USD/CAD Weekly Forecast: Fundamental change is still elusive

- USD/CAD falls 1% to five-week low at 1.2720.

- WTI rises 3.7%, closes at $113.93, an 11-week high.

- Bank of Canada expected to hike 0.5% to 1.5% on Wednesday.

- US inflation and Treasury yields drop, PMI, real income fall.

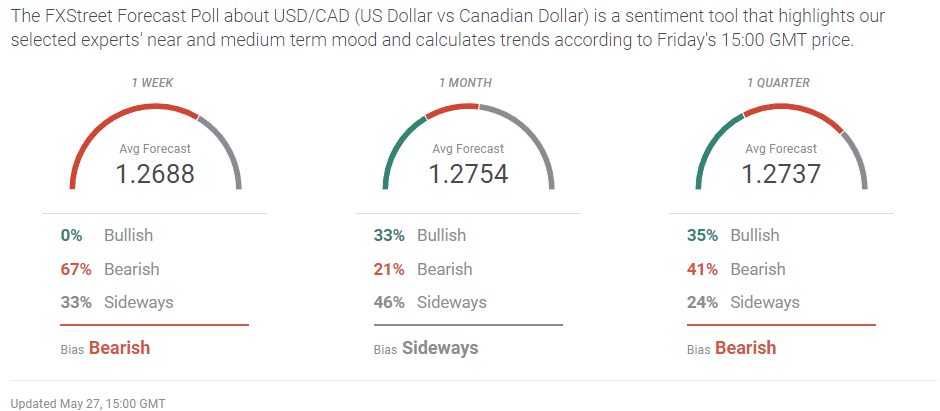

- FXStreet Forecast Poll anticipates consolidation above 1.2700.

The two-week old general reversal in the US dollar brought the USD/CAD to 1.2726 on Friday, its lowest close since April 22. Fading US Treasury yields, slightly lower US inflation, an expected Bank of Canada (BoC) rate increase and a 3.7% jump in crude oil all played their part, as did the market disfavor that has plagued the US dollar for two weeks.

Treasury rates in the US peaked in the second week of May. The 10-year finished at 3.13% on May 6 and has been ebbing ever since. It closed at 2.74% on Friday, off 38.7 basis points from that high. Treasury yields had been a direct driver of the dollar’s recent gains against the loonie and other currencies

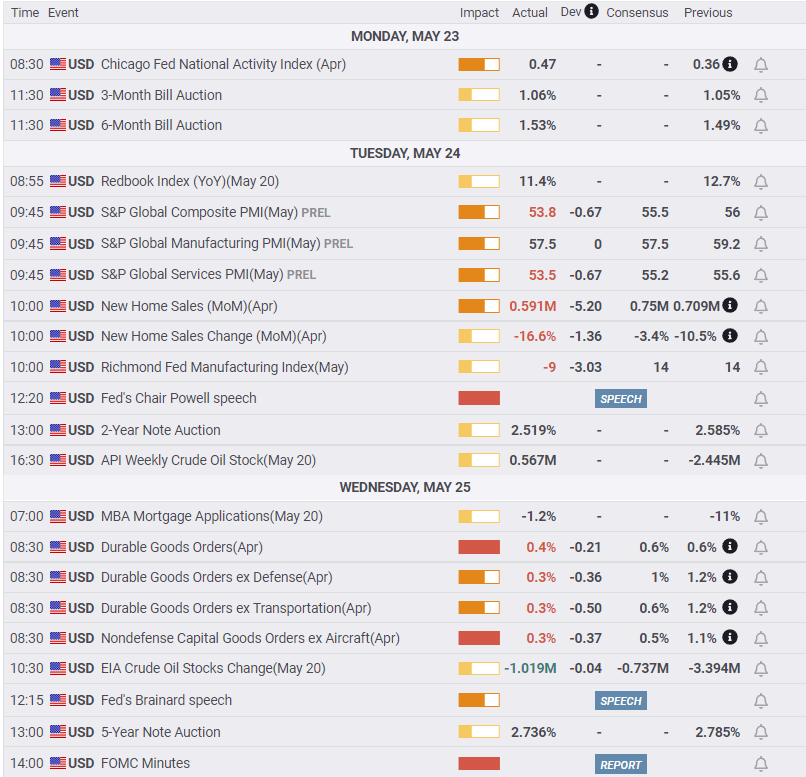

Core PCE inflation, the Fed’s chosen gauge, rose 4.9% as expected in April, down from 5.2% in March. Headline PCE dropped to 6.3% from 6.6%.

Market concerns over the health of the US economy are coupled with worries that the Federal Reserve’s rate hikes, projected to reach at least 3% by the end of the year, could slow or halt the recovery.

