USD/JPY Forecast: Bearish correction set to continue

USD/JPY Current Price: 109.45

- Risk aversion related to the coronavirus backed safe-haven assets.

- Japan’s Jibun Bank Manufacturing PMI foreseen at 48.7 vs. the previous 48.4.

- USD/JPY at risk of extending its decline as long as 109.70 caps advances.

The USD/JPY pair fell to 109.26, its lowest in two weeks, on the heels of risk-aversion. The number of coronavirus cases has continued to increase while spreading outside China. This last, closed the city of Wuhan, where the virus originated, and a couple of neighbour cities, putting around 20 million people in quarantine. However, it seems the outbreak is not yet controlled, weighing on investors’ mood. Equities were down worldwide, although US indexes´ decline was moderated. Government debt yields also fell, with the yield on the benchmark 10-year US Treasury note down to 1.71%.

Japanese data released at the beginning of the day fell short of the market’s expectations, as the December Merchandise Trade Balance posted a wider-than-anticipated deficit of ¥-152.5B. Imports were down by 4.9% while exports decreased by 6.3%, also worse than expected. Japan has a tight macroeconomic calendar this Friday as the country will release December National Inflation, the BOJ will publish the Minutes of its latest minutes, while the Jibun Bank will release the preliminary estimate of the Manufacturing PMI, foreseen at 48.7 vs. the previous 48.4.

USD/JPY short-term technical outlook

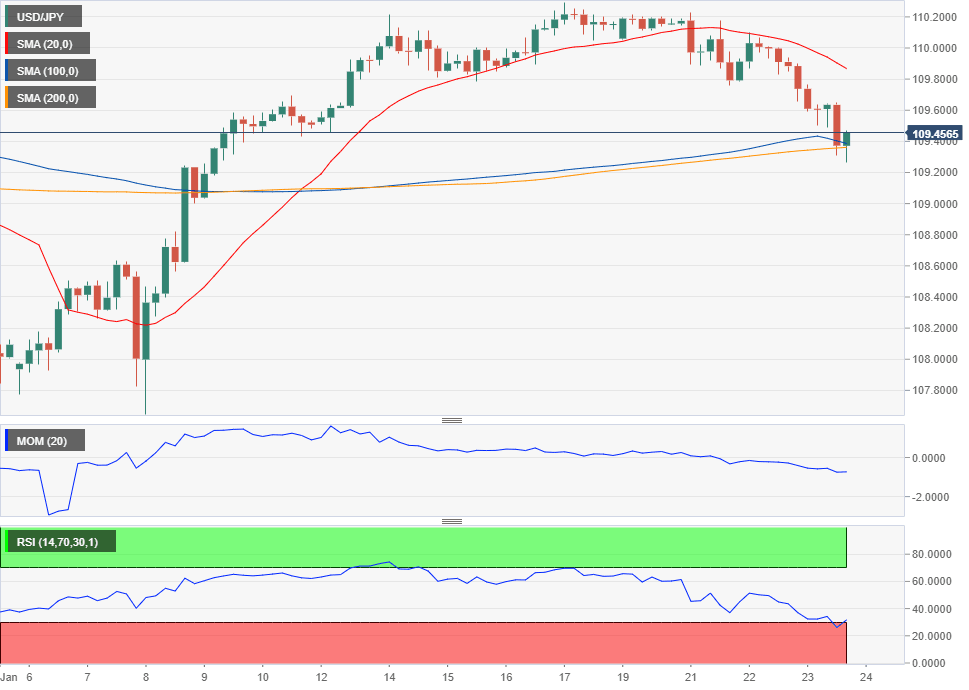

The USD/JPY pair is trading around 109.40, bearish according to the 4-hour chart. The pair is well below a now bearish 20 SMA while hovering around the 100 SMA, the first time around the indicator in two weeks. The Momentum indicator heads south at fresh multiple weeks’ lows, while the RSI decelerated its decline around 24, anyway maintaining the risk skewed to the downside.

Support levels: 109.20 108.90 108.65

Resistance levels: 109.70 110.05 110.40

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.