USD/CAD Weekly Forecast: Have the fundamentals prevailed or is it COVID?

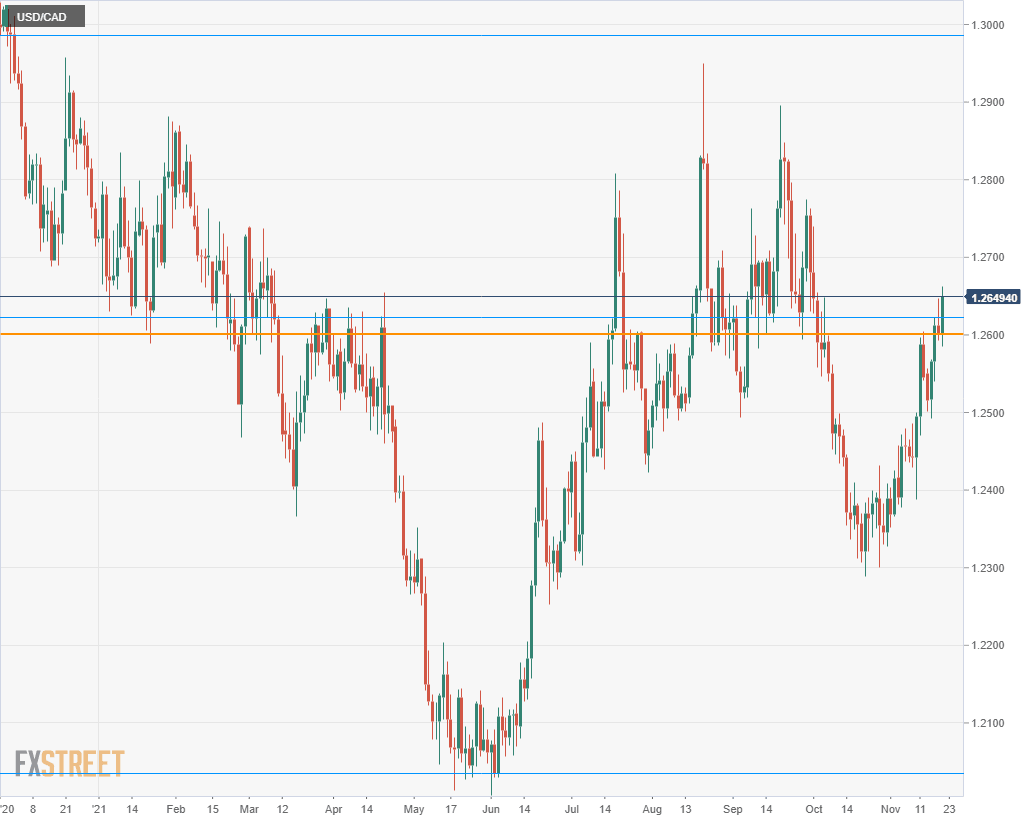

- USD/CAD closes above 1.2600 on Wednesday, Friday’s finish a seven-week high at 1.2649.

