USD/JPY Forecast: Neutral near December high

USD/JPY Current price: 109.48

- Japanese data was mixed, with inflation improving but Industrial Production collapsing.

- USD/JPY neutral in the short-term, risk skewed to the upside.

The USD/JPY pair has fallen to 109.42 after flirting with December high at the opening, confined to a 30 pips’ range this Thursday. The pair fell on broad dollar’s weakness, although the optimism that weighed lower the greenback also prevented the JPY from appreciating.

Japanese data released overnight came in mixed, as December Tokyo inflation beat the market’s expectations, up to 0.9% YoY. The core reading ex-fresh food resulted at 0.8%, above the 0.6% expected. The November unemployment rate in the country decreased to 2.2%, also better than expected, but Retail Trade fell by 2.1% YoY in November. Also, the preliminary estimate of November Industrial Production resulted much worse than anticipating, plummeting 8.1% YoY.

USD/JPY short-term technical outlook

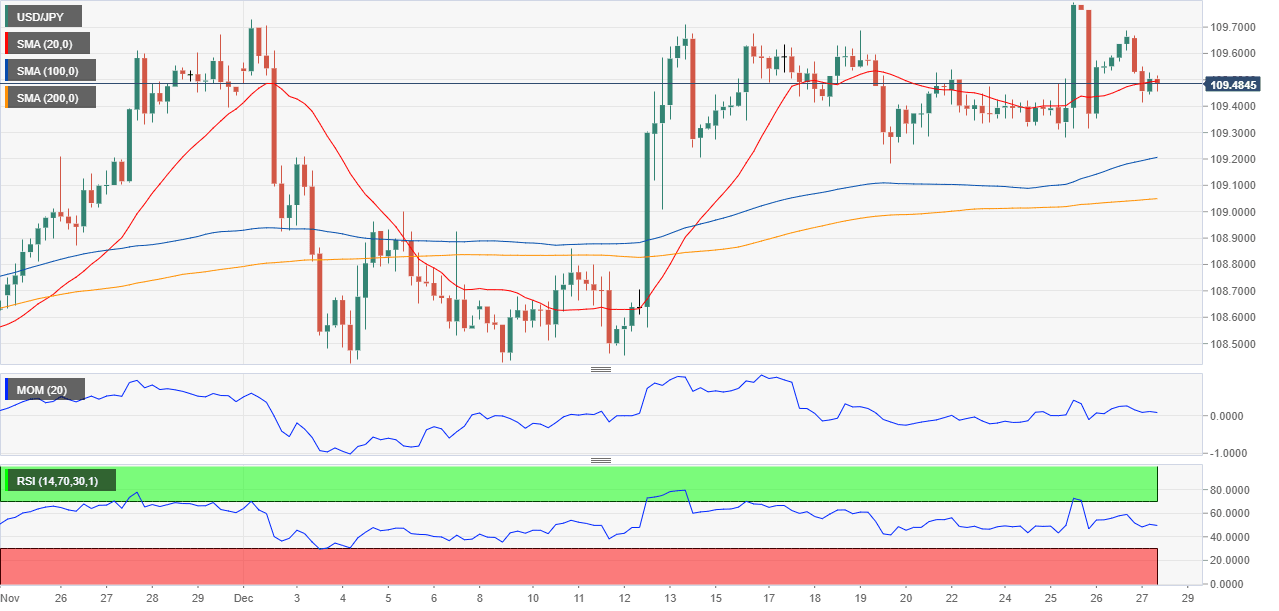

The USD/JPY pair is trading at the lower end of its daily range, neutral in the short-term. The 4-hour chart shows that the price hovers around a directionless 20 SMA, while technical indicators head nowhere, stuck around their midlines. The downside is being protected by buyers aligned around 108.90, while the pair needs to advance beyond 109.70 to become attractive for bulls.

Support levels: 109.20 108.90 108.60

Resistance levels 109.70 110.00 110.40

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.