USD/CAD technical analysis: Trade sentiment lifts CAD, but risk appetite remains on thin ice

- USD/CAD has dropped below the 1.32 handle to a low of 1.3120 as

- Trade developments and the price of oil had been supportive to the Loonie.

- However, China's Gross Domestic Product expanding the slowest in 27 years could be a weight to risk sentiment.

- The USD/CAD daily chart is painting strong bearish picture.

- The FX Poll is showing a mixed picture within a 124 pip range.

USD/CAD's downside, beyond the 23.6% Fibonacci of the May - July range, will depend on a continued recovery of optimism in the geopolitical sphere. The price of oil will be monitored closely considering steep surpluses of crude on the horizon vs simmering political tensions. Scheduled events will come in the form of the Bank of Canada Business Outlook Survey, Canadian Retail Sales and Canada's Federal Election. The major risk is whether the US and China will indeed sign a "Phase-1" contract or not, for further delays in clarity will fan the flames of uncertainty and potentially weigh on commodity-linked currencies such as the Canadian Dollar.

This was the week:

Oil prices were a dominant theme, with the price of a barrel of oil falling and recovering within a 5.6% range in terms of Western Texas Intermediate crude oil prices, (WTI). Bulls are some way off from a convincing recovery yet – Indeed, prices were ending the week at a loss on demand concerns as data showing slower economic growth in China's Gross Domestic Product expanded at a 6% pace in the third quarter, the slowest in 27 years.

Meanwhile, the US Dollar has been on the back-foot as risk appetite returned, making for a springboard effect from which the loonie was able to capitalize on a positive data overall. Trade talks between the US and China are still as ever up in the air, although there had been some signs of progress at the end of last week.

However, China has demanded that the US cancel new tariffs for a trade deal to take place – “We hope both sides can continue to work together to advance the negotiations and, as soon as possible, reach a phased agreement and make new progress on cancelling tariffs,” said China’s Ministry of Commerce spokesman Gao Feng. Unfortunately, there has not been any confirmation as to when a 'phase-1' agreement would be signed or whether the leaders of both countries planned to meet.

Key CAD events:

A positive Manufacturing Sales number was rising 0.8% in August vs a contraction in the prior month, helping to prop up the Loonie. However, the Headline Consumer Price Index was weaker than expected at 1.9% year on year in September. Mind you, the stronger core inflation should give the Bank of Canada cover to look past the headline miss.

For the week ahead, the Bank of Canada's (BoC) Business Outlook Survey (BOS) on October 22nd will likely be a mixed bag, but "unlikely to make a strong case for a near-term cut, keeping the focus on 2020," analysts at TD Securities argued. Retail Sales will be one to watch, and so too will the Federal Election:

"Recent polls are tilted heavily towards a minority, with the Liberals and Conservatives in a virtual tie. Should neither party win a majority, the government will need to rely on ad-hoc arrangements to survive confidence motions. However, if neither party can viably govern, it would open the door to a formal coalition or a hasty return to the polls,"

Analysts at TD Securities explained.

Key U.S. events:

Next week is quiet on the US calendar with only a handful of second-tier data, such as Durable Goods Orders and Markit's preliminary Purchasing Managers' Indexes (PMIs) as well as Existing and then New Home Sales later in the week.

The main focus, therefore, will stay with US trade relations with the EU and China. It will be interesting to see how much hype there will be due to the fresh tariffs that the US imposed on EU imports which kicked in on Friday 18th October. Given the Chinese GDP disappointment, global growth and trade concerns could be a major influence on the US Dollar, likely catching a bid on risk-off flows and a softer euro. For now, investors seem to be satisfied enough that China has agreed to buy US agri-products and that a 'Phase-1' deal is in progress.