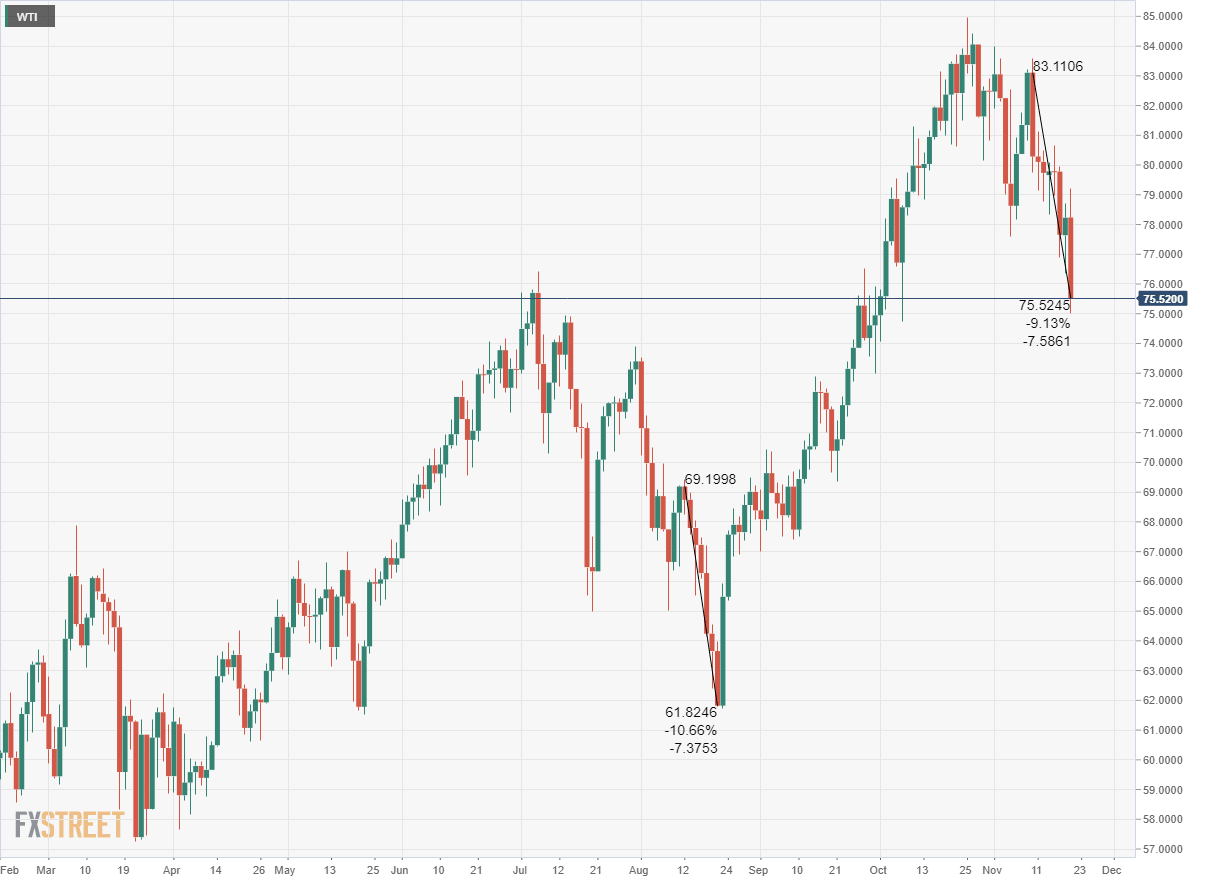

- WTI sheds 4.1% to $75.52, lowest close since October 4.

- European COVID resurgence drives a US dollar safety-trade on Friday.

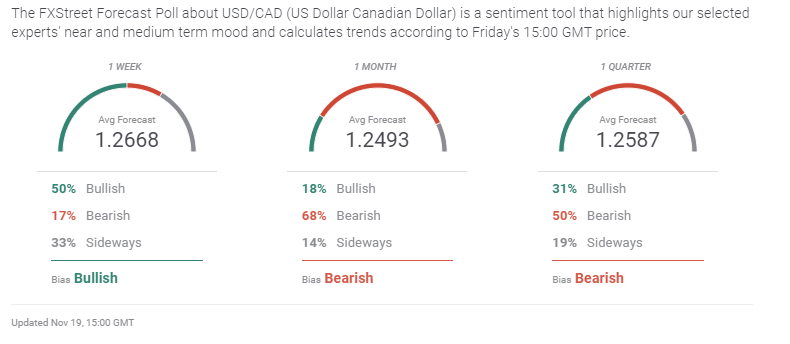

- The FXStreet Forecast Poll predicts that resistance at 1.2660 will hold followed by consolidation.

The USD/CAD finished at its highest level in seven weeks as new Covid restrictions in Europe drove a US dollar safety rally on Friday, capping a week of falling oil prices and improving American economic statistics.

Rising Covid cases and hospitalizations on the continent provoked several countries to return to the policies of the first pandemic response last year. Germany has banned unvaccinated people from public places and the Czech Republic has forbidden them from attending events. Austria has instituted a home lockdown for the unvaccinated and Sweden ordered a health pass for gatherings of over 100 people.

