US ISM Services PMI May Preview: The employment puzzle

- Service sector activity expected to remain strong in May.

- Employment PMI is the key metric for markets.

- Manufacturing Employment PMI saw sharp drop to 50.9 n May.

Something unusual appears to be happening in US labor markets and it may be the key to how traders view the American economic recovery.

The economy is growing smartly. Gross Domestic Product (GDP) expanded at a 6.4% annual rate in the first quarter. The Atlanta Fed estimates a 10.3% pace in the current quarter.

New business is pouring into firms as consumers make up for time lost over the past year. Prices are soaring as demand collides with lingering product and material shortages from the lockdown regime.

Employment

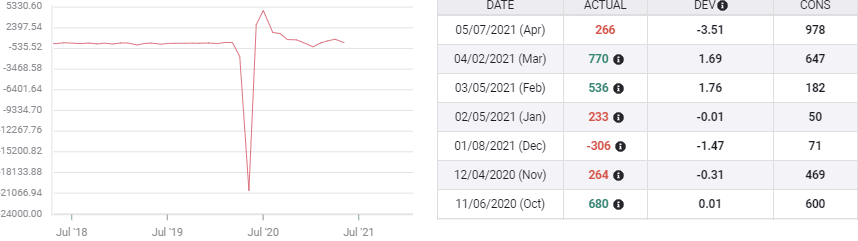

Yet, despite the booming economy, hiring is woeful. The April Nonfarm Payrolls (NFP) added 266,000 new workers, barely a quarter of the expected 978,000 and the March total lost 146,000 to 770,000 upon revision.

Nonfarm Payrolls

FXStreet

With almost 8 million workers still thought to be unemployed from last year's closures and 8.1 million jobs on offer in March the lack of hiring is a puzzle.

In a sign that the April NFP figure might not be a statistical fluke or a passing unemployment benefits fancy, the May Manufacturing Employment Purchasing Managers’ Index (PMI) fell to its lowest level since last November, even though the overall and new business indexes remained strong.

Services PMI

The Institute for Supply Management (ISM) Purchasing Managers’ Index (PMI) is forecast to rise slightly to 63 in May from 62.7 in April. The New Orders Index is expected to slip to 57.9 from 63.2. The Prices Paid Index is predicted to edge lower to 75.9 from 76.8 and the Employment Index, is projected to slide to 58 in May from 58.8 in April

Manufacturing PMI

Manufacturing business sentiment in the Institute for Supply Management (ISM) Purchasing Managers’ Index, long considered a leading indicator for the overall economy, rose to 61.2 in May, the second highest score of the pandemic after March’s 64.7. The 62.2 average of the last three months is the highest in over a decade.

The New Orders Index rose to 67 from 66.3. The Prices Paid measure fell to 88 from 89.6 but this year's average of 86.3 is the highest in over ten years.

Only the hiring indicator belied the excellent general results. Employment PMI unexpectedly dropped to 50.9, just tenths above the 50 division between expansion and contraction. It was the worst reading since November 2020 at 48.3.

Manufacturing Employment PMI

Conclusion

Is the anemic NFP hiring in April and the weak manufacturing employment sentiment in May temporary or a sign of deeper problems in the US labor markets. Has the factory employment outlook spread to the vastly larger service sector? Are federal unemployment benefits, extended and enhanced, keeping people from returning to work, especially in lower wage jobs that are barely more remunerative?

Most importantly will the employment weakness continue into May’s Nonfarm Payrolls?

Because services make up the bulk of the US economy and restoring employment has been the focus of Fed policy and markets, a poor result in the employment PMI will likely outweigh any other index, no matter how expansive. The line from the services Employment PMI to Nonfarm Payrolls runs right though the currency, equity and credit markets.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Joseph Trevisani

FXStreet

Joseph Trevisani began his thirty-year career in the financial markets at Credit Suisse in New York and Singapore where he worked for 12 years as an interbank currency trader and trading desk manager.