USD/JPY Forecast: US inflation and the ECB to take over

USD/JPY Current price: 109.51

- US inflation is expected to have been revised up to 4.7% YoY in May.

- The European Central Bank will announce its monetary policy decision.

- USD/JPY is neutral in the near-term, with the risk skewed to the upside.

The USD/JPY pair keeps trading around 109.50, pretty much unchanged on a weekly basis, as investors prepare for the first-tier events of the week. The greenback seesawed between gains and losses but holds near its Monday’s opening levels against most major rivals as investors wait for inflation-related news. The US will publish today the final reading of its May headline inflation, foreseen at 4.7% YoY vs the previous estimate of 4.2%. Some analysts believe it could even hit 5%.

Higher inflation levels would need a response from the US Federal Reserve, that is, pull out some of the massive stimulus meant to support the economy. Stocks will suffer the most, while US Treasury yields would likely jump higher alongside the dollar. At the same time, the European Central Bank will announce its monetary policy. Should it maintain a cautious stance, it will highlight the imbalances between the Fed and its counterparts, exacerbating the market’s reaction to the news.

Earlier in the day, Japan published the May Producer Price Index, which beat expectations by hitting 4.9% YoY. Apart from inflation, the US will publish Initial Jobless Claims for the week ended June 4, foreseen at 370K.

USD/JPY short-term technical outlook

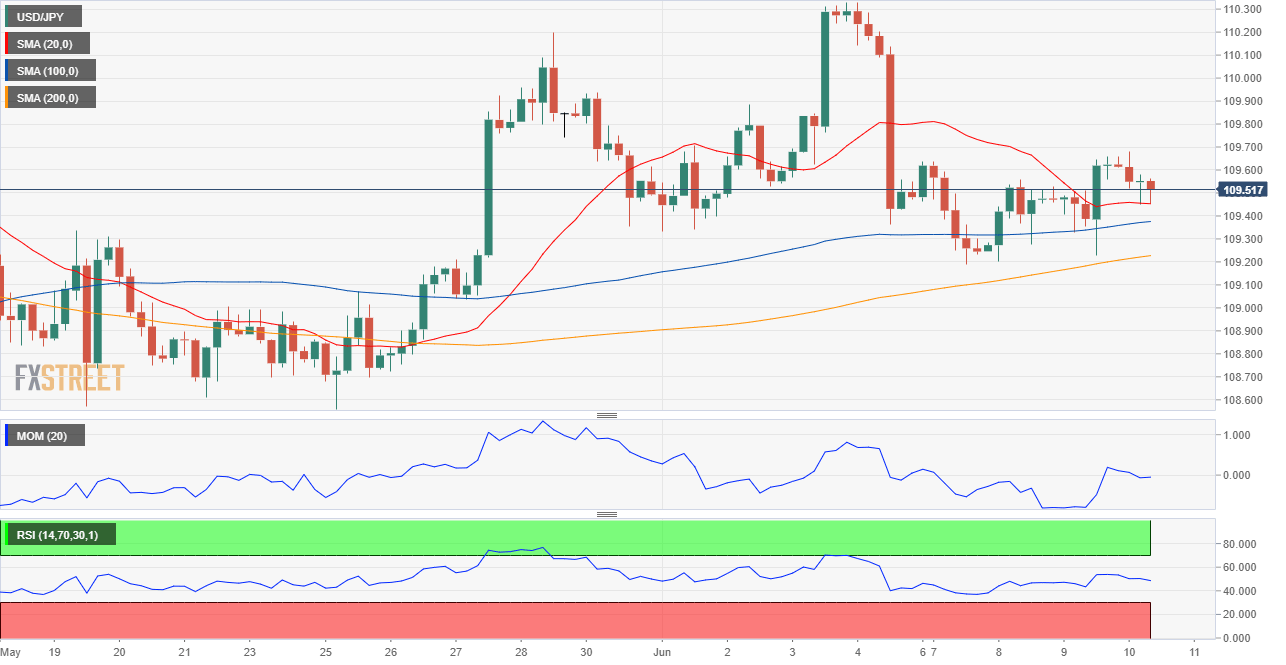

The USD/JPY pair is neutral in the near-term, with the risk skewed to the upside. The 4-hour chart shows that it is developing above directionless moving averages, while technical indicators head nowhere around their midlines. Further gains are likely on a break above 109.67, the immediate resistance level, while bears will likely take over on a break below 108.90.

Support levels: 109.20 108.90 108.50

Resistance levels: 109.70 110.10 110.45

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.