Currency markets bought the US dollar in all pairs on Friday except the USD/JPY where the yen has a minor safe-haven trade of its own.

West Texas Intermediate (WTI) opened the week at $79.79. Wednesday’s close at $77.65, down 2.7% to a six-week low, was enough to propel the USD/CAD to 1.2612, its first finish above 1.2600 since October 1. After a slight rise to $78.23 on Thursday with a minor drop in the USD/CAD to 1.2600, the WTI decline restarted on Friday. The North American crude oil standard fell 3.4% on the day, concluding the five sessions at $75.52, off 5.2%.

Since the open on November 10 at $83.11, WTI has lost 9.1% in eight sessions. It was the largest sustained drop in WTI since the 10.7% decline over seven sessions from August 12 to August 20. Markets are beginning to factor in the economic drag from the new European measures and perhaps others in the US and elsewhere before the winter is over.

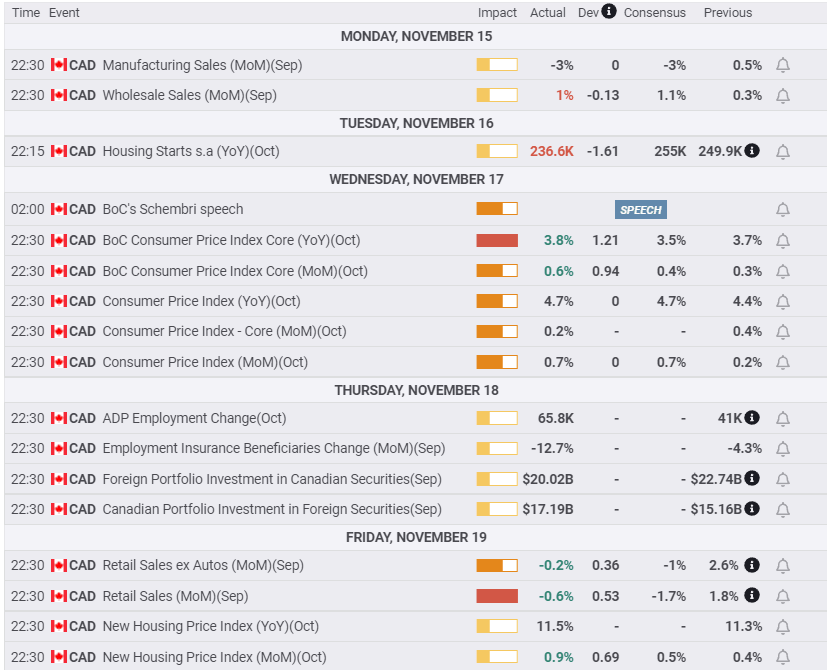

Canadian data was better than expected. September Retail Sales fell 0.6% instead of the estimated -1.7%. Inflation, as in the US, was hotter than predicted in October. Core CPI from the Bank of Canada (BOC) rose 3.8% on the year, up from 3.7% the prior month, topping the 3.5% forecast.

In the US, Wednesday’s three October releases gave the dollar a solid boost. Retail Sales more than doubled to 1.7% from 0.8% in September. Industrial Production jumped 1.6% from September’s 1.3% decline. Capacity Utilization climbed to 76.4% its best level since February 2020, from 75.2% in September.

Despite the general expectation for higher interest rates in the US, within that assumption there is a good deal of uncertainty.

Current Fed projections, to be updated at the December 15 Federal Open Market Committee (FOMC) meeting, have one fed funds increase in 2022. Predictions based on the fed funds futures have two hikes next year and one in early 2023.

Quickening US economic growth and rampant inflation may prompt an advance in the Fed’s taper timetable which is fixed only for a $15 billion cut this month and next, with an expectation of a straight through reduction each month to June.

The COVID resurgence in Europe brings the possibility of the same in the US and likelihood of the Fed raising rates during lockdowns seems far-fetched.