Several other US data points were also weaker than predicted. The S&P Global Purchasing Managers Index (PMI) for the service sector came in at 53.5 below expectations for May. Existing Home Sales, 90% of the US housing market, dropped to a 22-month low in April as 30-year mortgage rates had jumped to 5.1% by the end of May. On March 3 the national average was 3.76%.

Durable Goods Orders for April were lower than expected despite a strong performance from Retail Sales. Personal Spending was stronger than anticipated, rising 0.9% on a 0.7% projection. Personal Income rose 0.4%, just under the 0.5% estimate.

However, when April income and spending figures were corrected for inflation, in a second series from the Bureau of Economic Analysis (BEA), both lost ground.

Real personal spending (PCE) rose 0.7% in April, 0.2% lower than the unadjusted figure. Real disposable personal income dropped to flat in April after inflation’s price gains were removed.

Over the period from December to April, real disposable income has fallen an average of 0.42% per month. In contrast, the uncorrected personal income figure averaged a positive 0.42% for the same five months.

The real disposable income loss explains why consumers were again forced to draw on savings to maintain spending levels in April.

The Atlanta Fed estimate for second quarter GDP dropped to 1.8% from 2.4% and revised first quarter growth slipped to -1.5% from -1.4%. It had been forecast to rise to -1.3%. It is an open question whether the Fed would pause its rate campaign if second quarter growth is negative, fulfilling the traditional definition of a recession with two consecutive declining quarters.

Bank of Canada Governor Tiff Macklem is widely expected to raise the overnight rate 50 basis points to 1.5% at the Wednesday meeting. The Federal Reserve is predicted to follow suit at its June 15 meeting.

West Texas Intermediate (WTI) rose 3.7% from Monday to Friday, closing at $113.93, its highest finish since March 8.

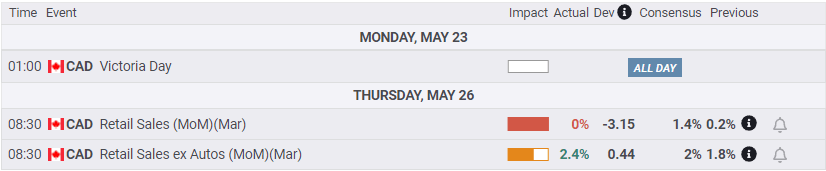

Canadian data was unimportant; only March Retail Sales was released. Though the ex-Autos number was stronger than predicted, March is old news.

USD/CAD outlook

The 2.4% decline in the USD/CAD since closing at 1.3044 on May 12 is not so much a fundamental change in favor of the loonie but a recognition that the advantages of the US dollar had played out. The surge in US Treasury rates brought on by the Fed’s belated acknowledgement of inflation and very public determination to curb prices, has been tempered by the reality of a weak economy and a badly stretched consumer. While US households have continued to spend, the fear that inflation will, if not controlled soon, begin to bite into consumption is one of two scenarios pushing equities lower. The second is the concern that the very rapid pace of Fed increase will themselves curb economic activity. The plunge in home sales to an almost two year low is a signal of the danger to rate sensitive industries.

Despite the sharp drop in the USD/CAD it has only reached about mid-way (in a wide definition) of the range of the past 11 months.

Except for the rise in WTI, the other inputs for the USD/CAD level, central bank interest rates, growth and inflation, are unlikely to differentiate for two such closed tied economies as the US and Canada. The change in US rate perception was the major fundamental shift over the last two weeks. Reality instructs that the BoC and the Fed, unexpected developments aside, will be alternating rate increases until the end of the year. There is no permanent advantage to either side of the USD/CAD.

