US November Retail Sales Preview: If consumer spending fades?

- Retail Sales forecast to fall for the first month since April.

- Control Group expected to rise 0.2% from 0.1% in October.

- Dollar weakness could be exacerbated by poor Retail Sales.

The toll of American closures and layoffs may be spreading to consumer spending at the worst time for the economy, just before the holiday season.

Retail Sales are forecast to drop in November for the first time in seven month,s a development that could reverberate through a US economy still unsteady from almost a year of pandemic lockdowns and unemployment.

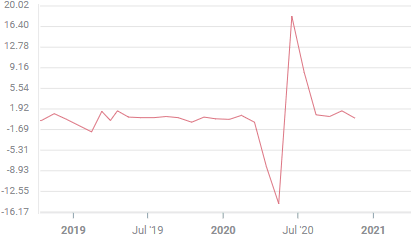

Retail Sales

The Retail Sales Control Group that closely mimics the consumption component of the Bureau of Economic Analysis' GDP calculation, is forecast to gain 0.2% on the month after a 0.1% increase in October. The Retail Sales ex-Autos category is projected to rise 0.1% in November following 0.2% prior.

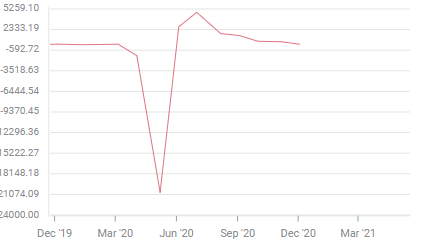

Nonfarm Payrolls and Initial Jobless Claims

November payrolls added 245,000 workers the fewest of the seven-month recovery and just over half of the 469,000 consensus forecast.

Nonfarm Payrolls

Before the November payrolls were released on December 4, a two-week rise in Initial Jobless Claims, the first since August, had warned that the labor market might be deteriorating under the pressure of the new business closures ordered by several states.

New filings rose from 711,000 in the November 6 week (reported on November 12) to 787,000 in the November 20 week (reported on November 25). The concern seemed misplaced when the following week, November 27, claims dropped to 716,000 when they were issued on December 3.

However, the subsequent week, December 4 (released on December 10) reversed again and claims rose to 853,000, the highest number of new unemployment requests in 11 weeks. This Thursday claims are forecast to drop back to 800,000 in the December 11 week. December payrolls are not issued until Friday January 8.

Retail Sales in recovery

Sales and the Control Group have had an excellent recovery from the collapse in March in April.

For the eight months beginning in March sales and control have averaged increases of 0.89% and 1.06% per month, rates that compares favorably with a well-functioning consumer economy.

The robust pace of consumer spending, partially fueled by government emergency payments was one of the reason for the sharp GDP growth of 33.1% annualized int the third quarter after the plunge of 31.4 % in the second.

Consumer spending is about 70% of US economic activity. It has held up remarkably well in the difficult circumstances of the pandemic. Even with the current labor market and consumption figures the Atlanta Fed GDPNow model estimates that the economy was expanding at an 11.2% annualized rate in the final quarter.

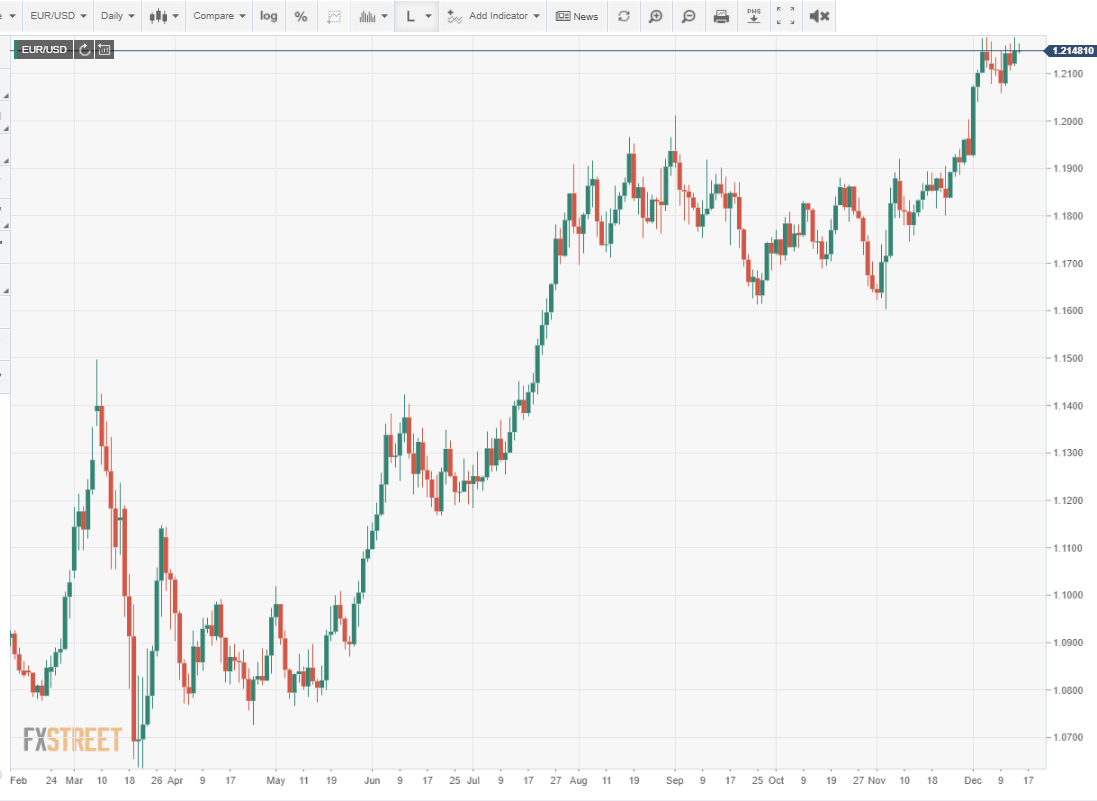

Conclusion and the dollar

The sharp decline of the dollar over the past two weeks has been predicated on the possibility that the advancing business closures would create enough new unemployment to damage or reverse the US economic recovery.

A retreat in consumption could not happen at a worse time for the retail industry. Many stores depend on the November and December holiday season for most or all of their annual profits.

If lockdowns and their attendant unemployment and layoffs, lead to diminished Retail Sales in November and December the ramifications for the US economy and the dollar could make the New Year a very different place than the last six months.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Joseph Trevisani

FXStreet

Joseph Trevisani began his thirty-year career in the financial markets at Credit Suisse in New York and Singapore where he worked for 12 years as an interbank currency trader and trading desk manager.