US stocks ignite: All-time highs breakout after shutdown fears fade [Video]

- Bullish scenario from yesterday’s analysis has now materialized, with Dow, S&P 500, and Nasdaq blasting to fresh all-time highs.

- Momentum fueled by easing shutdown fears and strong investor appetite, as markets shift focus back to growth and Fed support.

- Breakouts confirm upside structure, with indices now in price discovery mode — but eyes remain on NFP Friday for confirmation.

![US stocks ignite: All-time highs breakout after shutdown fears fade [Video]](https://editorial.fxsstatic.com/images/i/nvidia-01_XtraLarge.jpg)

Update: From forecast to reality

Yesterday, I outlined the shutdown vs. NFP dilemma and highlighted that the bullish case would kick in if confidence improved and support levels held.

Today, that’s exactly what unfolded. U.S. equities didn’t just bounce — they exploded higher, reclaiming momentum and driving into all-time high territory.

This is one of those moments where preparation and scenario planning pay off. By mapping out both the bearish and bullish paths, we were ready for whichever side the market chose. And it chose strength.

Why the rally happened

The fuel behind this move is twofold:

- Shutdown fears easing: With signs of progress in Congress toward averting a prolonged government shutdown, the political overhang has lightened, boosting sentiment.

- Fed and liquidity narrative: Markets continue to price in further policy easing later this year, giving growth stocks and big tech the oxygen to lead the charge.

- Positioning squeeze: Many traders had hedged defensively into the shutdown risk — and the unwinding of those hedges added fuel to the upside.

This combination turned yesterday’s cautious consolidation into a breakout frenzy, sending the indices into price discovery mode.

PMI surprise supports the rally

The ISM Manufacturing PMI for September printed at 49.1, slightly above the forecast of 49.0 and the previous 48.7.

While the reading remains in contractionary territory (below 50), the uptick was enough to ease growth concerns and signal a modest improvement in manufacturing activity.

For equity markets already leaning bullish after easing shutdown fears, this data acted as a confirmation trigger, encouraging risk-on flows and accelerating the breakout to all-time highs.

VIX confirms the move

The VIX, which was perking higher just days ago, has stabilized, signaling that fear is being replaced by risk appetite. This supports the narrative of renewed confidence.

