US dollar rises as Trump hints at China decoupling

The Japanese yen weakened against the US dollar as traders reacted to mixed economic data from the country. According to the Japan bureau of statistics, the country’s economy contracted by 28.1% in the second quarter after falling by 2.2% in the second quarter. It had previously declined by 7.4% in the fourth quarter of 2019. This decline happened because of a 4.7% decline in capital expenditure, 3.0% decline in external demand, and 7.9% decline in personal spending. Other data showed that overtime pay dropped by 16.6% in July while household spending fell by 7.6%.

The US dollar rose against other currencies as traders reacted to a statement from Donald Trump. In it, he said that if re-elected, he would seek to decouple the country from China. This means that he will seek to end a significant amount of business between the two countries. That statement came on the same day that data from China showed it had a trade surplus of more than $58 billion. That was in contrast with the US trade deficit of more than $63 billion. However, such a move would also hurt the US, because of the large number of American companies that do business in China.

The euro declined slightly against the US dollar ahead of key data from the region. In the morning hours, we will receive the German and French trade numbers. Analysts expect the data to show that German exports rose by 5% in July while exports rose by 3.3%. Later we will get the industrial production data from Sweden and the final reading of Q2 GDP data. Analysts expect the data to show that the Eurozone economy contracted by 15% in the second quarter.

