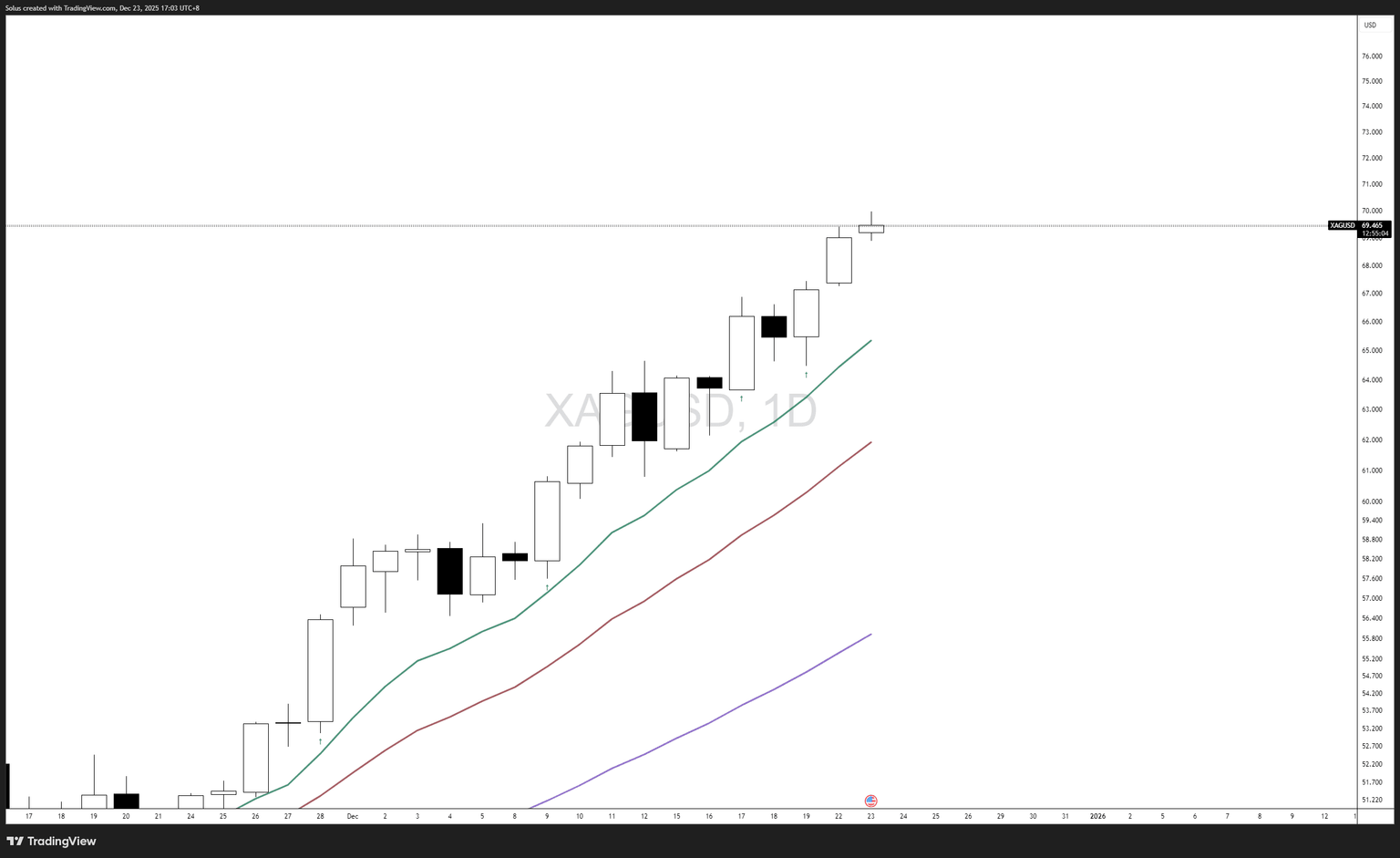

Silver price forecast: XAG/USD holds all-time highs as strength builds

- Silver surges to multi-year highs, extending its bullish trend as price holds above key breakout levels near $69.

- Industrial demand, tight supply conditions, and sustained gold outperformance continue to position silver as a relative strength metal.

- Technical outlook remains bullish, with pullbacks viewed as corrective unless price breaks below the $67.30–$68.20 demand zone.

Silver maintains all-time high territory as bullish momentum persists

Silver price action continues to impress as XAG/USD consolidates near all-time highs, reinforcing its role as one of the strongest-performing commodities in the current macro environment. While gold has already entered aggressive price discovery, silver is now catching up — supported by a powerful blend of industrial demand, structural supply constraints, and favorable technical conditions.

Unlike short-lived speculative spikes, silver’s advance shows orderly continuation, characterized by shallow pullbacks, strong trend alignment, and repeated defenses of key bullish zones. This behavior suggests accumulation rather than exhaustion.

Why Silver is strong right now

1. Industrial demand is driving structural strength

Silver is not just a precious metal — it is a critical industrial input, particularly in:

- Solar panel manufacturing.

- Electric vehicles and battery components.

- Semiconductor and electronics production.

As global energy transition policies accelerate, silver demand continues to outpace new supply growth. This creates a structural bid under price, separating silver from purely speculative assets.

2. Gold’s price discovery is pulling Silver higher

Historically, silver lags gold during early phases of precious-metal rallies — then outperforms during continuation phases. With gold already deep into price discovery, capital rotation into silver has intensified.

This relative-value dynamic explains why silver remains strong even without fresh breakout news headlines.

3. Supply constraints reinforce the bullish narrative

Silver supply remains constrained due to:

- Limited new mining investment.

- Declining output from base-metal mines (where silver is often a byproduct).

- Rising production costs.

These factors tighten the physical market, reinforcing upside risk during periods of strong demand.

Technical outlook: Silver price forecast (XAG/USD)

Trend structure remains intact

On the 4-hour timeframe, silver maintains a clean bullish structure:

- Higher highs and higher lows remain intact.

- Price holds above rising short- and medium-term moving averages.

- No meaningful bearish displacement has occurred.

Momentum remains constructive, even as price consolidates near highs.

Bullish scenario: Continuation toward new nighs

Silver remains bullish as long as price respects the $68.20–$67.30 demand region.

Bullish confirmation includes:

- Successful pullback into demand followed by bullish rejection.

- Holding above rising trend support.

- Renewed momentum through $69.80.

Upside targets:

- $70.50.

- $72.00.

- Extension toward $75.00 if momentum accelerates.

This scenario favors buy-the-dip behavior rather than chasing extended candles.

Bearish scenario: Deeper correction without trend reversal

A bearish outcome remains corrective, not structural, unless key levels fail.

Bearish risk increases if:

- Price breaks and closes below $67.30.

- Momentum shifts below rising daily structure.

- Failed retests of prior demand zones occur.

Downside levels to monitor:

- $66.00.

- $64.80.

Even in this scenario, silver would remain within a broader bullish macro cycle unless a major fundamental shift occurs.

What this means for Silver traders

Silver is not showing signs of distribution — it is showing controlled consolidation at premium prices. This is typical behavior before continuation moves in strong commodity trends.

Traders should focus on:

- Patience during consolidation.

- Structured pullback entries.

- Clear invalidation levels rather than prediction.

Silver’s strength is structural, not emotional — and price behavior supports that narrative.

Author

Jasper Osita

ACY Securities

Jasper has been in the markets since 2019 trading currencies, indices and commodities like Gold. His approach in the market is heavily accompanied by technical analysis, trading Smart Money Concepts (SMC) with fundamentals in mind.