US Initial Jobless Claims Reverse: COVID-19 relief bill in doubt

- First time claims were 803,000 after 892,000 in the prior week.

- Continuing Claims dropped to 5.337 M, the lowest of the pandemic.

- Congress passes COVID-19 relief bill after delaying for three months.

Unemployment claims continued their seesaw ride unexpectedly falling in the latest week by almost the same surprise amount that they rose the week before.

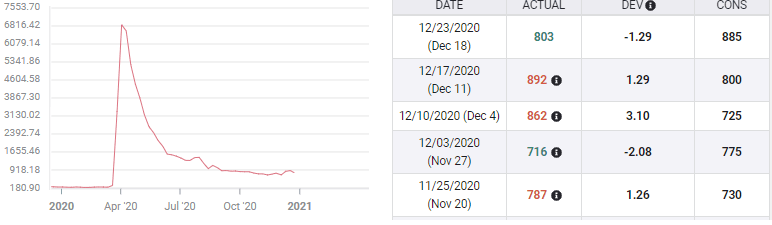

Initial filings for jobless benefits dropped to 803,000 in the week of December 18 from a revised 892,000, after having been forecast to come in at 885,000. The previous week claims had been predicted to be 800,000, instead they were 885,000. The four-week moving average was 818,250 following 814,250 the prior week, the first instances above 800,000 since October 16.

Initial Jobless Claims

Continuing Claims were 5.337 M in the December 11 week, well below the 5.558 M forecast and 5.507M the previous week. It was the lowest total since the pandemic accounts began on March 20.

Continuing Claims

In all about 20.4 M American are receiving some form of unemployment benefits, according to the Labor Department.

COVID-19 relief package

Earlier in the week Congress passed a much-delayed $900 billion stimulus and COVID-19 relief bill. The package was delayed for three months as each party tried to gain an advantage in the run to the November 3 vote. The legislation includes a $600 payment to most individuals, $300 -per-week in federal unemployment benefits and $320 B for business support.

President Trump has called the bill a “disgrace” because the payments to individuals and families was so low. Previous versions of the bill tabled but not passed in the weeks before the election has budgeted an $2500 one-time stipend.

It is not clear whether President Trump will veto the bill which passed both houses with large enough majorities to override a White House rejection.

It requires a two-thirds vote in the House and Senate to pass a bill over a president's veto.

In practice that would require many Republicans in the House and the Senate to vote with the Democrats. There are 435 members of the House, 290 are required for an override and the Democrats hold 233 seats. They would need 57 Republicans to join them in a rejection vote.

In the Senate 67 votes are required to override and the Democrats currently hold 47. They would need 20 Republican Senators to vote against the president.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Joseph Trevisani

FXStreet

Joseph Trevisani began his thirty-year career in the financial markets at Credit Suisse in New York and Singapore where he worked for 12 years as an interbank currency trader and trading desk manager.