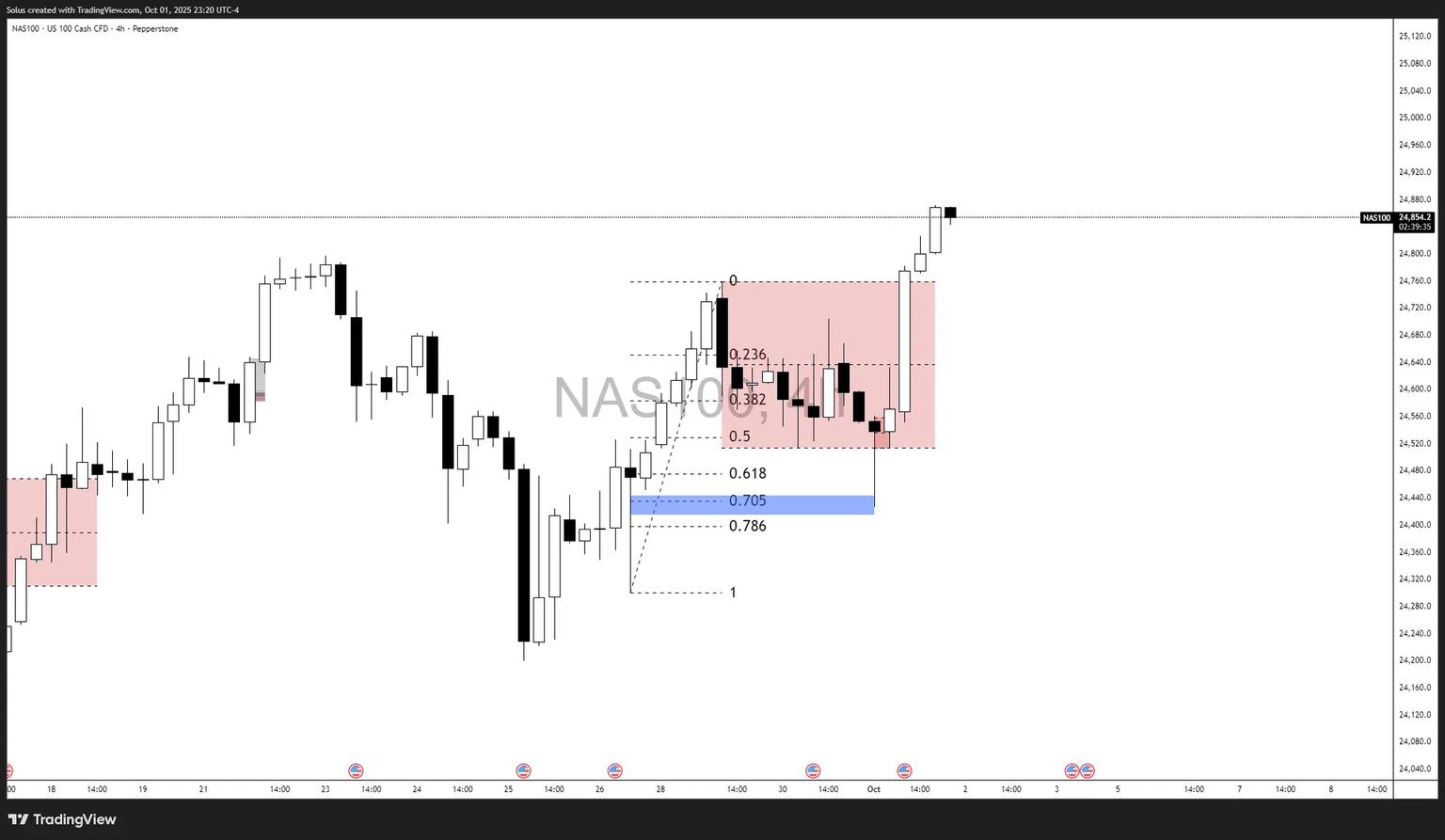

Technical outlook on US indices: Dow, Nasdaq, S&P

Dow Jones (US30)

Price has pushed decisively above the 46,500 resistance, a level that capped momentum earlier this week. The breakout confirms bullish intent, with buyers defending higher lows and targeting the 46,700–46,900 zone next. As long as price holds above 46,500, structure remains firmly bullish.

S&P 500 (US500)

The S&P has surged cleanly beyond the 6,700 breakout zone, now trading in price discovery. Strong impulsive candles show buyers in control, with momentum supported by unwinding of defensive positioning after easing shutdown fears. Immediate supports now rest at 6,700–6,690, while upside could extend toward 6,740–6,760.

Nasdaq-100 (NAS100)

The Nasdaq cleared its consolidation box and exploded higher from the 0.705 retracement / demand zone, reclaiming bullish order flow. Price now trades near 24,850, with the breakout confirming strong momentum. If this strength holds, the next target lies near 25,000, while 24,700 now acts as key support.

In short: All three indices have transitioned from consolidation to breakout mode, with prior resistance zones now flipping into support. Momentum is clearly bullish, and the charts confirm that yesterday’s upside roadmap has materialized into fresh highs.

Final thoughts

This is exactly why scenario planning matters. Yesterday, we mapped out that a bullish breakout was on the table if shutdown fears subsided — and today, that’s the story.

Now, with NFP on Friday, the question is whether momentum can sustain, or if a hot/cold jobs print forces another shift in narrative. But for now, U.S. indices are on fire, and the bullish roadmap has played out to perfection.

Author

Jasper Osita

Independent Analyst

Jasper has been in the markets since 2019 trading currencies, indices and commodities like Gold. His approach in the market is heavily accompanied by technical analysis, trading Smart Money Concepts (SMC) with fundamentals in mind.