US stocks soar as transition and vaccine boost sentiment

US equities climbed to a record high as traders reacted to the latest news on vaccine and political transition. The Dow Jones rose by more than 1.5% and closed above the $30,000 mark while the S&P 500 closed at a record high of $3,635. This increase was driven, in part, by a move to value stocks that are set to benefit from an economic recovery like Tesla and Apple. It was also driven by Trump’s decision to allow transition and the appointment of Janet Yellen as the next Treasury secretary. Analysts believe that she will swiftly reverse the recent Treasury’s refusal to extend the Fed’s emergency lending facilities.

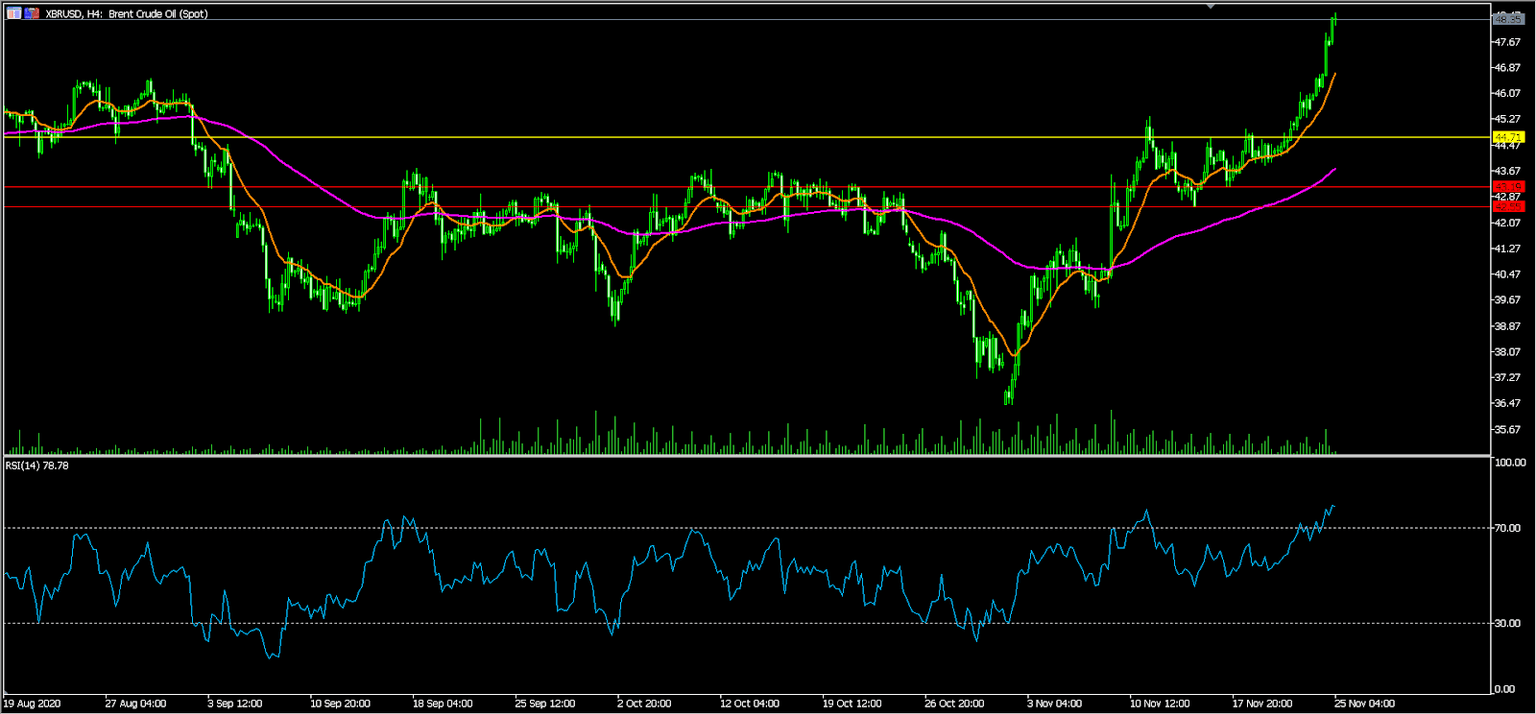

The price of crude oil also rose sharply in overnight trading as investors focused on the potential economic recovery as countries start planning for vaccinations. Brent, the international benchmark, rose to a high of $48.48, which is less than $2 below the important level of $50. Similarly, the West Texas Intermediate (WTI) rose to a high of $45.58. Data from the American Petroleum Institute (API) showed that inventories rose by more than 3.8 million last week. This was higher than the expected contraction of more than 333k barrels that analysts were expecting. Later today, the Energy Information Administration (EIA) will release the official data.

The US dollar declined in overnight trading because of the overall risk-on sentiment that is going on in the market. Investors also reacted to the weak consumer confidence data. According to the Conference Board, consumer confidence declined to 96.1 in November, a significant drop from October’s increase of 101.4. This performance was mostly because of the reported increase in covid infections. Later today, the currency will react to US new home sales, Q3 GDP estimates, initial jobless claims, new home sales, and the FOMC minutes.

EUR/USD

The EUR/USD pair rose to an intraday high of 1.1905, which is close to the highest level on November 11. On the four-hour chart, the pair has moved above the 15-day and 25-day moving averages. The accumulation and distribution indicator has also continued rising. Therefore, the path of least resistance for the pair is upwards, with the next important target being a November high of 1.1921.

GBP/USD

The GBP/USD pair rose to a high of 1.3360 in overnight trading. This price is a few pips below this month’s high of 1.3398. On the four-hour chart, the price has moved above the 25-day moving average while the money flow index (MFI) has continued to rise. It is also slightly above the ascending yellow trendline. Therefore, the pair will likely continue rising, with the next main target being the month-to-date high at 1.3398.

XBR/USD

The XBR/USD pair rose to a multi-month high of $48.30. On the four-hour chart, the price is above the 25-day, 100-day, and 200-day moving averages, which is a sign of strength among bulls. The Relative Strength Index (RSI) has moved above the overbought level of 70 while the momentum indicator has continued to rise. Therefore, the pair will most likely continue rising as bull's eye the $50 resistance level.

Author

OctaFx Analyst Team

OctaFX

OctaFX is a market-leading forex broker, providing personalised forex brokerage services to customers in over 100 countries worldwide.