US Dollar Forecast: Attention shifts to the US labour market and Fedspeak

- The US Dollar Index resumed its weekly uptrend.

- US tariffs on Canada and Mexico kick in on February 1.

- The Federal Reserve kept its interest rates unchanged.

Following two consecutive weeks of losses, the Greenback managed to regain composure and eventually end the current week with marked gains. Indeed, the US Dollar Index (DXY) staged a meaningful comeback in the wake of Monday’s six-week lows just below the 107.00 support to advance to multi-day highs well north of the 108.00 barrier towards the end of the closing bell in Wall Street.

To tariff or not to tariff

The Dollar weakened immediately after Inauguration Day on January 20, extending its rejection from fresh cycle tops beyond the key 110.00 hurdle (January 13). This marked leg lower came in response to President Donald Trump's inconclusive remarks regarding the implementation of tariffs, a central theme of his presidential campaign.

However, as the week progressed, the White House shed some light on the subject and announced the implementation of 25% tariffs on imports from Canada and Mexico, starting as soon as February 1. Both nations, in the meantime, pledged to respond to tariffs with measures of their own.

Still around tariffs, Trump appeared to soften his stance on China as per his latest comments, prompting market participants to speculate that tariffs on imports from the Asian economy might ultimately fail to materialise. And still remains the European Union, although no further discussions or details have been provided on this so far.

Despite President Trump’s failure to provide clear direction on his trade policies, bouts of weakness in the Greenback are likely to be temporary and shallow. Stronger underlying factors are expected to support a constructive outlook for the US Dollar throughout the year.

Extra wings came from the Fed’s hawkish hold

The Federal Reserve (Fed) opted to keep interest rates steady within the 4.25% to 4.50% target range during its January 29 gathering, marking a pause after three consecutive rate cuts in late 2024. While this decision reflects confidence in the economy’s resilience, policymakers cautioned that inflation remains "somewhat elevated," signaling persistent challenges on the horizon.

In his usual post-meeting press conference, Fed Chair Jerome Powell emphasised that the central bank is in no rush to shift its policy stance, citing the economy's ongoing strength. He stressed the importance of a cautious approach as the Fed monitors evolving economic conditions.

Powell also addressed the uncertainty surrounding tariffs, describing their potential impact as highly unpredictable. He noted the wide range of unknowns, including the duration, scale, and targets of the tariffs, possible retaliation, and how these factors could ripple through the economy to affect consumers.

Responding to questions about recent comments from President Trump, who last week called for an immediate interest rate cut, Powell confirmed he has had “no contact” with the president regarding monetary policy.

On Friday, Federal Reserve Governor Michelle Bowman expressed cautious optimism for the US Dollar, expecting inflation to decline further this year, which could allow for potential rate cuts. However, she highlighted risks from rising wages, strong markets, geopolitical tensions, and policy changes that could slow progress and keep inflation elevated. While anticipating core inflation to moderate, Bowman emphasized the need for gradual rate adjustments to maintain steady progress toward economic goals. She also supported the Fed's decision to hold interest rates steady, reinforcing the importance of a measured policy approach.

Key events on the horizon

Looking at next week’s US calendar, the US labour market will be in the spotlight with the releases of the JOLTs Job Openings, the ADP report and Nonfarm Payrolls. In addition, the ISM will release its manufacturing and services gauges for January, while Fedspeak throughout the week is expected to keep investors entertained.