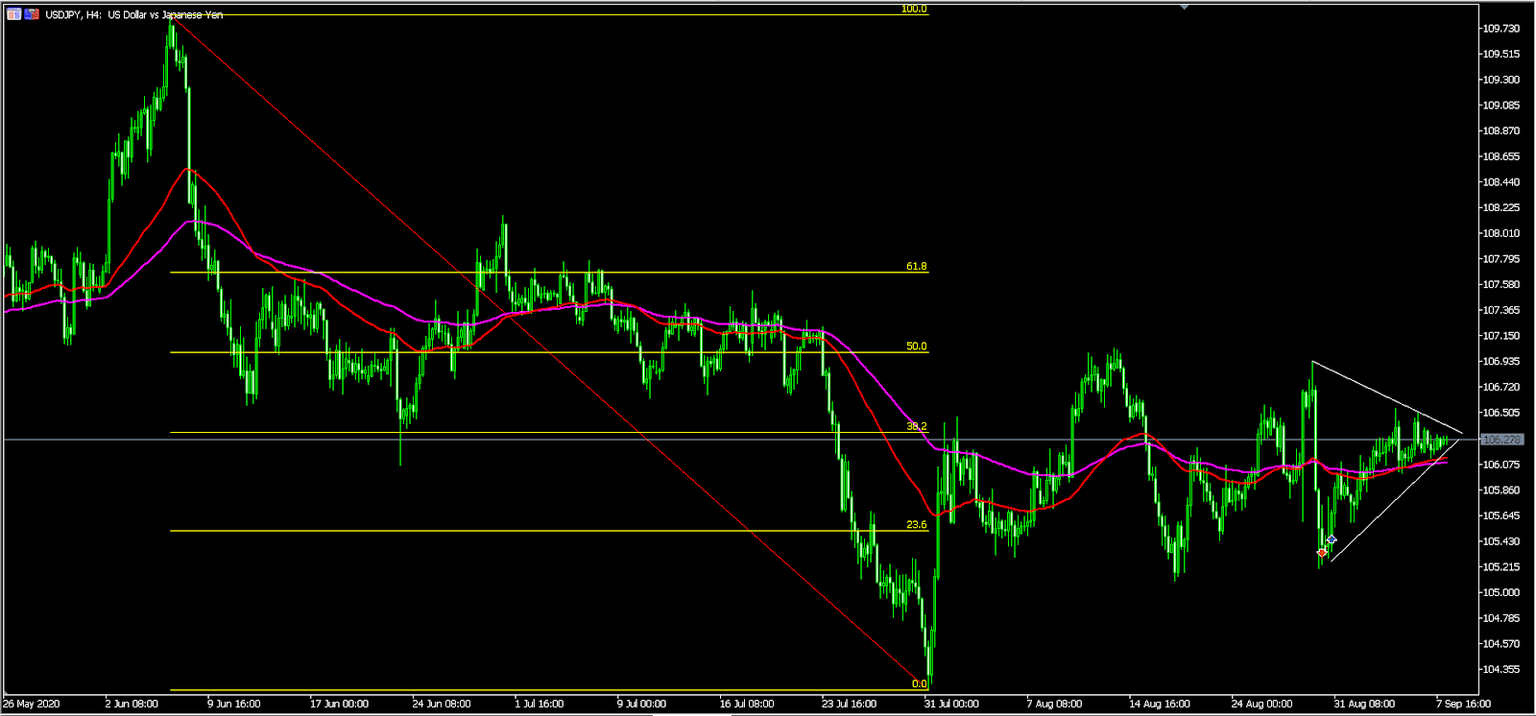

USD/JPY

The USD/JPY pair is trading at 106.27, which is in the same range as yesterday. On the four-hour chart, the pair is above last week’s low of 105.20. It is above the 50-day and 100-day exponential moving averages and slightly below the 38.2% Fibonacci retracement level. It is also forming a symmetrical triangle pattern that is shown in white. Therefore, the pair is likely to breakout higher considering the triangle is approaching its confluence zone.

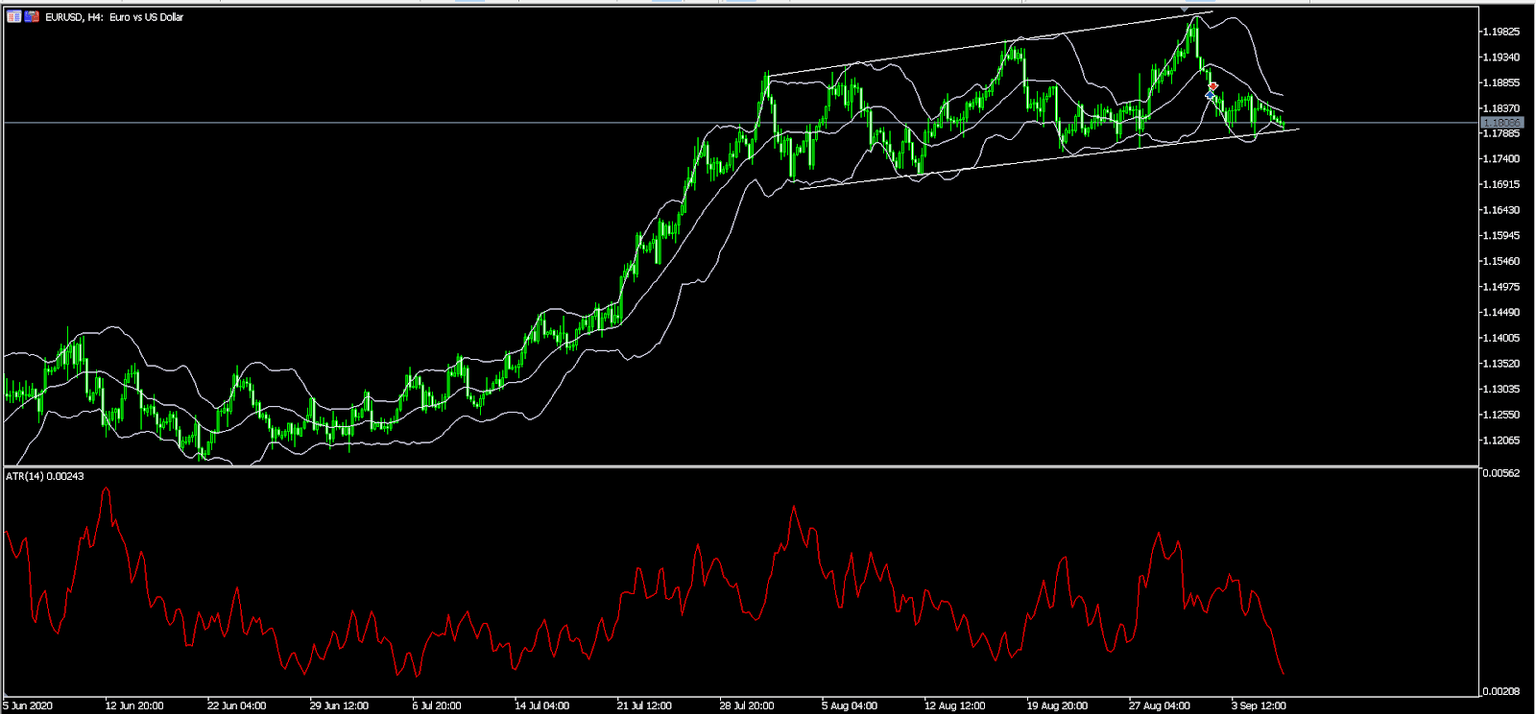

EUR/USD

The EUR/USD pair declined to an intraday low of 1.1810 in overnight trading. On the four-hour chart, the price is between the lower and middle line of the Bollinger bands while the Average True Range has dropped to the lowest level since July. The price is also along the lower support line that is shown in white. Therefore, there is a possibility that the pair will break out lower as bears attempt to move below 1.1800.