US Treasury rates fell on Friday when the White House suggested that President Biden would make his choice for the Fed Chair this weekend. Jerome Powell’s tenure ends in February and Washington was rife with speculation that he might be replaced with Fed Governor Lael Brainard. No policy difference is expected, though Ms Brainard might be considered slightly more accommodating than Mr Powell. She would however, owe her position to President Biden, whose party might not want to risk the economic impact of higher interest rates in 2022, a Congressional election year.

USD/CAD outlook

The prospect of higher US Treasury rates are the primary source of the recent USD/CAD strength. At the moment those trends are largely speculative. Markets expect US interest rates to rise but so far they have not done so.

The US 10-year Treasury yield lost 4 basis points on Friday closing at 1.548%. That is 20 basis points below this year’s high of 1.746% on March 31 and between 50 and 100 points below the range in 2018 and 2019.

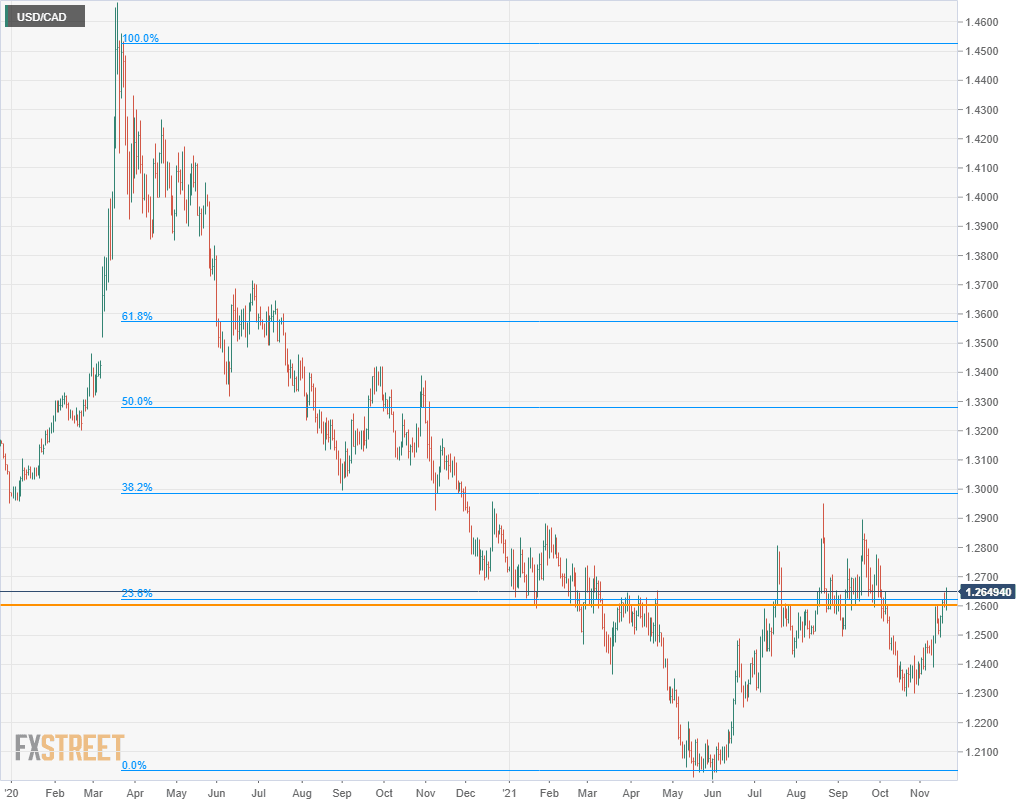

The combination of falling crude oil prices, the subsidence of bond market support from the Fed and the safety-trade to the dollar as the winter season approaches in the Northern hemisphere with its likely increases in Covid incidence, make the USD/CAD a strong candidate for a rising trend. When that is joined to the largely unrecovered levels from the April 2020 to June 2021 fall in the USD/CAD, the potential for a sustained move toward 1.3000 rises substantially.