US Dollar Index technical outlook

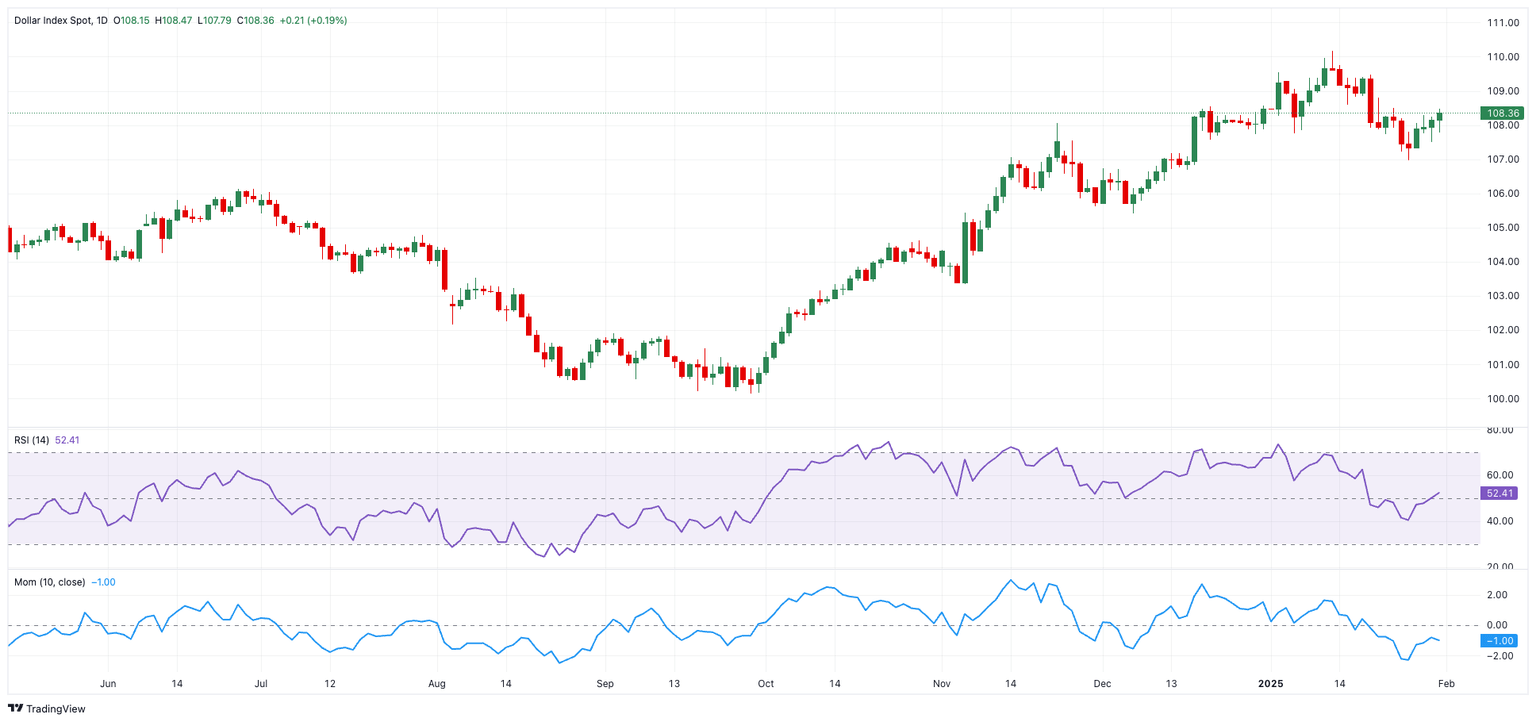

The US Dollar Index (DXY) could extend its upward momentum, potentially retesting its recent cycle high of 110.17 from January 13. A break above this level would set the stage for a challenge of the 2022 peak at 114.77, marked on September 28.

On the flip side, support levels to watch include the 2025 bottom at 106.96 from January 24, seconded by the December 2024 trough at 105.42, and the critical 200-day SMA at 104.77.

As long as the index holds above the latter, the bullish outlook remains intact.

Momentum signals are sending mixed messages. The daily RSI, climbing above 51, points to growing upside potential, but the ADX, sitting below 22, reflects weak trend strength, suggesting that the current rally may lack conviction.

Nonfarm Payrolls FAQs

Nonfarm Payrolls (NFP) are part of the US Bureau of Labor Statistics monthly jobs report. The Nonfarm Payrolls component specifically measures the change in the number of people employed in the US during the previous month, excluding the farming industry.

The Nonfarm Payrolls figure can influence the decisions of the Federal Reserve by providing a measure of how successfully the Fed is meeting its mandate of fostering full employment and 2% inflation. A relatively high NFP figure means more people are in employment, earning more money and therefore probably spending more. A relatively low Nonfarm Payrolls’ result, on the either hand, could mean people are struggling to find work. The Fed will typically raise interest rates to combat high inflation triggered by low unemployment, and lower them to stimulate a stagnant labor market.

Nonfarm Payrolls generally have a positive correlation with the US Dollar. This means when payrolls’ figures come out higher-than-expected the USD tends to rally and vice versa when they are lower. NFPs influence the US Dollar by virtue of their impact on inflation, monetary policy expectations and interest rates. A higher NFP usually means the Federal Reserve will be more tight in its monetary policy, supporting the USD.

Nonfarm Payrolls are generally negatively-correlated with the price of Gold. This means a higher-than-expected payrolls’ figure will have a depressing effect on the Gold price and vice versa. Higher NFP generally has a positive effect on the value of the USD, and like most major commodities Gold is priced in US Dollars. If the USD gains in value, therefore, it requires less Dollars to buy an ounce of Gold. Also, higher interest rates (typically helped higher NFPs) also lessen the attractiveness of Gold as an investment compared to staying in cash, where the money will at least earn interest.

Nonfarm Payrolls is only one component within a bigger jobs report and it can be overshadowed by the other components. At times, when NFP come out higher-than-forecast, but the Average Weekly Earnings is lower than expected, the market has ignored the potentially inflationary effect of the headline result and interpreted the fall in earnings as deflationary. The Participation Rate and the Average Weekly Hours components can also influence the market reaction, but only in seldom events like the “Great Resignation” or the Global Financial Crisis.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.