USD/JPY Forecast: Risk-on limits the bearish potential

USD/JPY Current price: 104.38

- Optimism surrounding coronavirus vaccines lifts demand for high-yielding assets.

- Japanese data resulted in better-than-anticipated, manufacturing output at 49 in November.

- USD/JPY is neutral-to-bullish in the near term, faces immediate resistance at 104.55.

The market’s mood has improved this Tuesday, with equities in franc recovery and the dollar down against all major rivals but the JPY. The USD/JPY pair trades around 104.40, marginally higher daily basis, amid the absence of interest for the safe-haven yen. The worlds’ run to beat the ongoing pandemic seems to be bearing encouraging fruits. Multiple vaccine producers have reported high effectiveness levels to prevent contagions and are applying before authorities for emergency use.

Japanese data published at the beginning of the day was generally positive. The November Jibun Bank Manufacturing PMI was upwardly revised from 48.3 to 49. The October Unemployment Rate came in at 3.1% as expected, while the Jobs/Applicants Ratio improved to 1.04.

Markit will publish the final US November Manufacturing PMI, while the country will release the official ISM Manufacturing PMI, foreseen at 58 from 59.3 in the previous month.

USD/JPY short-term technical outlook

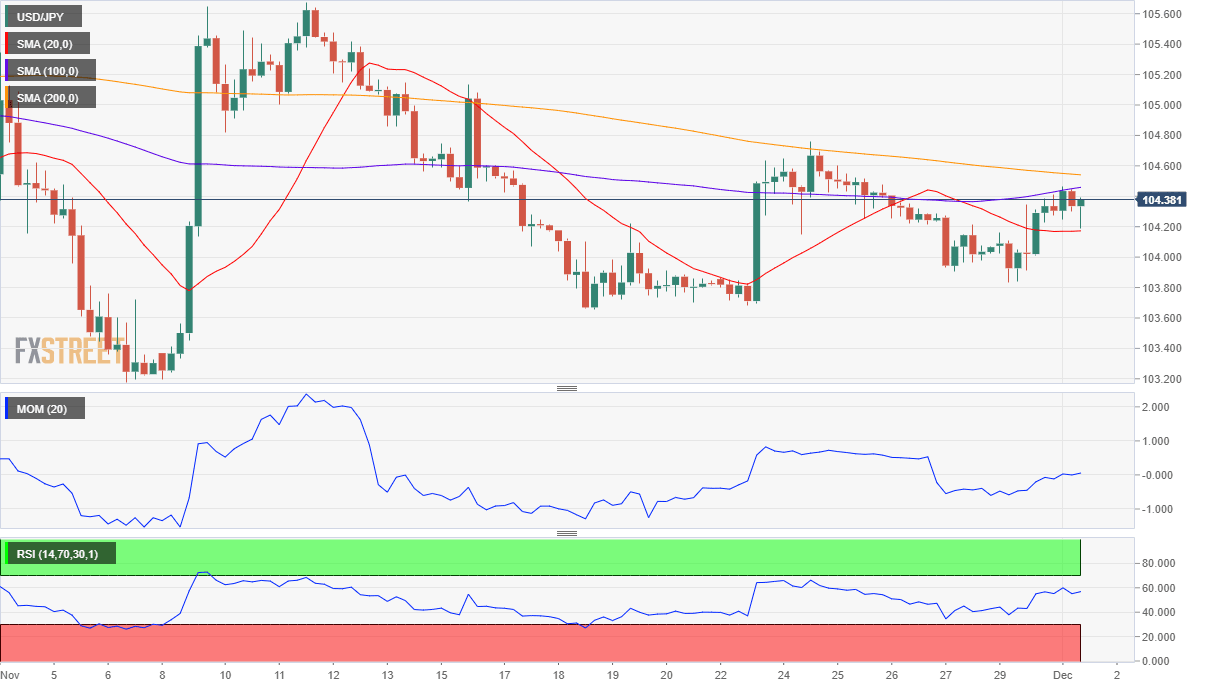

The USD/JPY pair is neutral-to-bullish in the near-term, trapped between moving averages in its 4-hour chart. The 200 SMA maintains its bearish slope, providing dynamic resistance around 104.55. Technical indicators advance within positive levels, rather reflecting the absence of selling interest than supporting another leg higher.

Support levels: 103.85 103.50 103.15

Resistance levels: 104.55 104.90 105.20

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.