USD/JPY Forecast: Tricky tests after Trump's one-two punch

- USD/JPY has been under pressure as US-Sino talks remained stuck.

- US GDP, durable goods, and further trade headlines stand out in the Thanksgiving week.

- Late November's daily chart is painting a mixed picture.

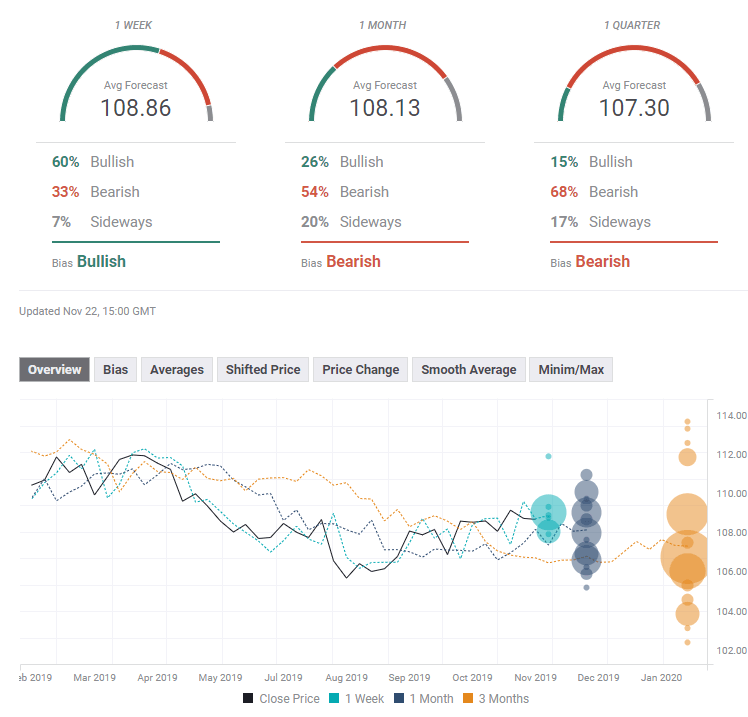

- The FX Poll is pointing to short-term gains and drops afterward.

President Donald Trump has dominated dollaryen trading – and downed it. Concerns about US-Sino talks supported the yen, while Trump's demands for a weaker exchange rate weighed on the greenback. Apart from these ongoing themes, top-tier US data is set to determine the moves this week.

This week in USD/JPY: Whipsawed by trade headlines

John Williams, President of the New York branch of the Federal Reserve, has reaffirmed the bank's stance that the US economy is in a "good place." Eric Rosengren, his colleague from the Boston Fed, has taken one step further and criticized the Fed's three rate cuts – saying it leaves fewer tools to battle the next recession. Rosengren voted against all rate reductions.

The Fed's meeting minutes have also shown that there is a broad consensus for leaving rates unchanged – supporting the dollar.

These upbeat comments would have pushed the greenback higher if it were not for Jerome Powell, Chairman of the Federal Reserve – who has been brought to the spotlight by the White House. President Trump summoned Powell for an unscheduled meeting and protested about the Fed's rates, which the president sees as high.

Trump also aired his complaints about the strong dollar – and markets reacted by selling the greenback, speculating that the Fed Chairman may succumb to pressure. Others wondered if the surprising encounter may precede a breakdown in trade talks, and the Trump is asking for Powell´s help in troubled times.

Upbeat comments from various administration officials and the reports of a video teleconference between high ranking officials kept markets cheerful early in the week, and USD/JPY advanced.

That changed quickly.

The media reported that China was skeptical about reaching a broad trade deal with the US. Hu Xijin, the editor of the Global Times – often considered a mouthpiece of Chinese authorities, criticized Trump for waiting for Chinese concessions that will not come. The downbeat tone strengthened the safe-haven yen.

Moreover, Congress passed a bill supporting protesters in Hong Kong and angering China. Negotiations around commerce are hard to separate from other topics. However, at the time of writing, Trump has refrained from signing the bill into law

Additional headlines whipsawed markets and USD/JPY as trade tops the agenda.

US housing figures were mixed, with Building permits leaping to an annualized level of 1.461 million while Housing Starts slipped to 1.314 million in October.

US events: GDP, durables, and more trade headlines

The upcoming week is a shorter one due to the Thanksgiving holiday. US markets will be closed on Thursday, and many traders are set to skip work on the following day – Black Friday.

Trade headlines are set to continue rocking markets. Any optimism toward reaching a trade deal may boost the dollar on lower chances for a rate cut. Downbeat comments may send the greenback lower.

Several housing figures are of interest on Tuesday, with New Homs Sales set to hold onto high levels over 700,000 units annualized. The Conference Board's Consumer Confidence disappointed in October but remained at high levels. It may advance in this publication for November.

