USD/JPY: Ascending channel morphs into complex correction –Trend shift emerging?

Last week, on May 5, 2025, I shared an initial projection on the USDJPY pair that labeled the structure as a standard ABC correction. At the time, the price action seemed to conform to a textbook corrective wave, potentially setting the stage for a fresh impulsive move. However, the market had other plans.

Market evolution: From simple ABC to complex correction

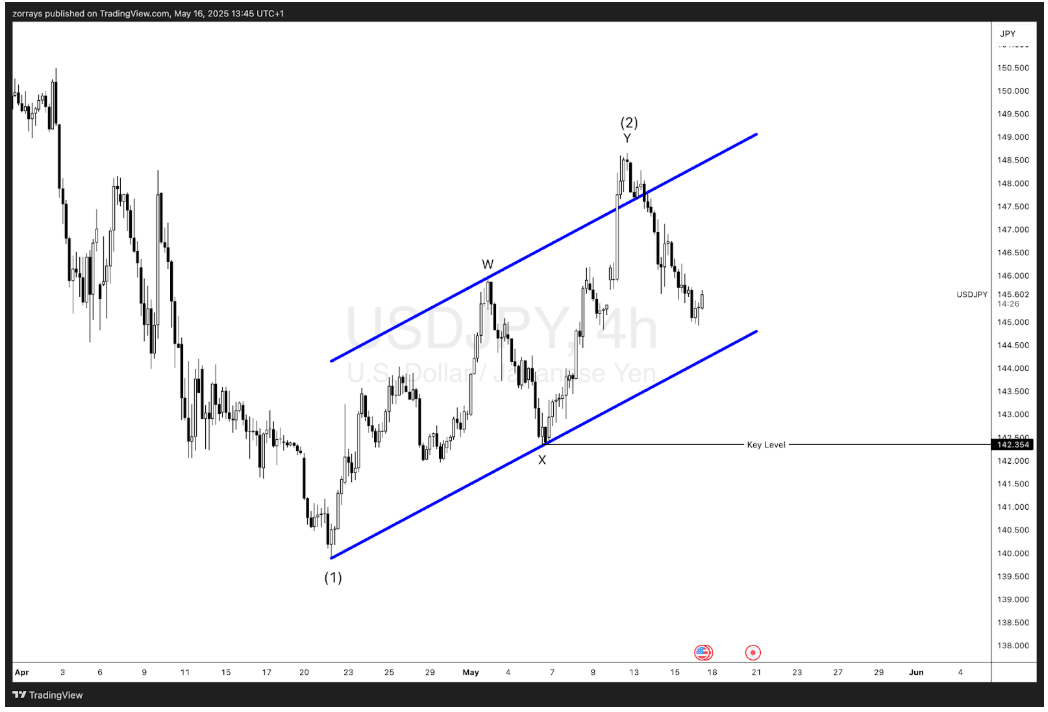

Since that post, the USDJPY pair has chosen to extend its correction within an ascending channel, clearly outlined in the chart. What initially looked like a typical ABC has now evolved into a more complex WXY structure, culminating in what appears to be a complete Wave (2) near the upper boundary of the corrective channel.

The transition from a simple to complex correction isn't uncommon, especially in forex markets that tend to exhibit choppier retracements. The internal structure of this correction has respected the channel boundaries remarkably well—until now.

Current price action: A bearish shift emerging

Since peaking at the top of Wave (2), USDJPY has fallen by over 2%, retreating sharply from its recent highs and now testing the mid-range of the channel. This decisive move hints at potential trend exhaustion within the corrective channel and opens the possibility that Wave (2) has indeed topped out.

The price is now closing in on the lower boundary of the channel, and a confirmed break below could signify the start of Wave (3)—typically the most powerful and extended in Elliott Wave terms.

Outlook: Preparing for potential downtrend

If this current bearish move continues and breaches both the channel bottom and the key level at 142.354, it would validate the end of the corrective structure and confirm the beginning of a larger degree Wave (3) to the downside.

Traders should now keep a close eye on the price interaction with the channel support and the key level. A clean break below with volume confirmation would increase the probability of a trend continuation downward.

Author

Zorrays Junaid

Alchemy Markets

Zorrays Junaid has extensive combined experience in the financial markets as a portfolio manager and trading coach. More recently, he is an Analyst with Alchemy Markets, and has contributed to DailyFX and Elliott Wave Forecast in the past.