USD/JPY Forecast: Yen retains its strength on market’s dismal mood

USD/JPY Current price: 108.50

- Chinese markets collapsed after returning from a long holiday.

- Japanese manufacturing PMI fell in January to 48.8, missing the market’s expectations.

- USD/JPY bearish as long as below 109.00 at risk of testing 107.64.

The USD/JPY pair has recovered from the multi-week low at 108.30 posted last Friday, trading in the 108.50 region in the European session. Risk aversion continues to dominate the financial world amid the coronavirus outbreak spreading further. Chinese markets collapsed after returning from a long holiday, dragging alongside other Asian indexes and commodities. European stocks, however, trade marginally higher, as the market is trying to stabilize.

The dollar, in the meantime, is benefiting from weaker European equities. The Pound is the worst performer, undermined by fears of a no-deal between the UK and the EU. In the data front, Japan released the Jibun Bank Manufacturing PMI for January which resulted in 48.8, worse than the 49.3 previous and expected.

The US macroeconomic calendar will include today the final version of the January Markit Manufacturing PMI, foreseen at 51.7, unchanged from the previous estimate. The country will also publish the official ISM Manufacturing PMI, expected in January at 48.5 from 47.2 in December.

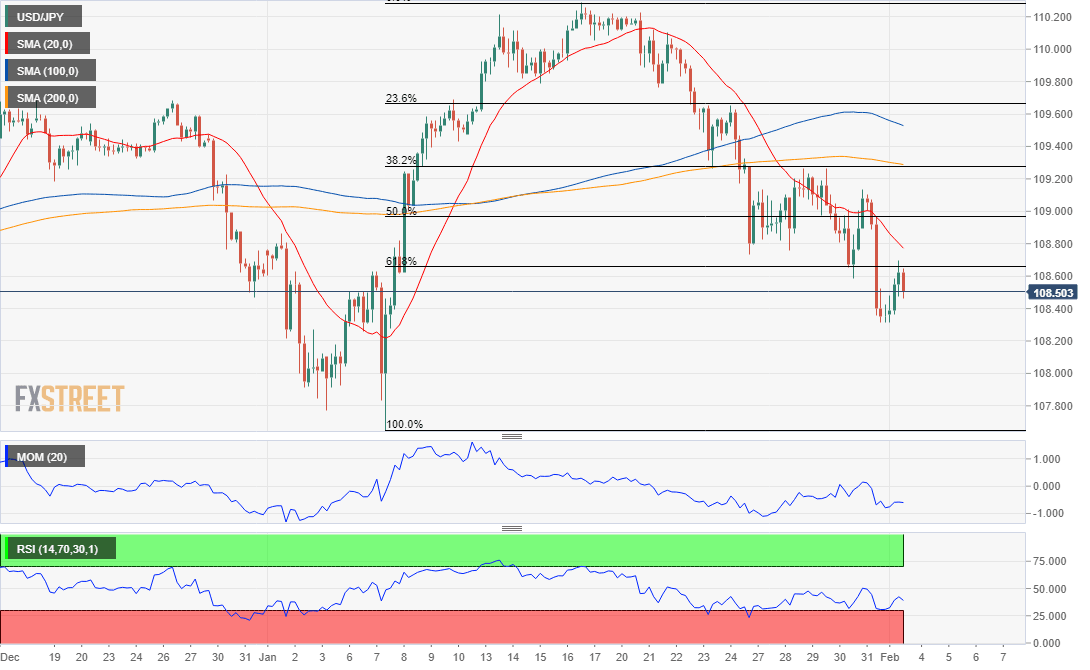

USD/JPY short-term technical outlook

The USD/JPY pair has peaked at 108.69, meeting sellers around a critical Fibonacci resistance level. The risk remains skewed to the downside, according to the 4-hour chart, as the pair continues to develop below all of its moving averages. The 20 SMA has extended its decline, now around 108.85. Technical indicators in the mentioned time-frame have recovered from near oversold levels, but lost directional strength and consolidate well into negative ground. Further declines are to be expected on a break below 108.30, with the market then eyeing the base of the range at 107.64

Support levels: 108.30 107.95 107.60

Resistance levels: 108.65 109.00 109.40

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.