Durable Goods Orders Preview: Long-term investment likely got a shot in the arm, dollar-positive

- Durable Goods Orders are set to rise in November, yet at a moderate pace in November.

- An underestimation of previous months implies a potential for another upside surprise.

- Vaccine news and the conclusive US elections may have also boosted long-term investment.

Winter has come early in the northern hemisphere – the winter wave of coronavirus has hit the US hard and caused the Federal Reserve to talk about a more moderate recovery. However, for long-term investment, the penultimate month of 2020 may have been upbeat.

Reflecting that slowdown – related to the virus and to the lack of additional federal stimulus – Retail Sales took a hit last month, falling by 1.1%. Jobless claims also missed estimated and showed a worrying increase.

Why Durables could beat expectations

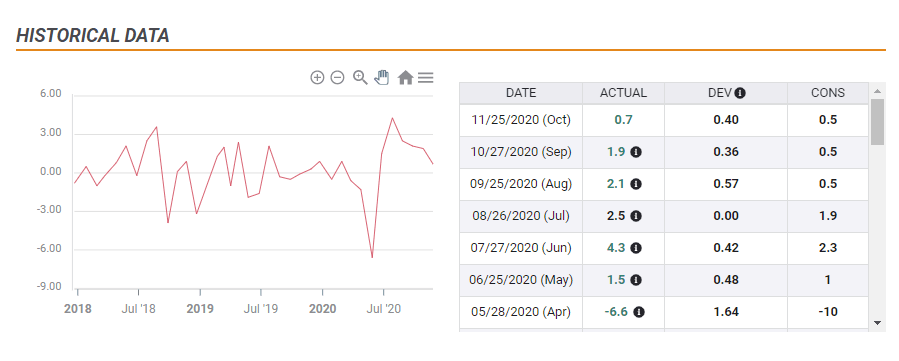

Economists expect Durable Goods Orders to follow a similar path, with the headline rising by a moderate 0.6%, around half October's increase of 1.3%. The Nondefence ex-air component – aka "core of the core" is forecast to advance by 0.6% a slowdown from 0.8% beforehand.

Source: FXStreet

However, there are two reasons to expect a better outcome rather than a weaker one. First, the chart above shows that core durables beat estimates in seven out of eight of the last releases, and met expectations in the sole exception. The consensus has been too downbeat, opening the door for another upside surprise.

The second reason is that durables reflect long-term investment – and that is based on expectations rather than the current situation. On November 9, Pfizer and BioNTech announced a high efficacy rate for their COVID-19 vaccine. On the following week, Moderna followed suit with a similar outcome.

Such upbeat developments may have pushed businesses to invest for the long-term, seeing the light at the end of the tunnel.

Another relief for markets came from the decisive US elections. While it took several days, the networks called the election for Joe Biden on November 7 – and President Donald Trump's attempts to overturn the results seemed improbable then as they look now, after a losing streak at the courts. The sense of relief probably contributed to calm.

Dollar reaction

If the assessment above is correct, there is room for an upside surprise and for the dollar to rise. A US economy that sees investment in the hard times is ready to surge once vaccines take their effect. A return to robust growth implies lower chances of the Federal Reserve buying more bonds.

In case the data meets estimates, markets would likely return to scrambling around the latest news, most notably the new covid strain. Positioning ahead of Christmas could overshadow any reaction to the figures.

In the unlikely case of an investment downfall, the dollar could be dragged lower on the expectation that the Fed increases its bond-buying scheme.

Conclusion

November's vaccine announcements are good reasons for Durable Goods Orders to beat estimates, boosting the dollar,

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.