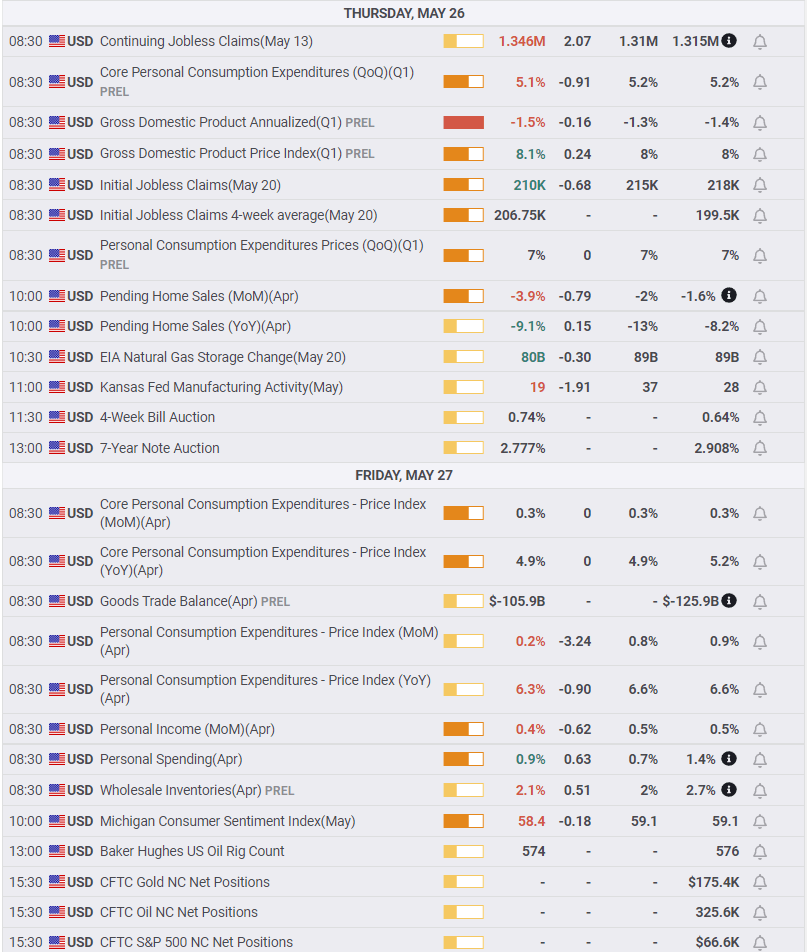

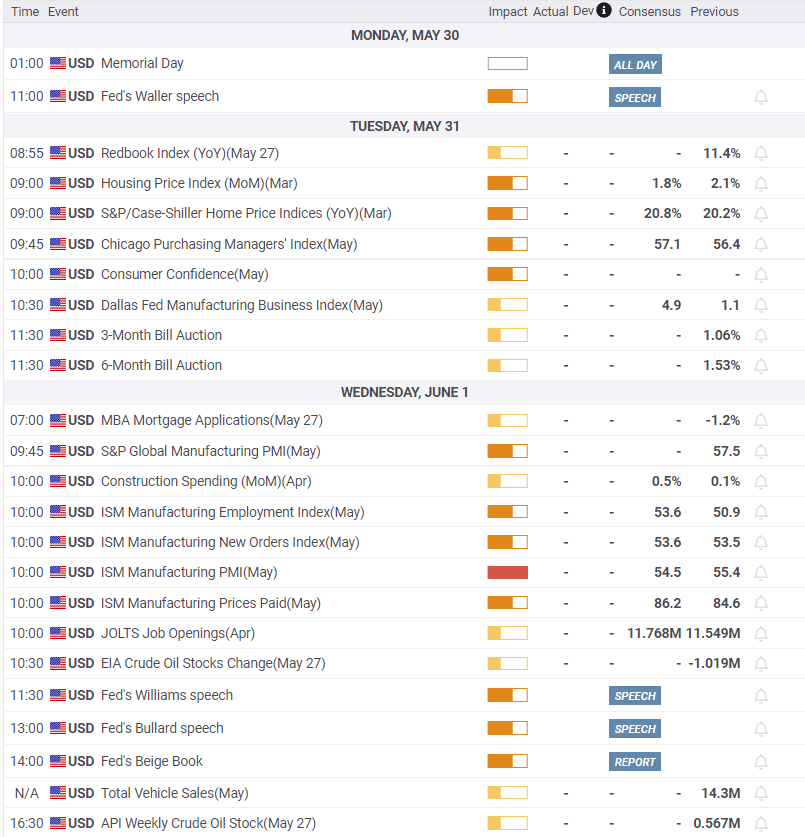

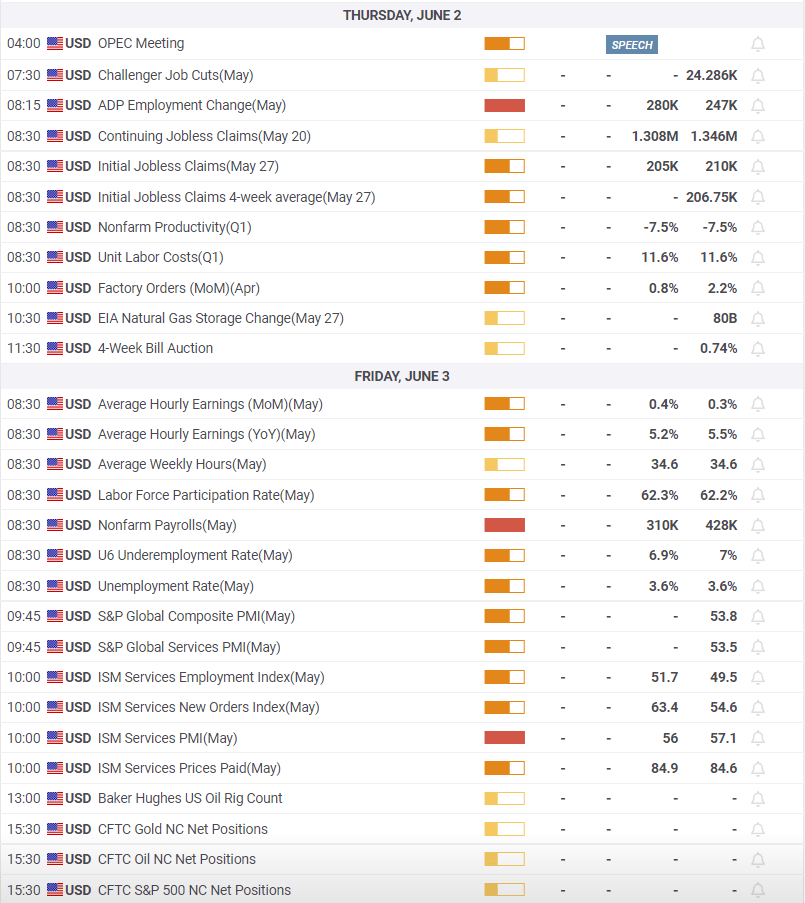

It is a busy week for US data. Nonfarm Payrolls on Friday is the headliner with a drop to 310,000 predicted, which would be the lowest in 13 months. Average Hourly Earnings is forecast to fall to 5.2% annually, widening the loss in purchasing power. Earlier in the week, Purchasing Managers' Indexes (PMI) in manufacturing and services from the Institute for Supply Management (ISM) will be monitored for signs of economic weakness. Consumer Confidence for May from the Conference Board should confirm the fall in the Michigan outlook. Markets are wary of any indication of US recession, statistical weakness plays against the dollar.

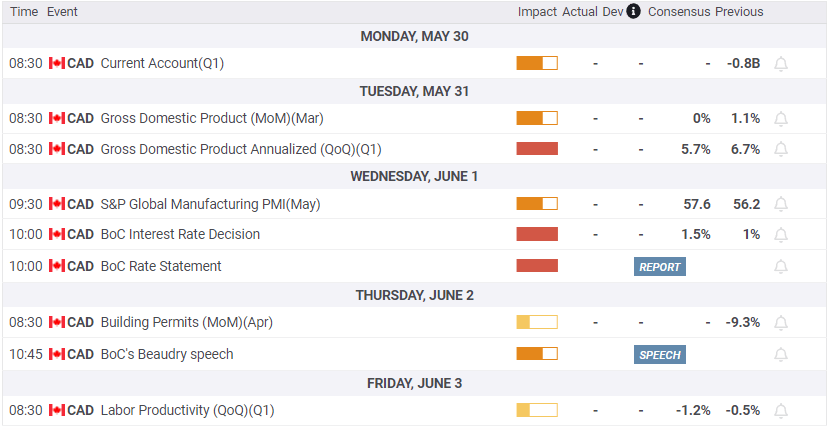

For Canada only the BoC rate decision on Wednesday is of import.

Expect the USD/CAD to drift lower and consolidate between 1.2650 and 1.2750. The caveat to this expectation is oil. A sharp rise in crude prices will send the USD/CAD lower.

Canada statistics May 23–May 27

US statistics May 23–May 27

Canada statistics May 30–June 3

FXStreet

US statistics May 30–June 3

USD/CAD technical outlook

The price line downward spread of the MACD (Moving Average Convergence Divergence) widened a bit this week but the sell signal is aging. Movement lower will be obstructed by the two-month stay of the USD/CAD between 1.2650 and 1.2750 from the end of January to early March. The Relative Strength Index (RSI) has slipped only just below neutral despite the 1% drop in the USD/CAD this week and the 2.4% fall since May 12.

