US September Nonfarm Payrolls Preview: Analyzing gold's reaction to NFP surprises

- Nonfarm Payrolls in the US are forecast to increase by 250,000 in September.

- Gold is likely to react slightly more significantly to a disappointing jobs report than an upbeat one.

- Gold's movement has no apparent connection with NFP deviation four hours after the release.

Historically, how impactful has the US jobs report been on gold’s valuation? In this article, we present results from a study in which we analyzed the XAUUSD pair's reaction to the previous 26 NFP prints*.

We present our findings as the US Bureau of Labor Statistics (BLS) gets ready to release the September jobs report on Friday, October 7. Expectations are for a 250,000 rise in Nonfarm Payrolls following the 315,000 increase in August.

*We omitted the NFP data for March 2021, which was published on the first Friday of April, due to lack of volatility amid Easter Friday.

Methodology

We plotted gold price’s reaction to the NFP release at 15 minutes, one hour and four hours intervals after the release. Then, we compared the gold price reaction to the deviation between the actual NFP release result and the expected result.

We used the FXStreet Economic Calendar for data on deviation as it assigns a deviation point to each macroeconomic data release to show how big the divergence was between the actual print and the market consensus. For instance, the August (2021) NFP data missed the market expectation of 750,000 by a wide margin and the deviation was -1.49. On the other hand, February’s (2021) NFP print of 536,000 against the market expectation of 182,000 was a positive surprise with the deviation posting 1.76 for that particular release. A better-than-expected NFP print is seen as a USD-positive development and vice versa.

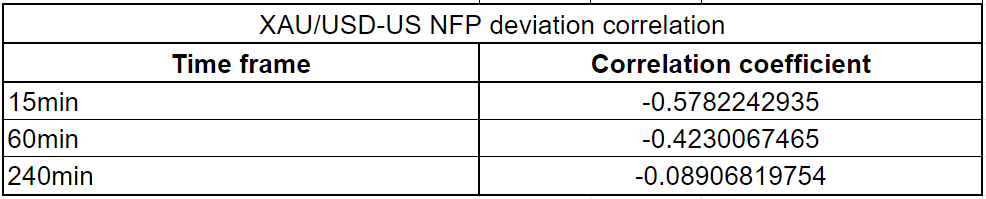

Finally, we calculated the correlation coefficient (r) to figure out at which time frame gold had the strongest correlation with an NFP surprise. When r approaches -1, it suggests there is a significant negative correlation, while a significant positive correlation is identified when r moves toward 1. Since gold is defined as XAU/USD, an upbeat NFP reading should cause it to edge lower and point to a negative correlation.

Results

There were 12 negative and 14 positive NFP surprises in the previous 26 releases, excluding data for March 2021. On average, the deviation was -0.86 on disappointing prints and 0.69 on strong figures. 15 minutes after the release, gold moved up by $3.97 on average if the NFP reading fell short of market consensus. On the flip side, gold declined by $2.79 on average on positive surprises. This finding suggests that investors’ immediate reaction is likely to be slightly more significant to a disappointing print.

However, the correlation coefficients we calculated for the different time frames mentioned above don’t even come close to being significant. The strongest negative correlation is seen 15 minutes after the releases with the r standing at -0.57. One hour after the release, the correlation weakens with the r rising to -0.42 and there is virtually no correlation to speak of four hours after the release with the r approaching 0.

Several factors could be coming into play to weaken gold’s correlation with NFP surprises. A few hours after the NFP release on Friday, investors could look to book their profits toward the London fix, causing gold to reverse its direction after the initial reaction.

It's worth noting, however, that the Fed announced in July that they have abandoned rate guidance and that they will assess the data releases before deciding on the next policy step. Hence, the Fed's data-dependent approach to policy could cause markets to react in a more significant way than usual.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.