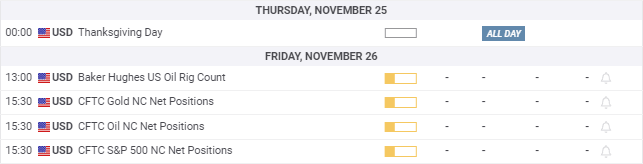

American information is heavily loaded on Wednesday before the Thanksgiving holiday on Thursday. Durable Goods Orders for October should confirm the excellent Retail Sales release. The first revision to third quarter GDP may offer a slight improvement. Better results will support the dollar. There are no Canadian statistics this week.

The USD/CAD bias is higher with the 2021 high close of 1.2828 on August 19 as the initial goal.

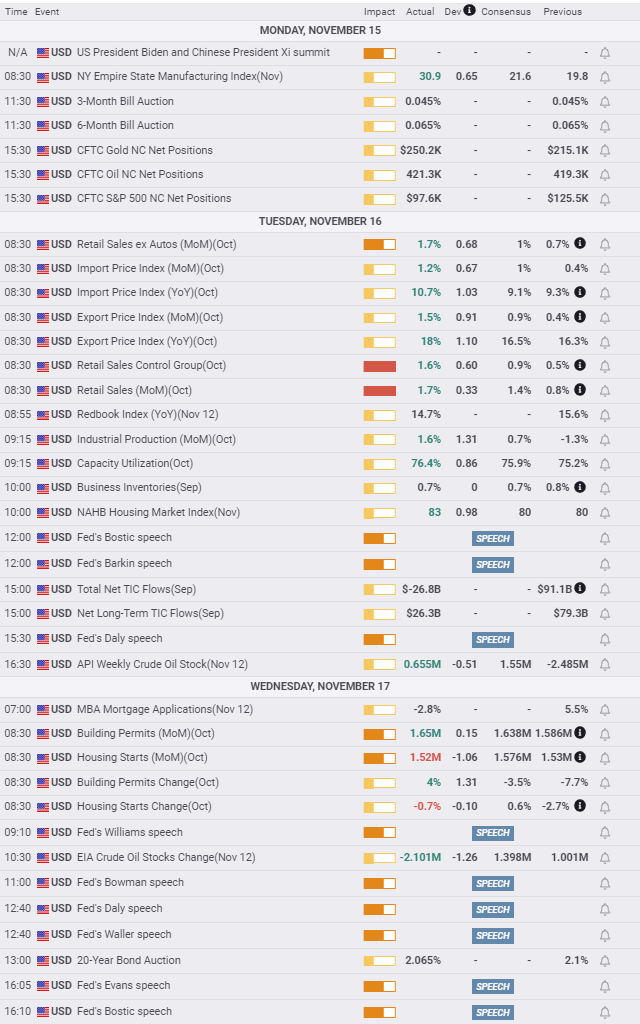

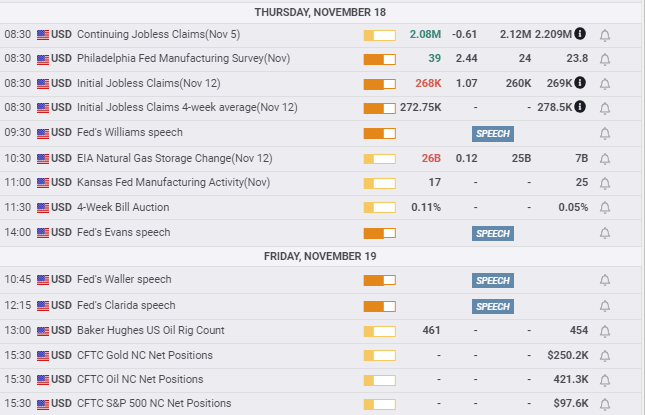

Canada statistics November 15–November 19

US statistics November 15–November 19

FXStreet

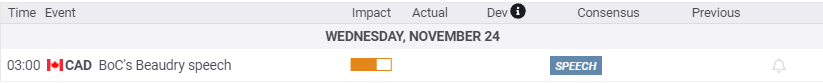

