US Federal Reserve Minutes Preview: Rate cuts, stimulus and more stimulus

- Edited minutes of the September 15-16 Federal Reserve Open Market Committee meeting.

- What were the discussions around the extension of guidance to 2023?

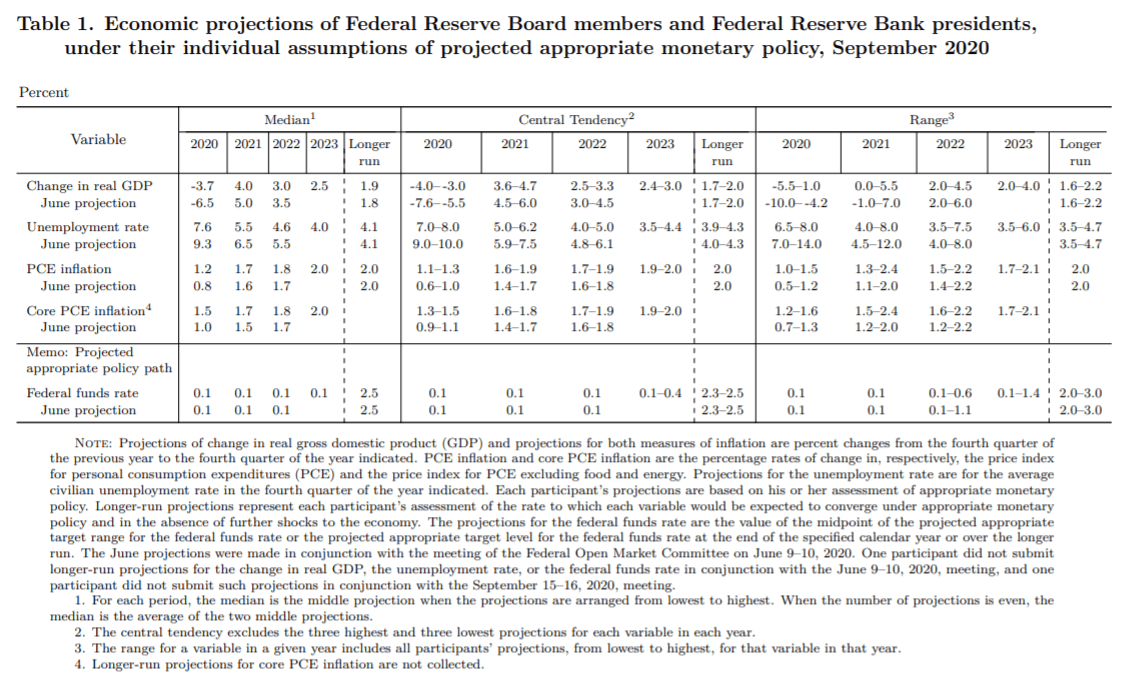

- Projection Materials portray an improved economy since the June release.

- FOMC minutes provide background information for markets, not trading catalysts.

The Federal Reserve's September meeting introduced two important policy changes, inflation averaging and extended rate guidance. Chairman Jerome Powell's emphasis on fiscal stimulus in his speeches and public appearances has presented the third leg of the Fed's pandemic support policies.

The governors replaced their 2% price target with inflation averaging. This new standard for interest rate policy will permit prices to run above 2% for as long as it take to bring the overall rate up to target before the FOMC will consider rate hikes. They also extended guidance for the fed funds rate out to four years, adding 2023 as the final specified year before the final 'longer run' category.

In combination the two new directives officially sanction what the Fed has been doing in practice since the financial crisis of over a decade ago, putting inflation policy in distant second place to promoting economic growth and job creation.

Mr. Powell's has repeatedly said that the central bank's rate and and other policies are insufficient to fight the economic contraction of the pandemic shutdown. He has insisted that the federal government continue its fiscal support until the economy is fully regenerated.

Deflation, the financial crisis and inflation averaging

The disinflationary pressures of globalization had been dampening price increases for a generation. To that natural process the financial crisis and recession added unemployment and plummeting consumer demand. Suddenly the Fed, whose primary inflation policy had been geared to preventing rampant price increases, was facing a deflationary price spiral.

Ben Bernanke, the Fed Chairman made the prevention of falling prices and the potential reduction of long-term inflation expectations, the immediate rationale for the first quantitative easing program. These programs in their many repetitions, have become the Fed's standard response to stimulating the economy in the global low rate environment.

Inflation averaging looks to a future where growth and inflation are again moving upward in tandem. When that happens the Fed will no longer have to consider, and perhaps more importantly, the credit markets will not assume, that 2% inflation will automatically engender a rate hike cycle.

Inflation, growth and rate guidance

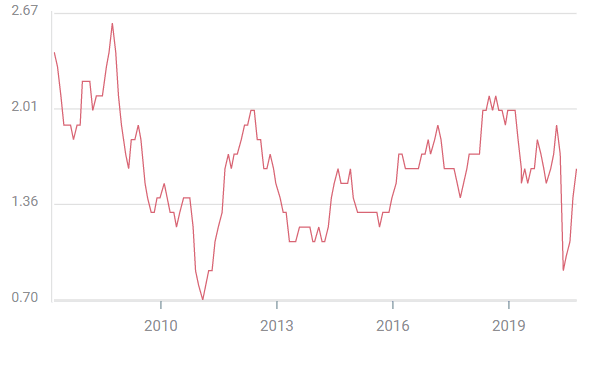

The Fed, and to be fair, central banks around the world, have been uniformly unsuccessful in promoting inflation in the last decade. Bank officials and policy have have maintained a rhetorical devotion to the inflation target. Though zero rate policies have, until the pandemic, had some success in promoting GDP they have not restored inflation to its 2% goal.

Core PCE Price Index

From a policy perspective the two aims of GDP and inflation are identical. In theory both are enabled by low interest rates. By adding a year to its official rate guidance the Fed has forestalled rate speculation for the immediate and medium-term futures.

Conclusion: Stimulus and GDP

The predicate for the Fed's policy innovations is the governors view that, despite the improved forecast in the Projection Materials, the USD economy is going to need substantial rate and spending support for several years.

It is that economic view and any elucidation and details the minutes may provide that give the FOMC record its interest. Markets already know the Fed's intention out to 2023. What traders want to know is why?

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Joseph Trevisani

FXStreet

Joseph Trevisani began his thirty-year career in the financial markets at Credit Suisse in New York and Singapore where he worked for 12 years as an interbank currency trader and trading desk manager.