USD/JPY Forecast: Holding below 109.00 without clear directional signs

USD/JPY Current price: 108.90

- Japanese data was generally encouraging, but inflation keeps contracting.

- The US will publish March core PCE inflation, Fed’s favorite measure.

- USD/JPY is neutral-to-bullish in the near-term, needs to advance beyond 109.20.

The USD/JPY pair trades just below the 109.00 level, consolidating weekly gains. The greenback trades mixed across the board, advancing mainly against its European rivals but generally stable against those considered safe-haven.

Asian indexes came under selling pressure, despite Wall Street managed to close in the green, while European indexes struggle around their opening levels. US Treasury yields, however, hover around their Thursday’s closing levels, helping to maintain the pair within familiar levels.

Japan published April Tokyo inflation, which resulted at -0,6% YoY, worse than anticipated. Industrial Production in the same month was up 4% YoY, according to preliminary estimates, while the April Jibun Bank Manufacturing PMI was upwardly revised to 53.6. Housing-related data was also upbeat.

The US will publish today March Personal Spending and Personal Income and core PCE inflation for the same month. Later into the session, the country will offer the final reading of the April Michigan Consumer Sentiment Index, foreseen at 87.5.

USD/JPY short-term technical outlook

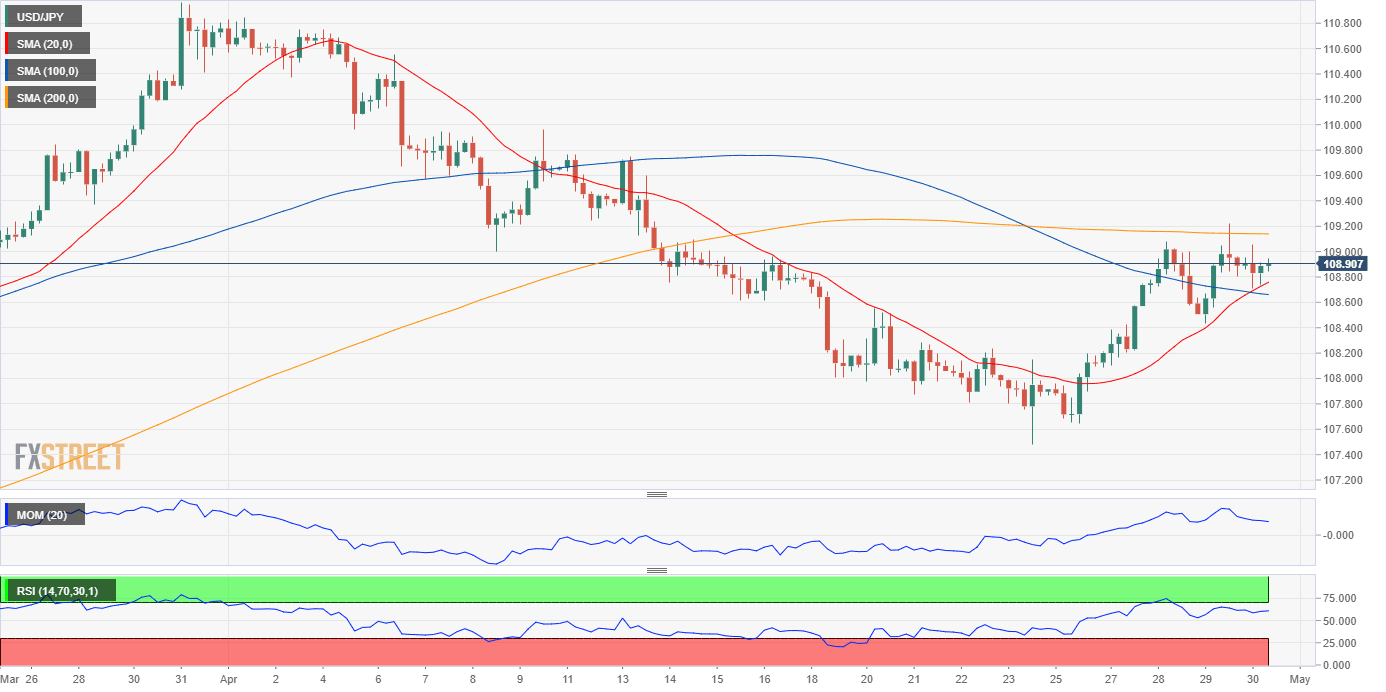

The USD/JPY pair is neutral-to-bullish in the near-term. The 4-hour chart shows that it is developing above its 20 and 100 SMAs, with the shorter one advancing above the longer one. The 200 SMA provides dynamic resistance around 109.20, while technical indicators lack directional strength, the Momentum around its midline and the RSI at 58.

Support levels: 108.70 108.25 107.90

Resistance levels: 109.20 109.60 110.00

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.