USD grinds higher despite poor payrolls report

Euro Falls For A Second Consecutive Session

The euro currency was down over 0.41% into Friday’s close, marking the second session of consecutive declines. The drop comes after the euro touched highs of 1.2284 on Wednesday last week.

While it is too early to call for a correction, the current drop remains consistent with the overall view. The EURUSD has been in a strong uptrend with little to no major corrections.

For the moment, the line in the sand comes in at the 1.2177 level of support. If the euro loses this handle, then we expect to see a move to the 1.2050 level of support next.

While this could weaken the upside bias, there is still scope for a rebound. But a close below 1.2050 will no doubt accelerate the declines to 1.1900 next.

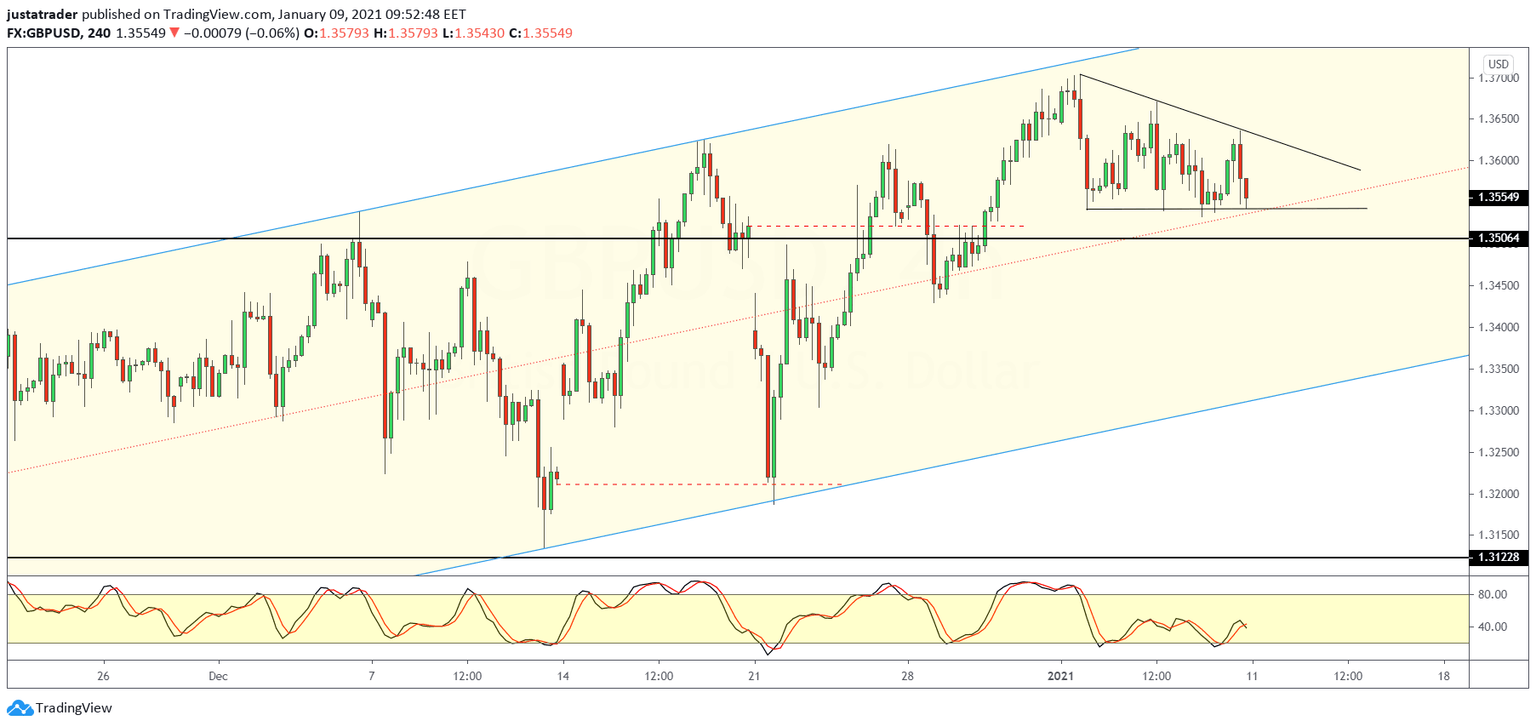

GBP/USD Closes Flat As Consolidation Continues

The British pound sterling is seen trading flat as the consolidation near the top end of the rally continues.

The cable has been in a strong volatile ride since late last year due to the Brexit trade talks. This has pushed the currency to test highs above 1.3650.

However, following the gains, price has been trading rather flat. On the short term charts, we see the consistent lower highs forming.

This could result in the descending triangle pattern likely to emerge. If the GBPUSD closes below the 1.3500 level of support, then we expect to see further declines lower.

The cable will most likely move back within the sideways range of 1.3500 and 1.3150 levels.

Crude Oil Rises To A Nine-Month High

Oil prices continue to push higher with prices settling near 52.60 last Friday. It marks the highest levels since February.

The gains also come with nine weekly consecutive gains so far. With price action cutting past the trendline from below, we expect to see a continuation higher.

But if price action retraces the gains, then a correction back to the 49.00 level is quite possible. Establishing support at this level will continue to see the bullish bias intact.

The next key level to the upside will come near the 55.00 level which marks a major support/resistance level back in late 2019/early 2020.

Gold Prices Push Past 1850

The precious metal continues to post strong declines. On Friday, the commodity lost over 3% into the close to settle at 1847.

Prices are now trading near a three-week low. The weekly bearish price action candlestick is also likely to signal a continuation lower.

The next key level of support comes near the 1817 level. If gold prices lose this handle, then we might get to see a stronger decline.

The next main support level will be found near the 1671 level and would potentially mark a strong retracement after testing new all-time highs just a few months ago.

Author

Orbex Team

Orbex