USD/JPY Forecast: Consolidating weekly losses

USD/JPY Current price: 104.42

- Japanese data was generally discouraging, indicating persistent deflation and soft growth.

- Equities trade in the red in Europe, as concerns remain over the coronavirus spread.

- USD/JPY is technically neutral in the short-term, risk skewed to the downside.

Major pairs settled down after Thursday’s events, with USD/JPY consolidating around 104.40. Against other rivals, the greenback is firmly up weekly basis, as concerns rule, due to the spread of COVID-19 in the northern hemisphere. Asian and European shares were unable to follow Wall Street and trade in the red, although off daily lows amid better than expected German data.

Japanese data was generally discouraging, with October Tokyo inflation down 0.3% YoY and the core reading ex-fresh food falling 0.5% in the same period. September Housing Starts fell 9.9%, worse than the 8.6% expected, while Construction Orders were down 10.6%. On a positive note, the unemployment rate remained steady at 3%, while Industrial Production surged 4% monthly basis. The US will publish today October Personal Income and Personal Spending, and the final version of the Michigan Consumer Sentiment Index.

USD/JPY short-term technical outlook

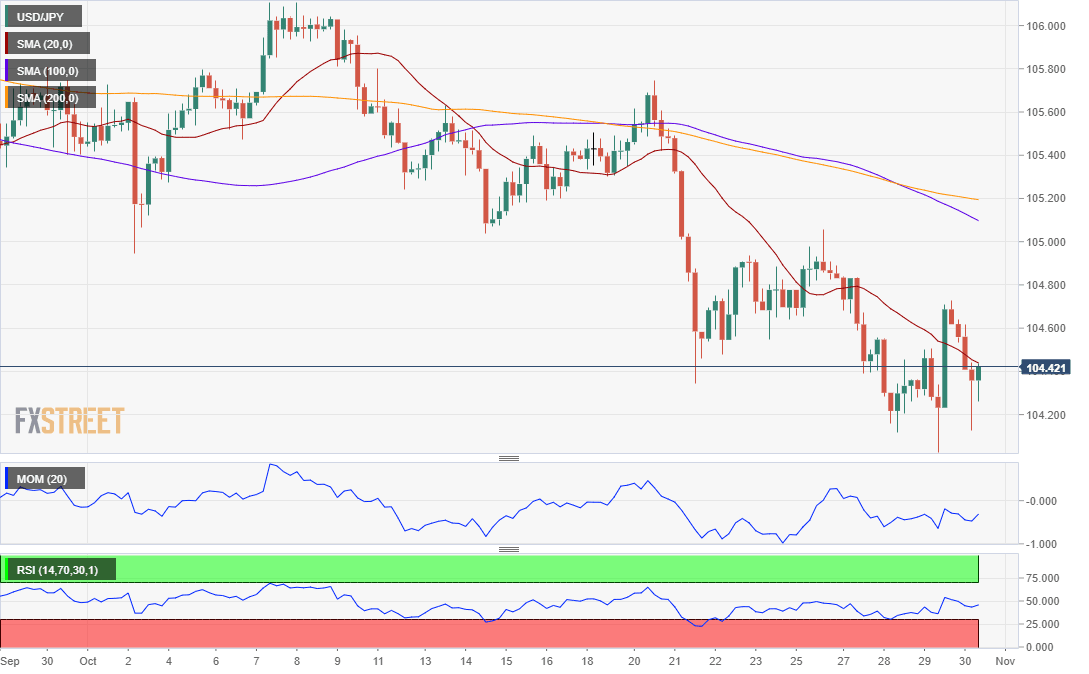

The USD/JPY pair is in the red for a third consecutive week. The 4-hour chart shows that it was unable to retain ground above a bearish 20 SMA, currently below it. The 100 and 200 SMAs maintain their bearish slopes well above the shorter-one, all of them indicating prevalent selling pressure. Technical indicators, in the meantime, hover within neutral levels, without clear directional strength. The pair has bottomed around 104.00 in September, and once again this October, with a break below the region opening doors for a steeper decline.

Support levels: 103.95 103.50 103.20

Resistance levels: 104.45 104.70 105.10

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.