A big bulk of figures is due out on Wednesday. The second read of US Gross Domestic Product for the third quarter is watched for any changes to the 1.9% annualized growth rate initially reported. While the US is outperforming its peers in the developed world, the expansion rate remains sluggish and may worsen.

Durable Goods Orders for October – already in the fourth quarter – are published at the same time and may steal the show. The Atlanta Fed's GDP estimate put fourth-growth at below 1% – and investment figures may rock markets. The most significant measure is Nondefense ex-air orders, which dropped by 0.6% in September and may decrease once again.

The Federal Reserve's preferred measure of inflation, the Core Personal Consumption Expenditure (Core PCE), is set to remain unchanged in October despite a drop in the parallel Consumer Price Index (CPI).

The Federal Reserve's Beige Book is the last pre-Thanksgiving publication. It provides anecdotal evidence from the Fed's contacts, and it may shed some light on the economic situation and the impact of trade.

Here are the top US events as they appear on the forex calendar:

Japan: Geopolitics and inflation figures

The Japanese yen holds onto its throne as the king of safe-haven currencies. It has an inverse correlation with the mood in trade talks and is also sensitive to geopolitical events. Iran has increased its nuclear capabilities, and North Korea is also frustrated with US policy. Flare-ups on both fronts may boost the yen.

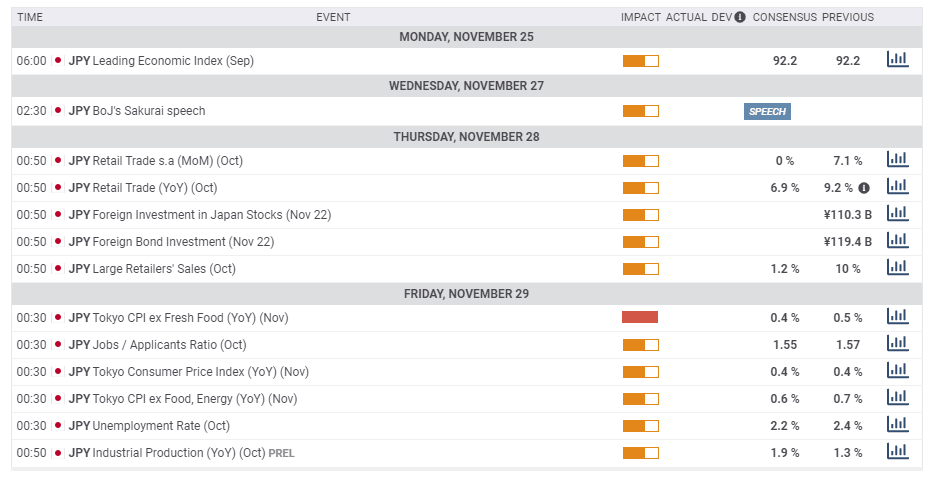

In Japan, the most significant economic release comes from the Tokyo region. Inflation figures for November will likely show meager levels of inflation. Consumer Price Index excluding fresh food, stands out.

Industrial Production figures may also be of interest. September's data have shown an annual increase of 1.3%, and the rise may be more moderate in the preliminary report for November.

Here are the events lined up in Japan:

USD/JPY Technical Analysis

Dollar/yen has lost its uptrend support, and attempts to recapture the line have failed. The currency pair remains supported by the 50-day Simple Moving Average but is capped by the 200-day SMA. Momentum continues flat.

All in all, bears enjoy a minor lead over the bulls.

Support awaits at 108.20, which is the confluence of the 50-day SMA and a low point in mid-November. It is followed by 107.90, which is the November low. It is followed by 107, a support line in late November, and a round number. Next, we find the late-October low of 106.50.

Resistance awaits at 109, which is the convergence of the 200-day SMA and a stubborn cap in late October. 109.35 held dollar/yen down twice. Next, 109.95 held it down in May, and 110.65 was a high point in May.

USD/JPY Sentiment

Trying to understand Trump is no easy feat, but chances for a trade deal are higher than for no accord. On the other hand, an agreement may have to wait for the last minute, and the longer it drags, the more USD/JPY comes under pressure.

The FX Poll is showing that experts foresee a moderate rise in the upcoming week but drops in the next month and also in the quarter. Targets are little changed from the previous week. It seems that forecasters are downbeat about the chances of a deal.

Related Forecasts

- EUR/USD Forecast: Further falls due amid downtrend channel downbeat data and trade troubles

- GBP/USD Forecast: Corbyn comeback or Boris bull-run? Opinion polls to move markets

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.

-637100329426214778.png&w=1536&q=95)