US Initial Jobless Claims confirm labor deterioration while Building Permits look ahead

- Unemployment requests jump to the most in 14 weeks.

- Four-week claims moving average at two-month high.

- Rising unemployment may force Congress to act on stimulus.

- Housing starts and building permits stronger than forecast.

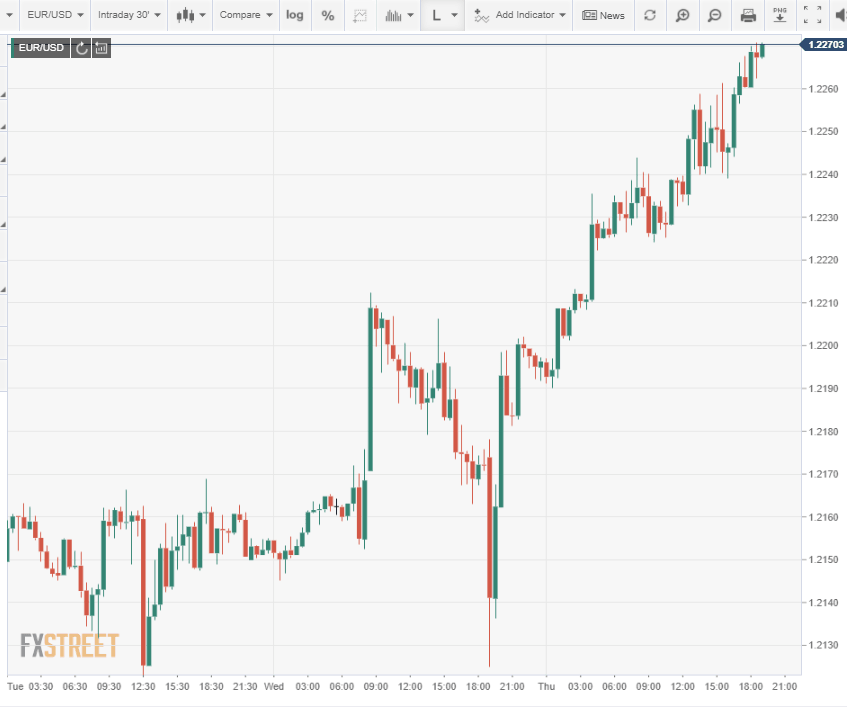

- Contrary claims and housing statistics provoke dollar volatility.

Questions over the extent and permanence of the recent labor market deterioration have been settled with the latest filings for unemployment benefits soaring to their highest total in 14 weeks.

Initial Jobless Claims vaulted to 885,000 in the week of December 11 far more than the 800,000 consensus forecast and the prior result was revised up to 862,000 from 853,000.

Claims have been volatile over the past six weeks. After reaching a pandemic low at 711,000 in the first week of November, filings then rose for two weeks to 787,000, dropped back to 716,000, and have since climbed for two weeks.

The four-week moving average, a better measure of the trend in layoffs, has increased 9.2% from its post-shutdown low of 743,500 in the November 13 week to 812,500 on December 11, its highest in two months.

Initial Jobless Claims, 4-week average

Continuing Claims slipped to 5.508 million in the December 4 week from 5.781 million previous, with more recipients exiting the rolls as their benefits expire than join with new claims.

Housing Starts and Building Permits

Ground breaking for new home construction rose 1.2% in November to 1.547 million (annualized) its highest level in eight months. Applications for building permits increased 6.2% to 1.639 million (annualized) its strongest rate since the boom days of the housing bubble over a decade ago.

Building Permits

Reuters

The surge in new home construction and especially in permits, which enable but do not mandate use, stems from several factors.

New homes have been in short supply as the pandemic and rising crime rates in many large US cities have encouraged a move to the suburbs.

Building rates were at a low ebb for the months from March to June, averaging just 1.11 million (annualized), 27.7% below the 1.53 million average of the previous four months.

The hoped for and pending end to the pandemic constriction of the economy sometime in the first or second quarter, should unleash a wave of demand and business response.

Finally, the trend to working at home and the dissolution of urban life may prompt a wave of relocation not seen in the US since the explosive growth of the suburbs after the Second World War.

Layoffs return with closures

Several states, notably California with the largest economy and New York, with the largest city, along with New Jersey, Ohio, Oregon, Pennsylvania and others have imposed varying degrees of business restrictions.

California has ordered all non-essential businesses closed and New York City has again banned indoor dining with the state governor threatening a total lockdown if case rates do not improve. Even though restaurants and many other business never fully opened enough staff had been rehired to produce the wave of layoffs when the new closure orders came down.

The situation is not uniform and to some degree is a matter of local government choice. Florida and Texas have remained remain open with far fewer COVID-19 cases and many fewer fatalities. No hospital system or ICU facility in the United States has reached capacity in the current wave. Several states in the mid-West have seen their case numbers peak two or three weeks ago and have been reducing or eliminating restrictions.

Retail Sales

The decline in consumer spending in November seems to confirm the slowing economy. Retail Sales fell 1.1% on a -0.3% forecast. It was largest drop since April. Sales ex-Autos dropped 0.9% on a 0.1% prediction and the Control Group fell 0.5%, missing its 0.2% projection.

Retail Sales

November is the important lead for the holiday shopping season. With so many retail businesses in dire condition from the prolonged restrictions, this report, confirming what most proprietors already know, bodes poorly for December and most importantly for hiring and firing in the New Year. It is an open question how many small businesses will survive until the economy is permitted to function.

Conclusion: Dollar response

Despite the opposite pictures of the economy in the claims and housing statistics, there is logic for an improving greenback in today's data. The dollar's initial volatility after the releases has resulted in modest gains in the USD/CAD and USD/JPY balanced by minor losses in the EUR/USD and GBP/USD.

It appears that Congress will finally approve a stimulus package. The confirmed threat of rising unemployment may be the final kick needed for a package that has been mired in election considerations for three months.

The expectation among builders for a vibrant economic recovery in the spring, given the successful vaccine development over the past six month and the accelerated distribution, is a worthy bet.

The split reaction to today's US data may be the first indication of a return to the economic comparisons of normal markets.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Joseph Trevisani

FXStreet

Joseph Trevisani began his thirty-year career in the financial markets at Credit Suisse in New York and Singapore where he worked for 12 years as an interbank currency trader and trading desk manager.