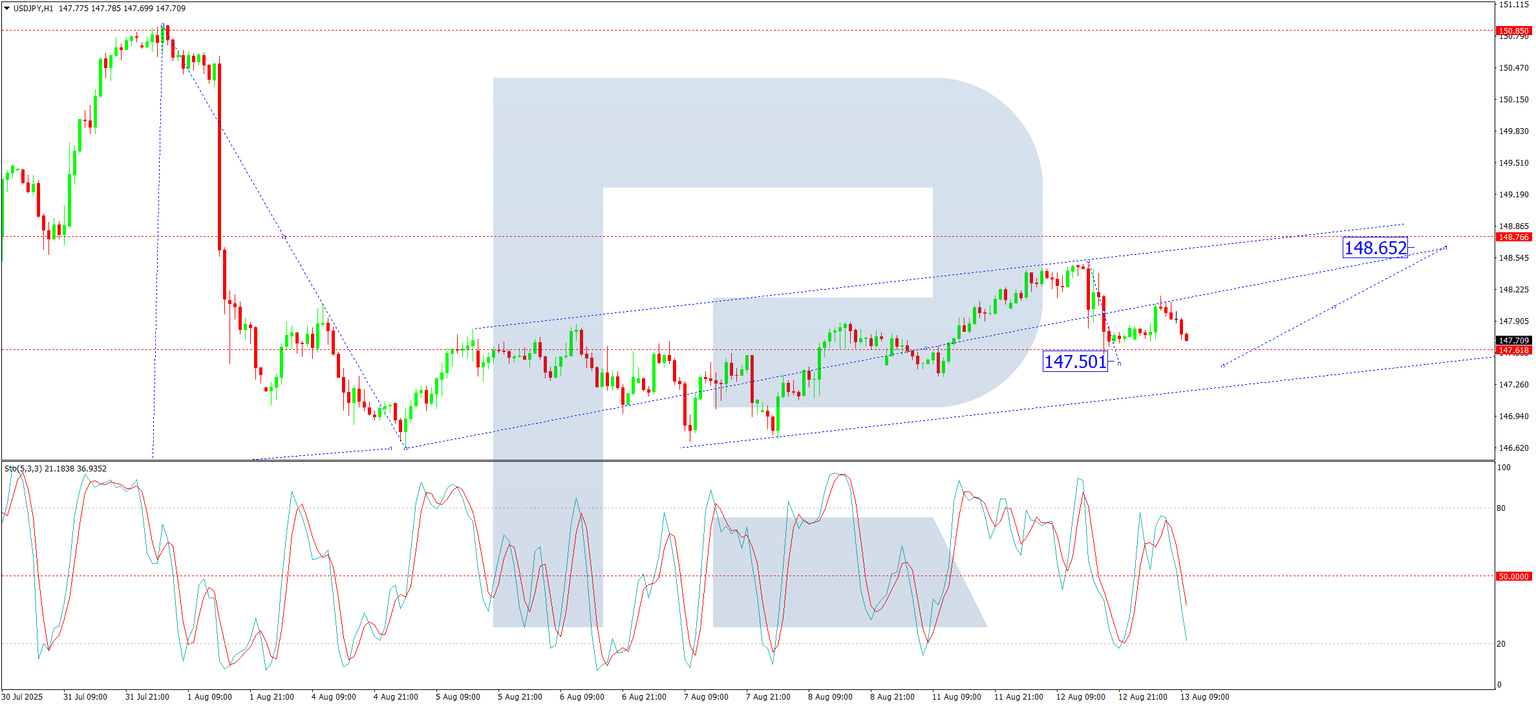

One-hour chart

The pair has entered a consolidation phase around 148.00. A dip to 147.50 is likely today, potentially followed by an extension towards 148.65. The Stochastic oscillator supports this view, with its signal line below 50 and pointing downward.

Conclusion

The USD/JPY remains buoyed by risk-on sentiment, though technical indicators suggest near-term volatility is likely. Traders will monitor BoJ policy signals and US economic data for further direction.

Author

RoboForex Analysis Department

RoboForex

RoboForex Analysis Department provides timely market insights, expert technical analysis, and actionable forecasts across forex, commodities, indices, and equities.