Average True Range (ATR) remains elevated reflecting the breaching of several important levels over the past two weeks. Volatility will likely decline as the USD/CAD encounters the 1.2650-1.2750 range.

The 21-day moving average (MA) tilted into decline from Tuesday to Wednesday. The 50-day and 100-day MAs bracket 1.2700 and form a solid base. The 200-day MA marks the lower side of the 1.2650-1.2750 range and support.

Resistance: 1.2770, 1.2810, 1.2840, 1.2890

Support: 1.2710, 1.2700, 1.2670, 1.2660, 1.2640, 1.2630

Moving Averages: 21-day 1.2864, 50-day 1.2707, 100-day 1.2697, 200-day 1.2662

FXStreet Forecast Poll

The FXStreet Forecast Poll is bearish in the immediate outlook but anticipates consolidation just north of 1.2700.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Joseph Trevisani

FXStreet

Joseph Trevisani began his thirty-year career in the financial markets at Credit Suisse in New York and Singapore where he worked for 12 years as an interbank currency trader and trading desk manager.

%20intro-637892876731172587.png&w=1536&q=95)

%20outlook-637892881125585933.png&w=1536&q=95)

%20tech%201-637892921023027665.png&w=1536&q=95)

%20tech%202-637892921202667317.png&w=1536&q=95)