US Personal Income Preview: Dollar may decline on reminder of dire straits yet timing matters

- Personal income data for November may reflect the lack of federal support.

- Spending figures may also paint a depressing picture amid the virus' resurgence.

- The dollar may decline in response, yet other figures are also in play.

Investors received a shot in the arm in November – promising vaccine announcements, but consumers only felt the pinch. The penultimate month of 2020 saw a surge in COVID-19 cases, causing shoppers to shy away from stores and several governors to impose restrictions.

Retail sales figures have shown a disappointing drop of 1.1% in expenditure and Personal Spending figures are likely to be a drag as well. After rising by 0.5% in October, economists expect a fall of 0.2% in November.

Despite online Black Friday sales, the downbeat mood likely pushed the data lower and that is already one reason to expect some pressure on the dollar.

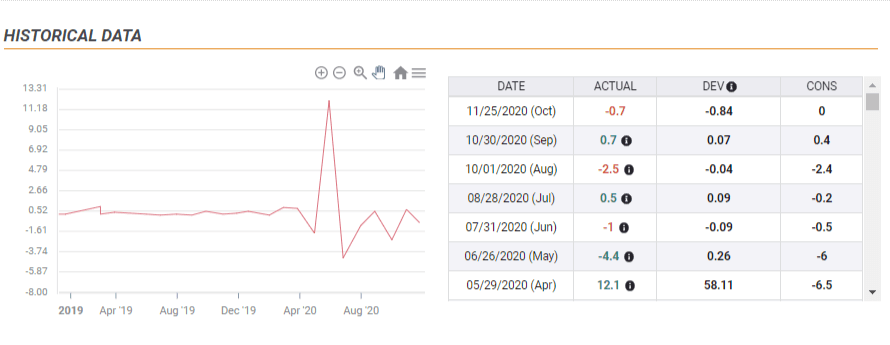

The same report also includes Personal Income data, and that is also projected to decline. A decrease of 0.3% is on the cards, after a retreat of 0.7% in October – falling short of estimates back then.

Source: FXStreet

Also here, there is room for disappointment – and not only due to last month's miss. Several federal aid programs lapsed in late July, and their effect is gradually being felt. Some of the funds – such as those in unemployment benefits – went to savings, but these are dwindling.

A weak income figure will likely help justify the $900 billion relief package Congress just passed – perhaps even showing that it is far from enough. It will take time until lawmakers push new legislation under President Joe Biden – if they win control over the Senate. It could add pressure on the Federal Reserve to act sooner than later, weighing on the greenback.

Timing matters

The figures are published ahead of the Christmas holiday when liquidity thins out. This could cause an outsized move, especially if both statistics miss estimates.

On the other, the festive season also means that the calendar is packed and includes also weekly jobless claims and Durable Goods Orders for November. Unemployment applications are set to show a worrying increase, compounding potentially weak income and spending figures and weighing on the dollar.

However, durables may surprise to the upside. The figures represent long-term investment, which is influenced by vaccine news rather than the grim virus situation. That could create volatility and choppiness.

See Durable Goods Orders Preview: Long-term investment likely got a shot in the arm, dollar-positive

Conclusion

Personal Income and Personal Spending figures will likely be downbeat, weighing on the dollar. However, these statistics could be offset by durable goods orders, complicating the market reaction.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.