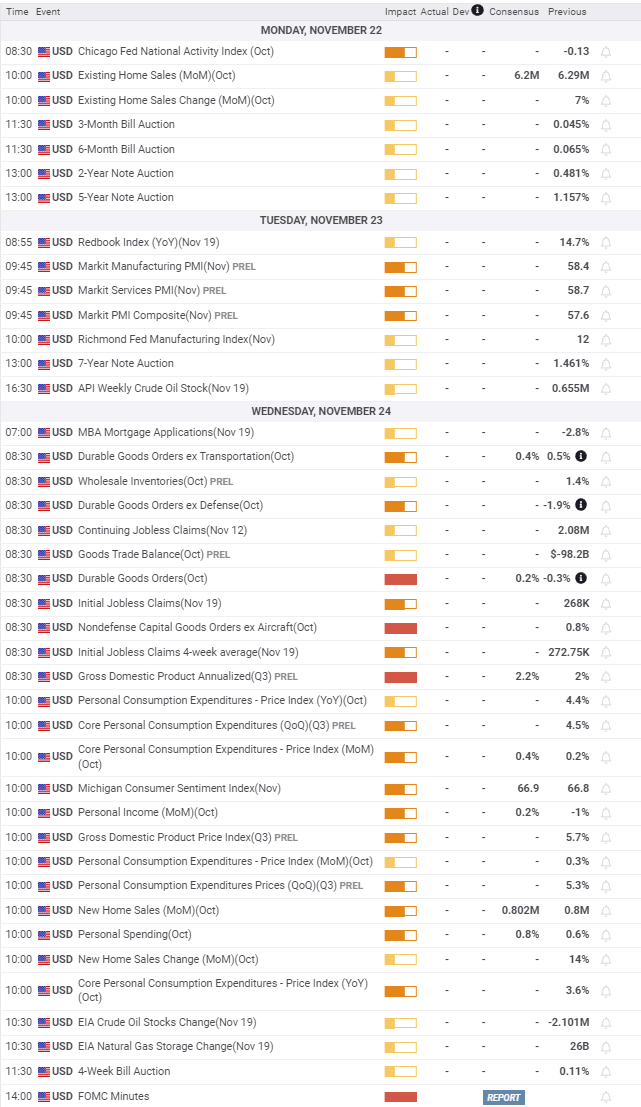

Canada statistics November 22–November 26

FXStreet

US statistics November 22–November 26

FXStreet

USD/CAD technical outlook

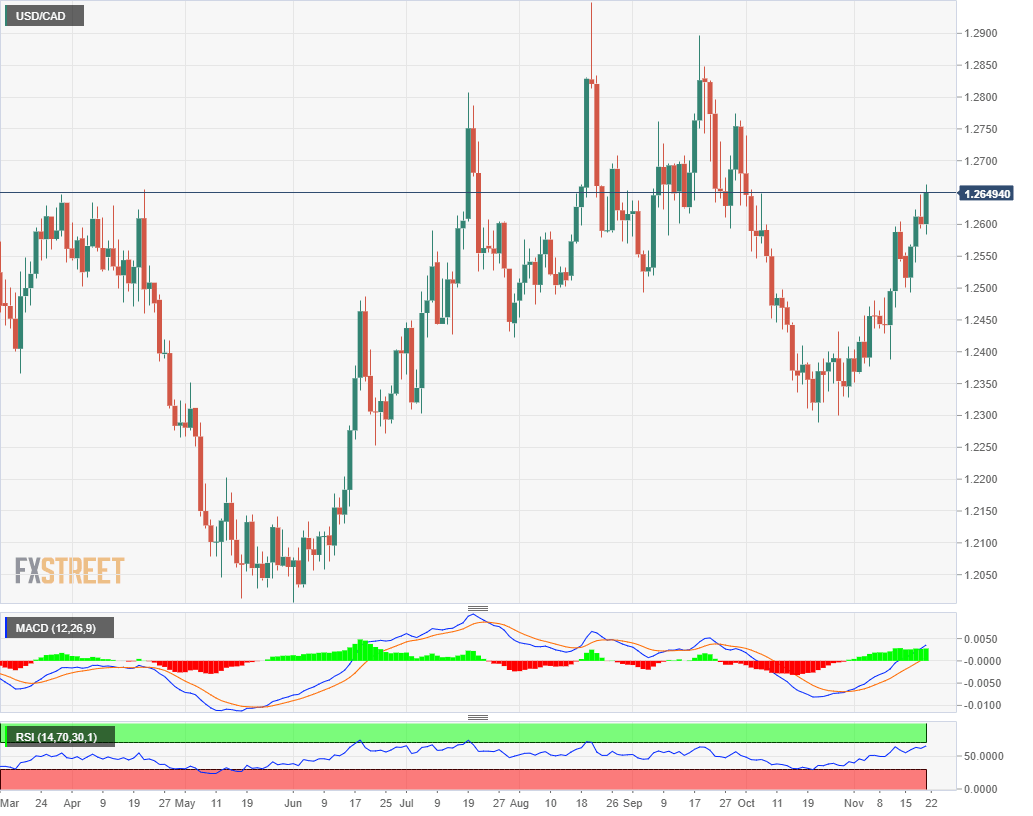

The MACD (Moving Average Convergence Divergence) cross of the signal line on October 28 retains its positive prognosis. The divergence degree fell slightly on Monday with the USD/CAD decline but widened to Friday. The Relative Strength Index (RSI) is approaching overbought status with its steady rise over the past six weeks but it remains a buy signal. The USD/CAD has gained 2.7% since the close on October 20, a rise which will naturally make traders think of profits.

