USD/JPY finally breaks above the bullish flag

The Japanese yen declined against the US dollar after the country's statistics bureau released mixed economic numbers. The preliminary industrial production declined by 1.6% in December after falling by 0.5% in the previous month. In its forecast, the bureau said that production would rise by 8.9% in January and then fall by 0.3% in February. Meanwhile, the country's unemployment rate remained unchanged at 2.9% while the jobs to applications ratio remained at 1.06. Further data showed that the country’s headline inflation dropped by 0.5% while the core CPI fell to -0.4%.

US stocks closed higher yesterday as investors digested the impressive corporate earnings by companies like Apple, Tesla, Microsoft, and Facebook. Also, traders continued to watch the recent euphoria in previously unloved companies like GameSpot, Nokia, and Blackberry. After soaring by more than 100% recently, the shares tumbled after top brokers like Webull, TD Ameritrade, and Robinhood suspended their trading. After declining sharply yesterday, these shares soared in extended trading. The Dow Jones, S&P 500, and Nasdaq 100 futures are up by more than 0.50%.

The economic calendar will have several important events from around the world today. In Hong Kong, the statistics agency will publish the first preliminary GDP estimate from the city. That's after the economy declined by 3.5% in the previous quarter. In Germany, the statistics office will publish the first preliminary GDP and unemployment numbers. The ECB will publish the latest supply figures. Finally in the United States, the statistics office will deliver the personal spending and income numbers. The data will come a day after it published the first preliminary Q4 data.

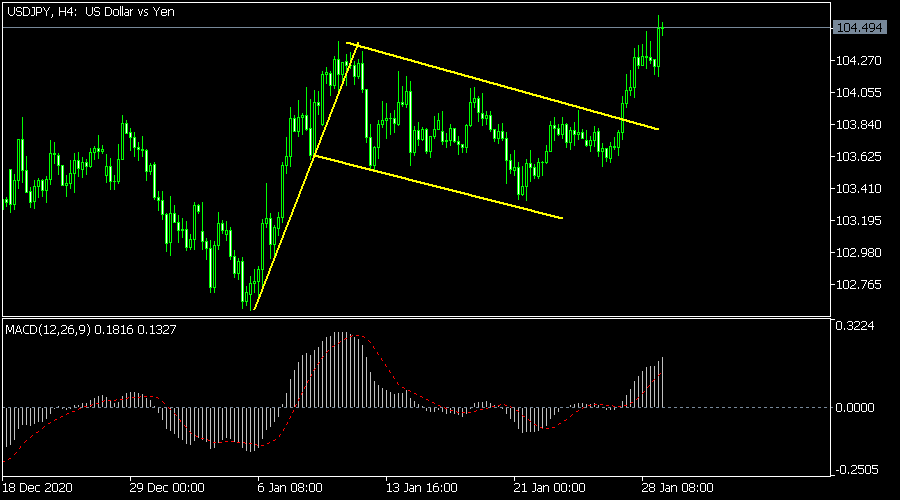

USD/JPY

The USD/JPY price jumped after mixed economic numbers published today. It is trading at 104.50, which is slightly higher than this week's low of 103.60. By breaking out, the pair confirmed the bullish flag pattern that is shown in yellow. Therefore, the most likely scenario is where the pair continues to rise as bulls target the next resistance at 105.0.

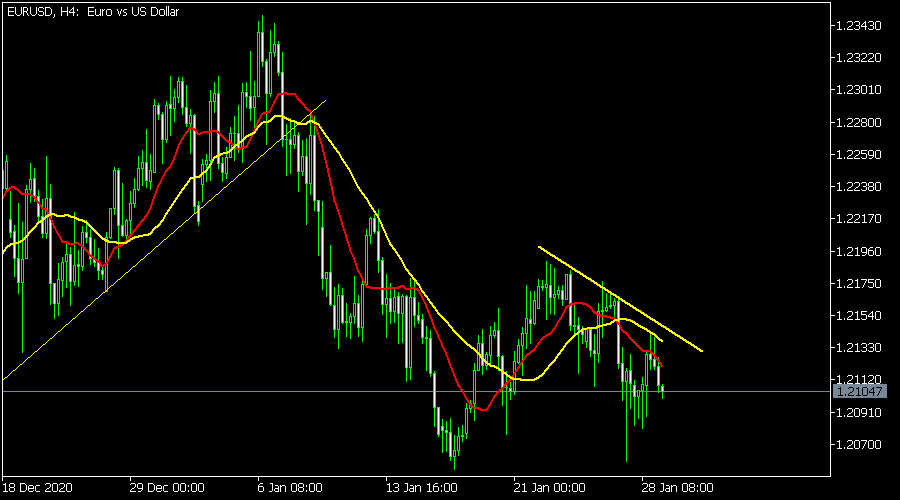

EUR/USD

The EUR/USD was under pressure in overnight trading after the mixed US GDP and jobless claims data. The pair is trading at 1.2100, which is lower than this week's high of 1.2145. It is slightly below the 25-day Simple Moving Average (SMA) and the descending trendline. The euro is likely to continue falling as bears target the YTD low of 1.2050.

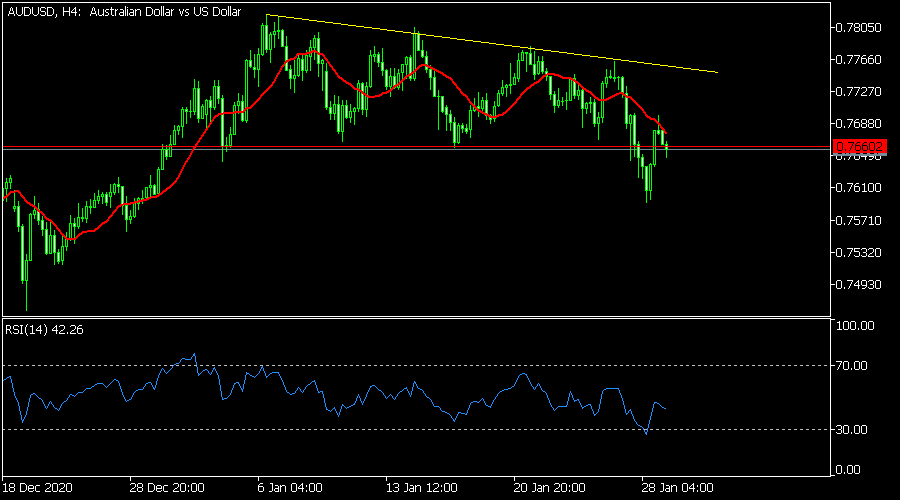

AUD/USD

The AUD/USD pair bounced back after declining to a low of 0.7495 yesterday. It is now trading at 0.7660, which is an important level since it was the lowest level on 11 and 15 January. It is also below the important declining yellow trendline and the 15-day exponential moving average. Therefore, the pair will likely pull-back as bears target the lowest point.

Author

OctaFx Analyst Team

OctaFX

OctaFX is a market-leading forex broker, providing personalised forex brokerage services to customers in over 100 countries worldwide.