USD/JPY Forecast: Advancing in slow-motion

USD/JPY Current price: 105.67

- The positive market’s mood eased amid coronavirus concerns and ahead of the presidential debate.

- Japan has a busy macroeconomic session with updates on sales, industrial production and the housing sector.

- USD/JPY retains its positive technical stance but continues to lack follow-through.

The USD/JPY pair has surpassed its previous weekly advance by a few pips, reaching 105.73, and trading nearby as the day comes to an end. The American currency remained weak against most major rivals, although it got to advance against the safe-haven yen, despite the sour tone of equities. European and US indexes spent most of their respective sessions in the red, as mounting coronavirus-related concerns weighed on investors’ mood. US Treasury yields, in the meantime, head lower amid caution ahead of the US presidential debate.

Japan published at the beginning of the day, September Tokyo inflation data. The CPI rose 0.2% YoY, below the 0.4% expected. However, the core reading resulted at -0.2%, slightly better than the -0.3% expected. This Wednesday, the country has quite a busy macroeconomic calendar, as it will publish August Retail Trade, foreseen at -3.5% YoY, and the preliminary estimate of Industrial Production for the same month, expected at 1.5%. Later into the session, Japan will publish August housing data.

USD/JPY short-term technical outlook

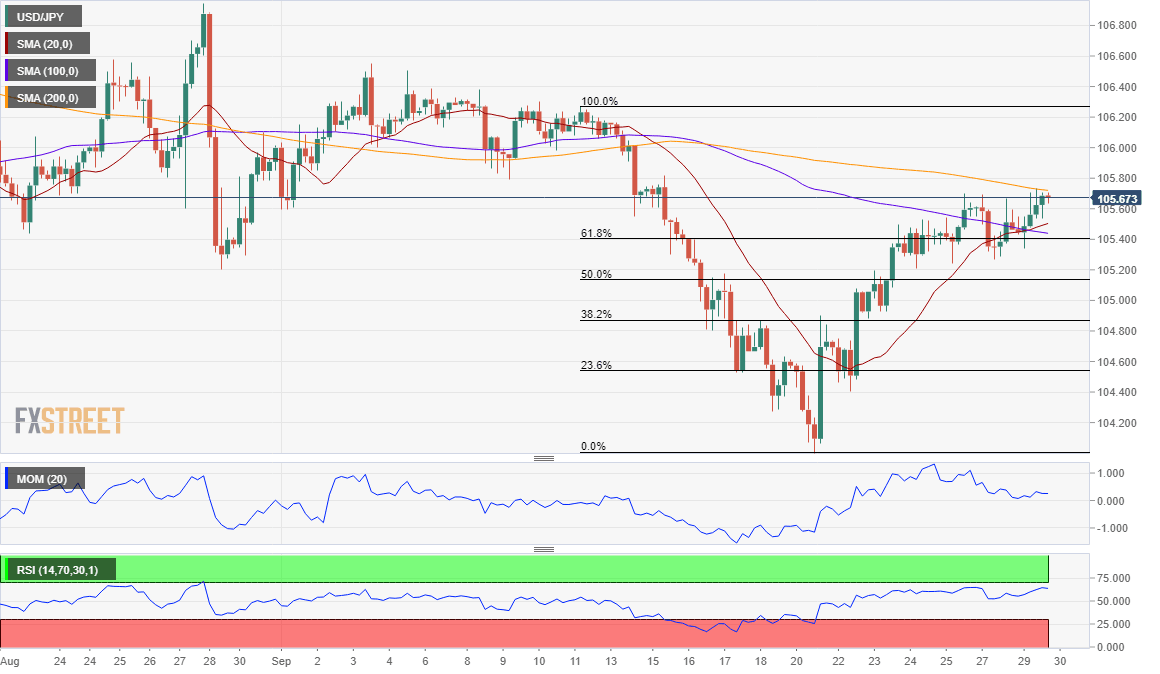

The USD/JPY pair is neutral-to-bullish as it holds above the 61.8% retracement of its latest daily decline. The 4-hour chart shows that technical indicators lack directional strength, but also that they stand above their midlines. The pair, in the meantime, is trapped between moving averages, with the 20 and 100 SMA converging below the current level and the 200 SMA providing an immediate dynamic resistance level at around 105.80. Once above this last, the pair could extend its advance towards the top of the range at 106.26.

Support levels: 105.40 105.00 104.60

Resistance levels: 105.80 106.25 106.60

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.