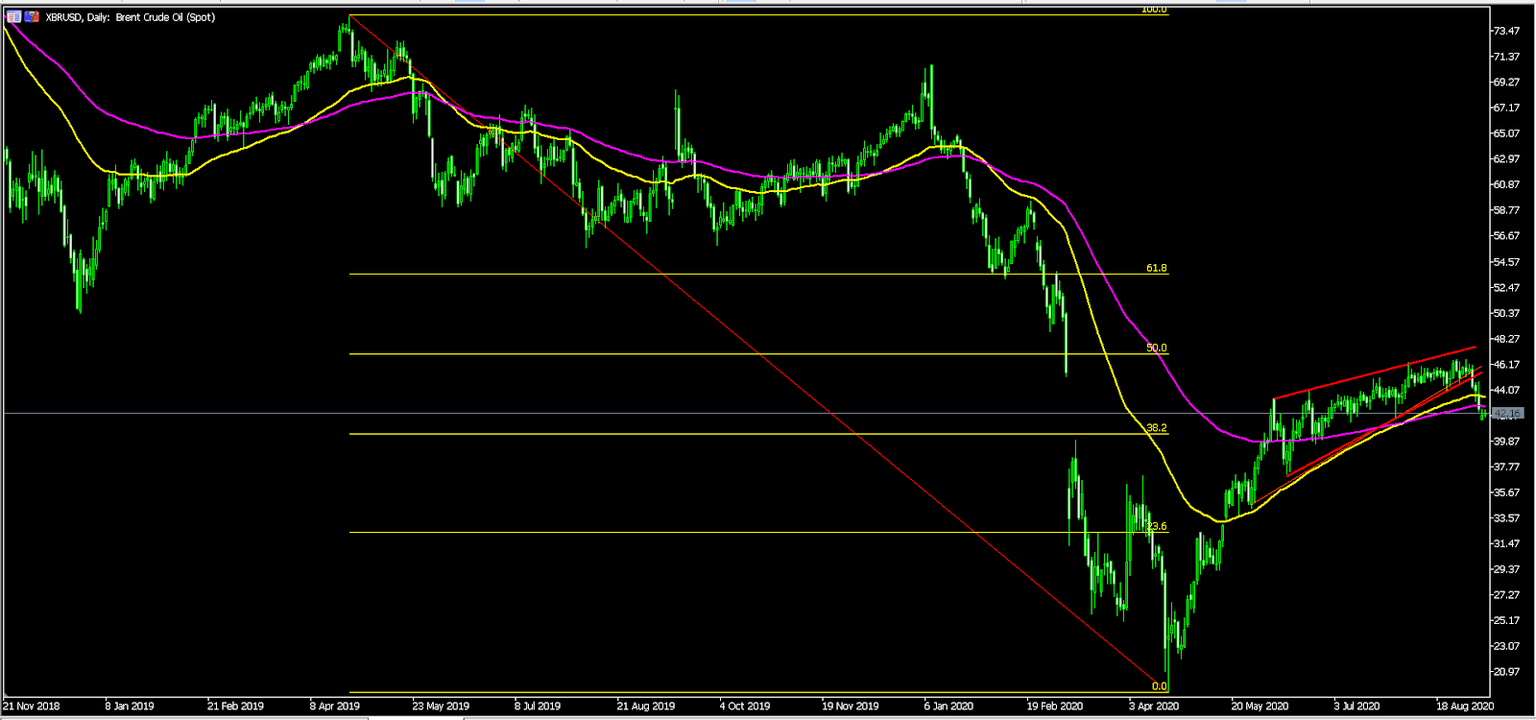

XBR/USD

The XBR/USD pair dropped to an intraday low of 41.91 in overnight trading. The price managed to break out below the rising wedge that is shown in red. The price has also moved below the 50-day and 100-day moving averages. It is also slightly above the 38.2% Fibonacci retracement level. Therefore, the price is likely to continue falling as bears attempt to move below 40.00.

Author

OctaFx Analyst Team

OctaFX

OctaFX is a market-leading forex broker, providing personalised forex brokerage services to customers in over 100 countries worldwide.