US dollar rises ahead of Fed rates decision

The US dollar rose today as traders waited for the outcome of the first interest rate decision by the Federal Reserve this year. The dollar index rose by more than 20% with most gains being against the euro and sterling. While the bank will most likely leave interest rates unchanged, traders will wait for Jerome Powell’s statement and the dot plot. They will also want to know what the bank plans to do with its quantitative easing plan. Also, they’ll want to learn from the new members of the FOMC, including Raphael Bostic, Charles Evans, Mary Daly, and Thomas Barkin. In a previous speech, Bostic signalled that the bank will be ready to start tightening in 2022.

The Australian dollar declined against the US dollar even after the relatively strong economic numbers from Australia and China. According to the Chinese statistics bureau, industrial profit increased by 20.1% in December and by 4.1% in 2020 amid the pandemic. Other numbers from China, including retail sales and PMIs have been relatively strong. Meanwhile, in Australia, the bureau of statistics released relatively strong fourth-quarter inflation numbers. In total, consumer prices rose by 0.9%, which is a bit lower than the 2% target by the Reserve Bank of Australia (RBA).

Global stocks were mixed today as traders waited for the Fed decision. Also, investors are reacting to the mixed financial results from the biggest companies in the United States. Yesterday, Microsoft reported strong revenue, helped by its cloud and gaming businesses. Later today, tech giants like Alphabet and Facebook will publish their earnings. Other companies that will publish their earnings today are Abbott Laboratories, Tesla, and Progressive.

EUR/USD

The EUR/USD pair dropped today ahead of the Fed decision. It is trading at 1.2113, which is lower than this week’s high of 1.2190. On the four-hour chart, the price is along the important support that joins the lowest levels this week. Also, it has moved below the second support of the Andrews Pitchfork tool. Therefore, the pair will likely continue falling as bears target the next support at 1.2080, which is the lowest level on Monday.

AUD/USD

The AUD/USD pair dropped today even after the strong Chinese data. The pair is trading at 0.7710, which is below this week’s high of 0.7763. On the four-hour chart, the price is below the descending trendline that connects the highest points this month. Also, the 25-day and 15-day exponential moving averages have made a bearish crossover. Therefore, the pair will likely drop as bears aim for the next support at 0.7660, which is the previous triple -bottom.

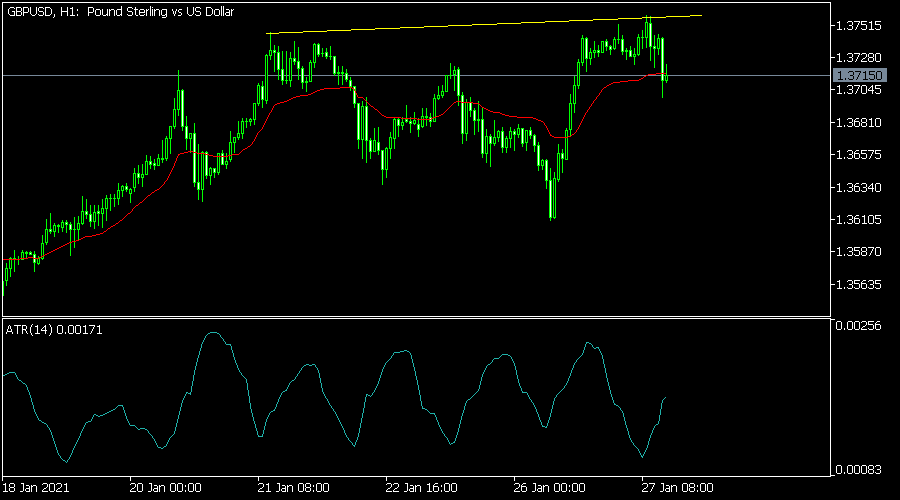

GBP/USD

After reaching its highest level in more than 2 years, the GBP/USD pair declined to an intraday low of 1.3698. On the hourly chart, the pair has formed a W pattern. The price is also along the lower line of the Bollinger Bands while the Average True Range (ATR) has started to rise. It is also along the variable index dynamic average. Therefore, the pair will likely continue falling before resuming its previous bullish trend.

Author

OctaFx Analyst Team

OctaFX

OctaFX is a market-leading forex broker, providing personalised forex brokerage services to customers in over 100 countries worldwide.