USD/JPY Forecast: Tensions between the US and China back the JPY

USD/JPY Current price: 108.64

- News indicated that US-China trade talks got interrupted by disagreement on farm purchases.

- US President Trump anyway, said that talks are going OK.

- USD/JPY bearish in the short term, key Fibonacci support at 108.50.

The USD/JPY pair has extended its decline to 108.56 so far this Thursday, hurt by mounting tensions between the US and China. According to headlines released ahead of Wall Street’s close, both economies disagree about the amount of agricultural purchases, halting negotiations. However, later in the day, US President Trump said that talks were marching “rapidly,” partially offsetting the negative sentiment. Still, stocks trade in the red in Asia and Europe, although US futures stand near record highs.

Japan released the preliminary estimate of Q3 Gross Domestic Product, which resulted below the market’s estimate. According to the official report, the economy grew at the slowest pace in a year, at an annualised rate of 0.2%. In the three months to September, the economy grew 0.1%. Chinese data released overnight was also below expected, fueling appetite for safer assets.

The US session will bring the usual weekly unemployment figures and a couple of Fed’s speakers, including the second day of Powell’s testimony before the Congress. Given the limited impact of yesterday’s statement, it seems unlikely that his words would affect the market today.

USD/JPY short-term technical outlook

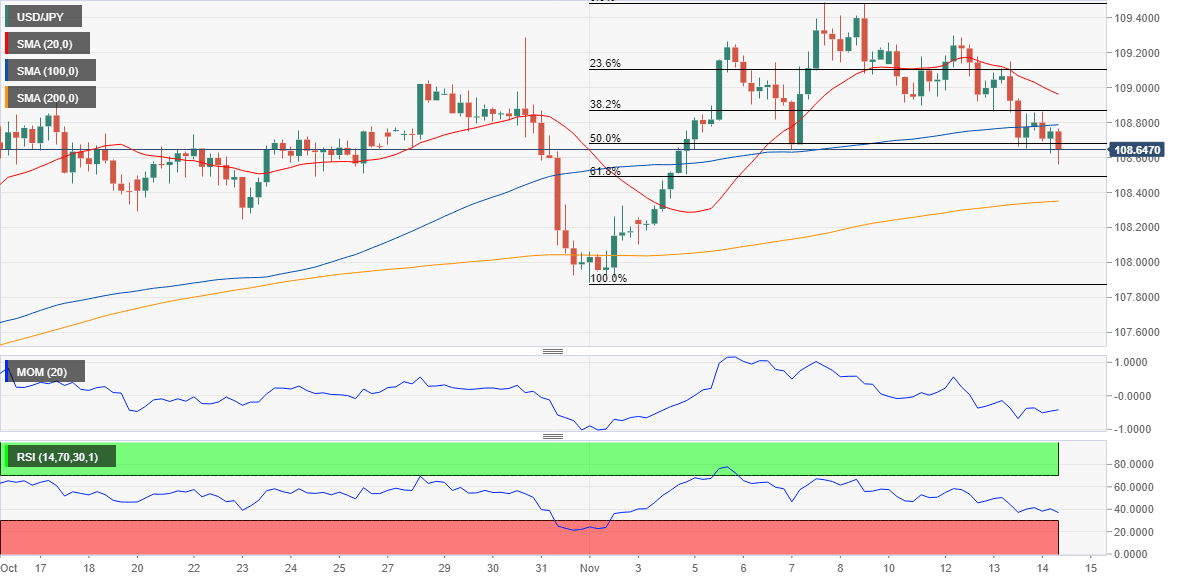

The USD/JPY pair trades around 108.65, below the 50% retracement of its latest daily advance. In the 4-hour chart, the pair is below its 20 and 100 SMA, with the shortest accelerating its slide below the larger one. Technical indicators, in the meantime, remain within negative territory, lacking directional strength and at weekly lows, keeping the risk skewed to the downside. The next Fibonacci support comes at 108.50.

Support levels: 108.50 108.15 107.70

Resistance levels: 108.90 109.35 109.60

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.