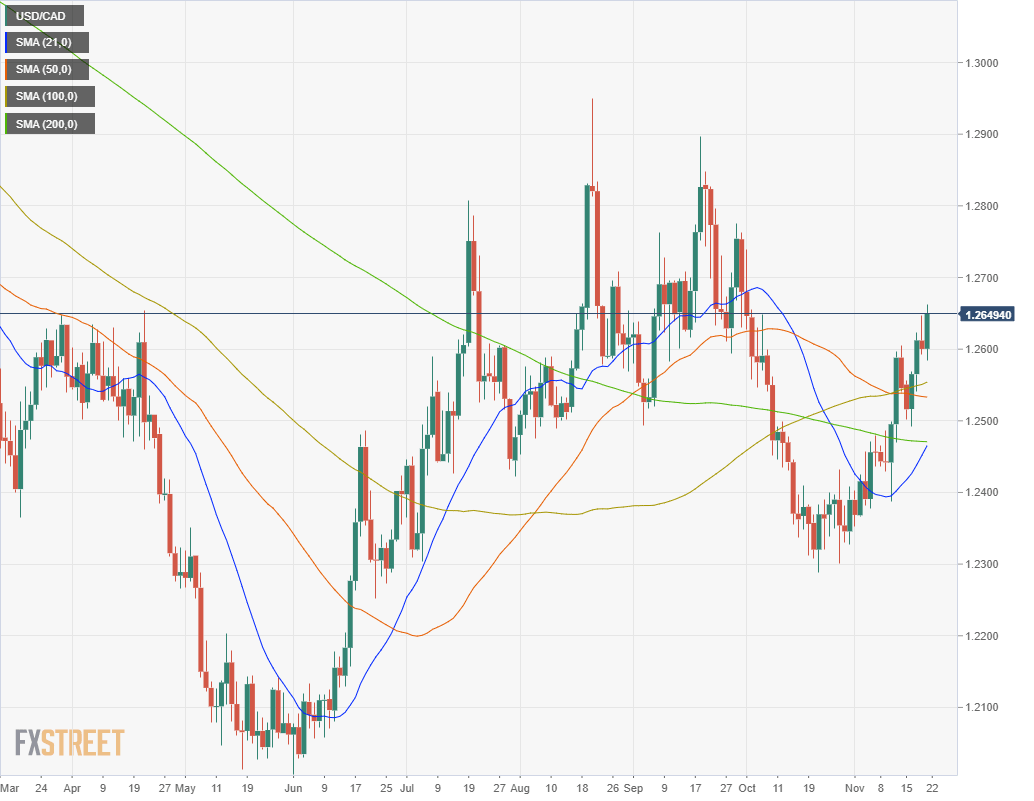

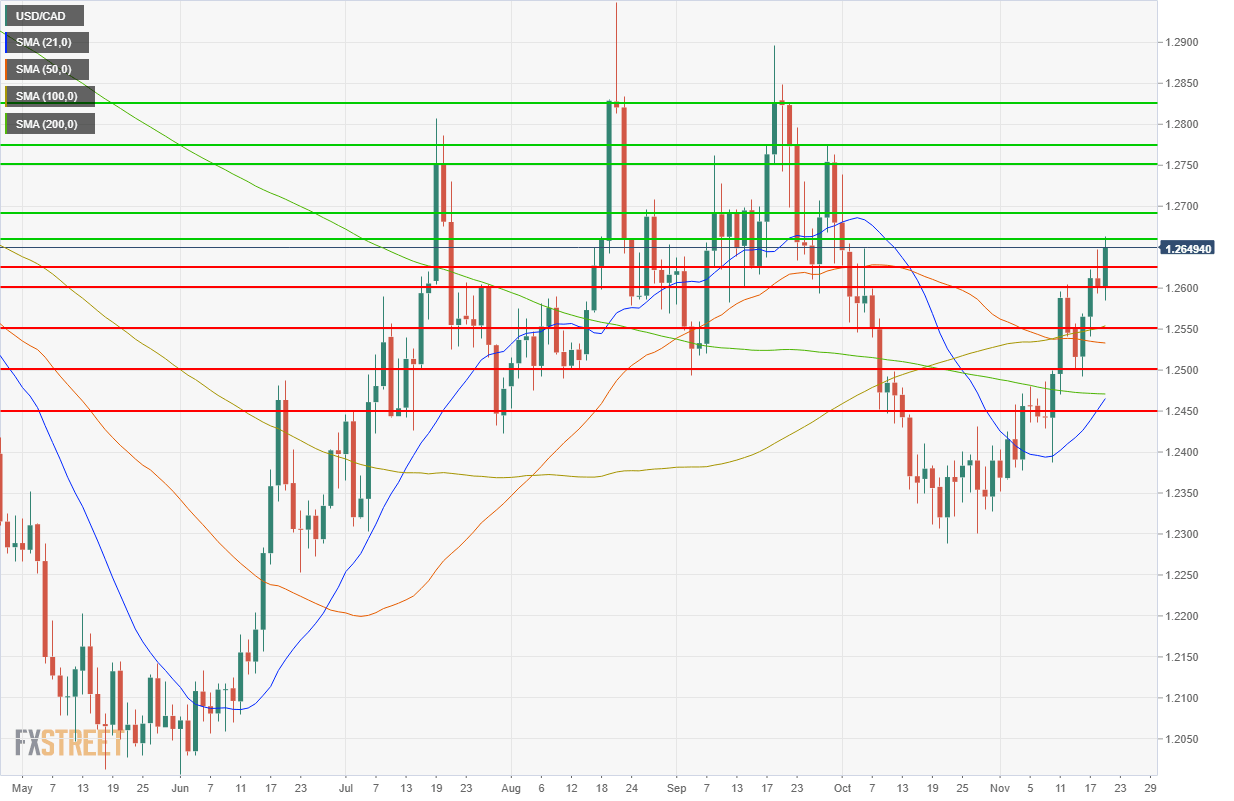

The two middle moving averages (MA), the 50-day at 1.2533 and the 100-day at 1.2554 form a band of support about 100 points below current levels and coincide with the ranges from November 11 to November 16. This support should hold if the USD/CAD drops beneath 1.2600. The 100-day MA crossed the 50-day MA on November 11 indicating that the longer-term view is becoming more positive. The 21-day MA and the 200-day MA at 1.2465 and 1.2471 form another strong support level.

Resistance: 1,2660, 1.2690, 1.2750, 1.2775, 1.2825

Support; 1.2625, 1.2600, 1.2555,1.2550

FXStreet Forecast Poll

The FXStreet Forecast Poll predicts failure at 1.2660 resistance followed by consolidation.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Joseph Trevisani

FXStreet

Joseph Trevisani began his thirty-year career in the financial markets at Credit Suisse in New York and Singapore where he worked for 12 years as an interbank currency trader and trading desk manager.