USD/CAD Technical Analysis

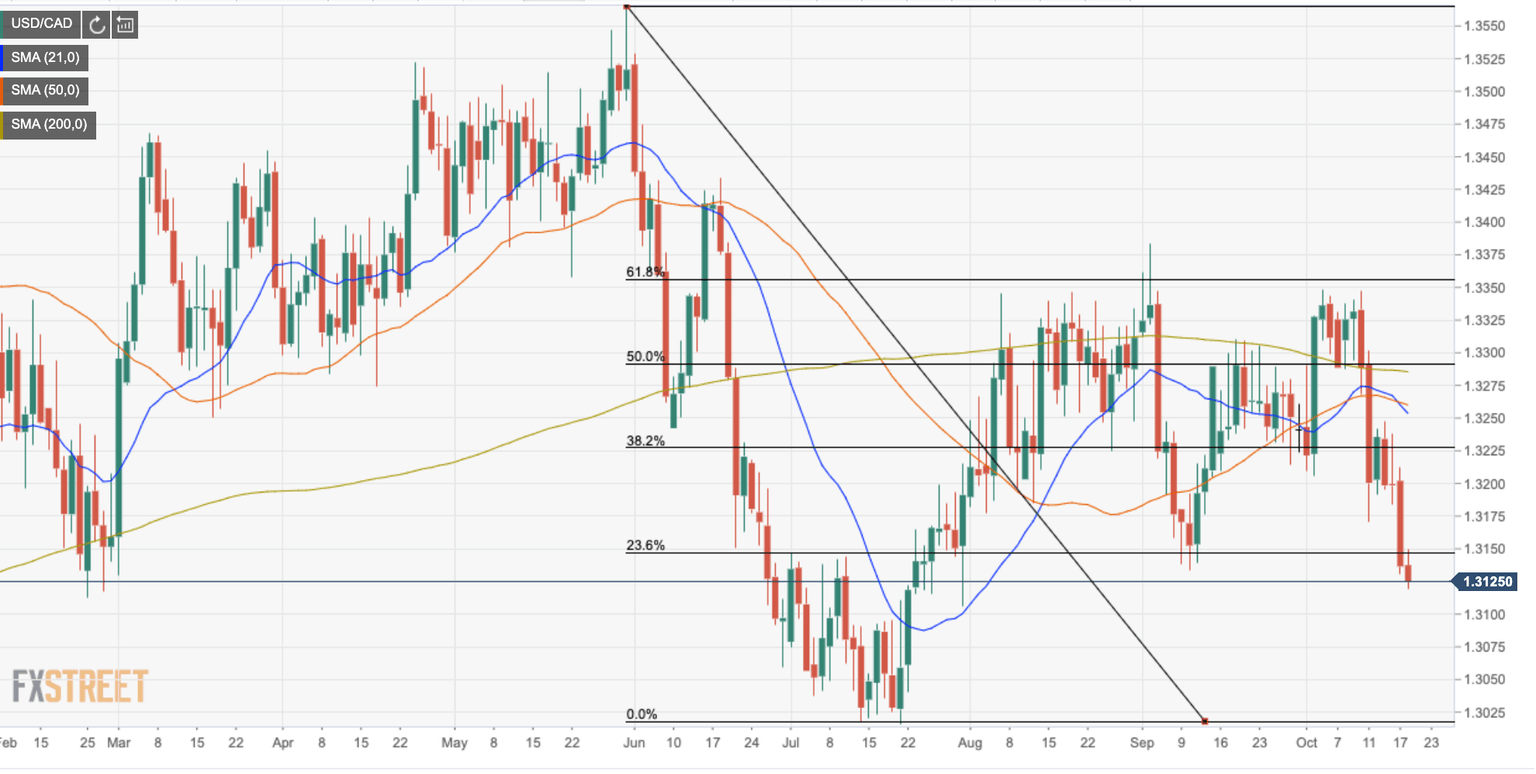

USD/CAD dropped last Friday from the 200-day moving average, bursting below the 21 and 50-DMAs as well as the 38.2% Fibonacci, extending the downside during the week to test back below the 23.6% Fibonacci of the May - July range. This leaves the pair licking its wounds below the 1.32 handle and testing the bull's commitments at the 1.3120 level. The double top also casts a bearish bias on the daily chart while bears get below the 10th Sep lows.

USD/CAD daily chart

USD/CAD Forecast Poll

The FX Poll is showing a moderate bullish bias in the short term and a substantial rise in the 1 month, tailing off as time goes by. The price range, however, is limited to just 124 pips over the same time period.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.