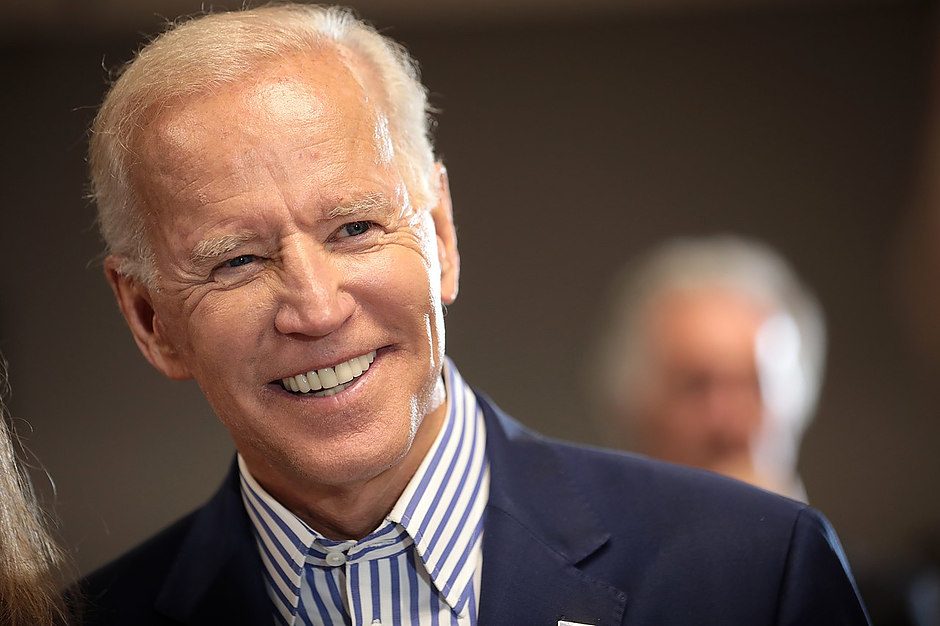

US President Biden says US would defend Taiwan in event of Chinese invasion

Asia Market Update: Quiet session ahead of multiple rate decisions this week; US President Biden says US would defend Taiwan in event of Chinese Invasion.

General trend

- Dollar mixed against currencies; CNH weaker against the USD.

- China ends total lockdown in Chengdu over the weekend.

- ECB members make hawkish comments ahead of rate decision.

- Equities opened mixed and turned broadly negative.

Headlines/economic data

Australia/New Zealand

- ASX 200 opened flat.

- (AU) TD Bank expects RBA to increase the cash rate by 50bps in Oct vs prior view of 25bps, expects terminal rate at 3.6% vs prior 3.35%.

- (AU) Australia will not ban tourists from Russia as part of sanctions - press.

- (AU) Australia sells A$700M v A$700M indicated in 0.50% Sept 2026 bonds; Avg Yield: 3.4555% v 3.1722% prior; bid-to-cover 3.21x v 2.6x prior.

- (AU) Reserve Bank of Australia (RBA) head of financial stability Kearns: The property market influences economic conditions and so indirectly affects interest rates. Housing constitutes around half of households' wealth - talk titled "Interest rates and the property market".

- (NZ) S&P notes coronavirus side effects will linger for Government, Banks, and insurers in New Zealand.

- (NZ) New Zealand Aug Performance Service Index (PSI): 58.6 v 54.4 prior.

- LNK.AU Received letter from Dye and Durham increasing initial cash offer to A$3.81 with potential for contingent A$0.13/shr payment; Cannot recommend new proposal.

- (NZ) Reserve Bank of New Zealand (RBNZ) Gov Orr: Company disclosure will be a catalyst for pricing risks, critical to get disclosure of climate risk.

Japan

- Nikkei 225 opened closed for holiday.

- (JP) Typhoon Nanmadol made landfall in Southern Japan and is expected to move up to Honshu, millions told to evacuate, Tokyo under flood advisory - Japan press.

Korea

- Kospi opened +0.2%.

- (KR) South Korea Govt has requested banks report their FX position every hour - financial press.

- (KR) South Korea sells 10-year bonds: Avg yield 3.765% v 3.210% prior.

- (KR) South Korea to discuss steps on FX stability with corporations on Sept 20th.

China/Hong Kong

- Hang Seng opened -0.4%; Shanghai Composite opened -0.1%.

- (CN) China PBOC Open Market Operation (OMO): Sells CNY2.0B in 7-day reverse repos v CNY2.0B prior; Sells CNY10B in 14-day reverse repos; Net inject CNY12B v Net CNY0B prior.

- (CN) China PBOC sets Yuan reference rate: 6.9396 v 6.9305 prior.

- (HK) Said that Hong Kong may cut its preboarding covid testing requirement - Press.

- (CN) China's Chengdu city [21M citizens] to resume normal life and social order from Sept 19th - press.

- (CN) China State Planner (NDRC): Approved 9 fixed asset investment projects worth CNY80.2B in Aug; Seeking to promote acceleration in domestic consumption recovery; To speed up injection of funds to begin project construction as soon as possible.

- (CN) China Aug YTD FDI (CNY-denominated) Y/Y: 16.4% v 17.3% prior.

- (CN) China expells a former Railway Corporation officer Sheng from the Chinese Communist Party citing suspected law violations - Xinhua.

North America

- (US) President Biden: US would defend Taiwan if there was a Chinese invasion; More optimistic than I have been for a long time, We are going to get control of inflation.

- (US) Goldman Sachs analysts cut 2023 US GDP forecast from 1.5% to 1.1%; Maintain 2022 US GDP forecast at 0.0%.

Europe

- (RU) According to Kremlin sources, proposals to return to negotiations have not yet found understanding with Pres Putin; But if earlier Putin was absolutely against it, now after Ukrainian counteroffensive he reportedly thinks about their possibility - Meduza.

- (EU) EU Foreign Policy Chief Borrell: It is Ukraine that must determine the conditions for peace and ending the conflict; EU countries should strengthen support for Ukraine.

- (IE) ECB's Lane (Ireland, chief economist): ECB could raise interest rates over the next several meetings and into the early part of 2023.

- (EU) EU Commission confirms to propose suspension of 65% of EU budget funds (roughly €7.5B) for Hungary from three programs under EU's cohesion policy [**Note: first time when EU Commission tests its 'democracy sanction'].

Levels as of 01:15 ET

- Nikkei 225, closed for holiday, ASX 200 -0.1% , Hang Seng -1.0%; Shanghai Composite -0.2% ; Kospi -1.1%.

- Equity S&P500 Futures: -0.2%; Nasdaq100 -0.4%, Dax +0.1%; FTSE100 -0.3%.

- EUR 0.9990-0.9994; JPY 143.24-143.27; AUD 0.6705-0.6707; NZD 0.5969-0.5970.

- Gold -0.4% at $1,676.85/oz; Crude Oil +0.4% at $85.10/brl; Copper -0.6% at $3.5190/lb.

Author

TradeTheNews.com Staff

TradeTheNews.com

Trade The News is the active trader’s most trusted source for live, real-time breaking financial news and analysis.