US stocks soar after the strong bank and Netflix earnings

US stocks rallied yesterday after strong earnings from leading American companies. The Dow Jones, Nasdaq, and S&P 500 rose by 0.40%,1.8%, and 0.8%, respectively. Goldman Sachs reported net earnings of more than $4.5 billion, helped by its trading division. Total revenue increased by 17% to $17 billion. Similarly, Bank of America revenue rose to $20.2 billion while profits fell to $5.47 billion. Netflix also reported strong earnings as its total number of users soared to more than 200 million. Later today, companies that will release their earnings are UnitedHealth, Procter and Gamble, and Morgan Stanley, among others.

The British pound rose in overnight trading ahead of the key inflation data from the UK that will come out in the morning session. Analysts expect the numbers to show that consumer prices rose by a MoM and YoY rate of 0.2% and 0.5%, respectively. They also expect the core CPI to rise to 0.2% and 1.3%, respectively. Weak inflation numbers will put more pressure on the Bank of England (BOE) to act. That's after the governor, Andrew Bailey, warned about the risks of negative rates.

The euro rose in the overnight session, continuing the gains made yesterday. The pair will today react to the European Union's consumer price index (CPI) data. The median estimate is for the headline CPI to have dropped to 0.3% in December. They also expect that the core CPI rose by an annualised rate of 0.2%. These numbers will come as the European Central Bank (ECB) starts its first monetary policy meeting of the year. Analysts expect that the bank will leave interest rates unchanged.

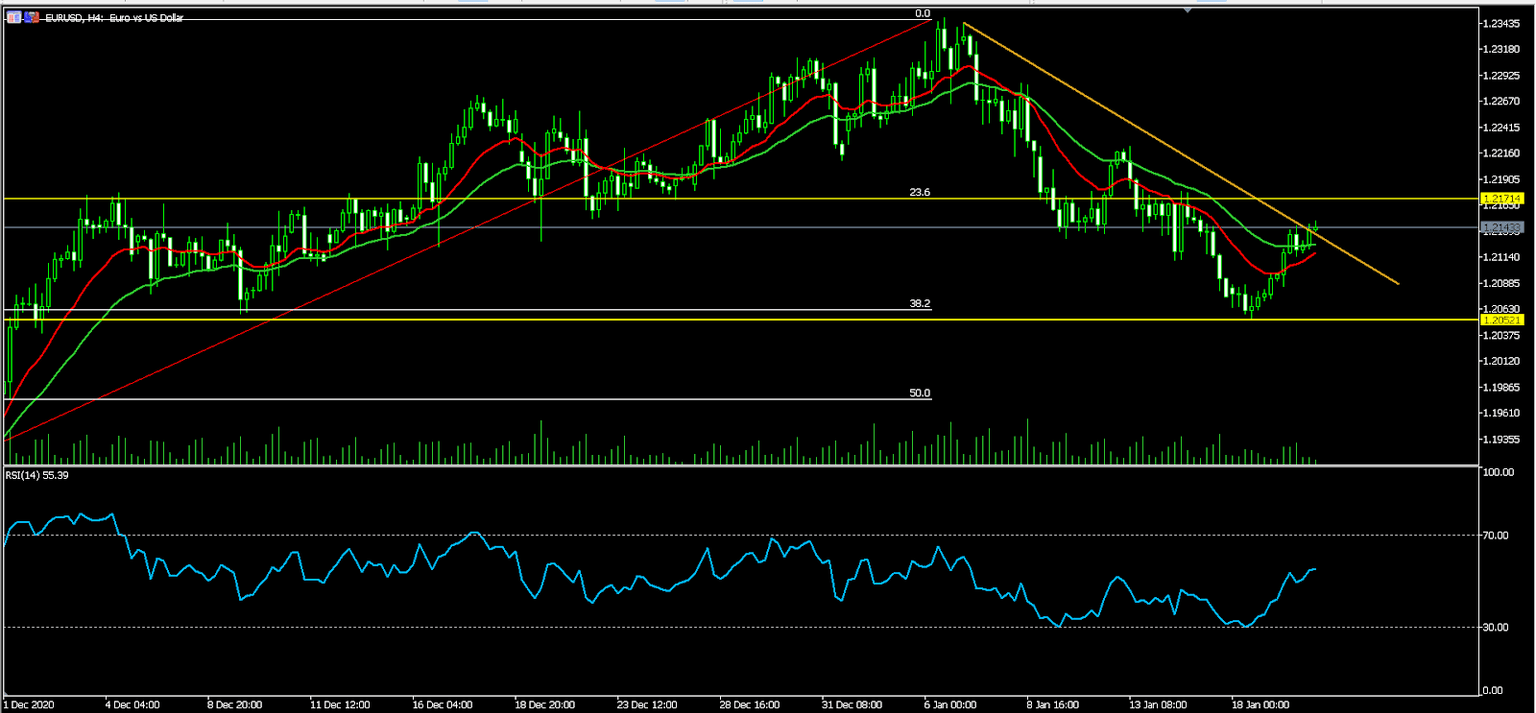

EUR/USD

The EUR/USD is in its second day of straight gains after the sharp declines experienced last week. It is trading at 1.2147, which is higher than this week's low of 1.2054. The price has also moved above the 25-day and 15-day moving averages, which is a sign that bulls are taking control. The Average Directional Movement Index (ADX) has also risen to 48. Still, the price seems to be in the corrective wave of the Elliot Wave pattern, meaning that it will likely resume the downward trend.

USD/CAD

The USD/CAD pair dropped slightly in overnight trading ahead of the Bank of Canada (BOC) interest rate decision. On the four-hour chart, the price is slightly below the descending trendline, meaning that bears are still in control. It has also moved below the 15- day EMA and is slightly above the YTD low of 1. 2625. The pair may continue falling with the next target being at 1.2650.

ETH/USD

ETH/USD rose to a high of 1,435 as part of the overall rally of altcoins. It is now consolidating at 1,387 as some bulls start taking profit. On the four-hour chart, the bullish trend is supported by the short and longer-term moving averages while the ADX indicator is at 35. Therefore, the pair will likely continue rising as bulls target the next resistance at 1,500.

Author

OctaFx Analyst Team

OctaFX

OctaFX is a market-leading forex broker, providing personalised forex brokerage services to customers in over 100 countries worldwide.