US stocks reach records as vaccine and consolidation events rise

The Canadian dollar was little changed in overnight trading as traders reacted to the relatively strong Canadian third-quarter GDP data. According to the country’s statistics office, the country’s economy bounced back by 40.5 in the third quarter after falling by 38.1% in Q2. On a QoQ basis, the economy expanded by 8.9% after contracting by 11.3% in the second quarter. This happened as personal consumption, exports, and government spending increased. Also, the relatively higher crude oil prices contributed to the strength of the economy.

US stocks rallied yesterday as hopes of a Covid vaccine increased. The Nasdaq, which is made up of technology stocks, increased by 1.28% and ended the day at $12,355. The Dow Jones and S&P 500 also rose by more than 1%. The ongoing wave of corporate consolidation has also helped boost the stocks. On Monday, S&P Global announced a $44 billion deal to acquire Markit. And yesterday, Salesforce announced a $27 billion deal to acquire Slack, the fast-growing communication platform. Other recent deals include AMD’s acquisition of Xilinx and Nvidia’s acquisition of Arm.

The Australian dollar rose during the Asian session as traders reflected on the RBA interest rate decision and the relatively strong GDP data from the country. In total, the economy expanded by 3.3% in the third quarter after dropping by 7.0% in the second quarter. On an annualised basis, the GDP fell by 3.8%, a better increase than the previous 6.4%. Private consumption increased by 5.9% while capital expenditure and chain price fell by 0.1%. Later today, we will receive mortgage data from the United States, German retail sales, and crude oil inventories.

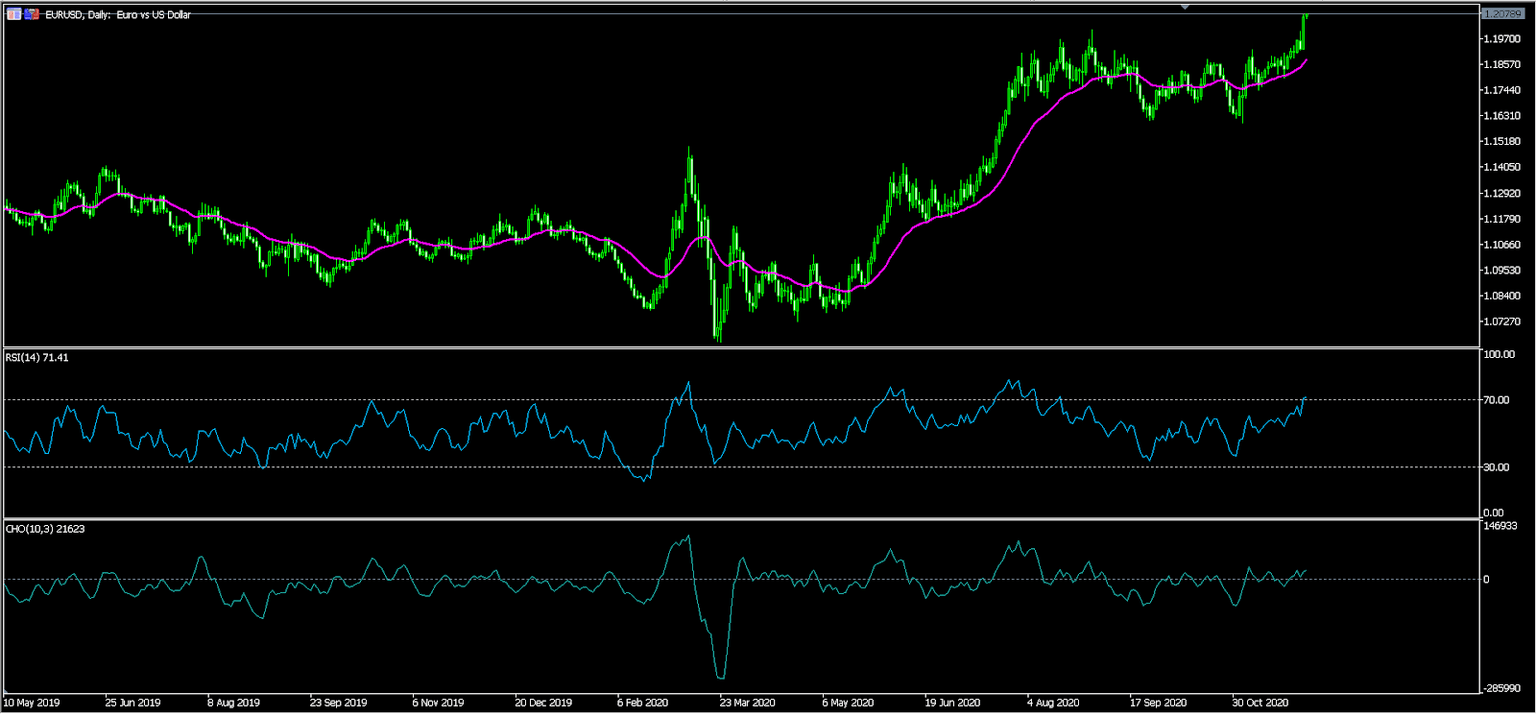

EUR/USD

The EUR/USD pair broke-out yesterday. After spending a few days below 1.2000, the pair managed to rally to 1.2076, the highest level since June 2018. On the daily chart, the price has moved above the 25-day and 15-day exponential moving averages. Oscillators have also risen, with the RSI rising to 71 and the Chaikin oscillator moving above the neutral line. Therefore, by breaking out, it means that bulls have prevailed, which will see the pair continue rallying in the near term.

XBR/USD

The XBR/USD pair dropped as disagreements among OPEC members rose. The pair is trading at 46.90, which is substantially lower than last week’s high of 48.95. On the hourly chart, the pair has moved below the 14-hour and 28-hour moving average while oscillators like the RSI and CCI have also continued falling. In the immediate near term, the pair will likely continue falling until a supply deal is reached. However, for the longer-term, the pair will likely continue rallying and possibly break-out above 50.

USD/CAD

The USD/CAD pair was little changed during the overnight session. On the hourly chart, the pair has been on an overall downward, forming a descending yellow channel. At the current price, the pair has moved slightly above the lower line of the channel. It is also below the moving averages while the stochastic oscillator has moved close to the overbought level. Therefore, the pair will likely rise as bulls aim for the upper side of the channel.

Author

OctaFx Analyst Team

OctaFX

OctaFX is a market-leading forex broker, providing personalised forex brokerage services to customers in over 100 countries worldwide.