US dollar momentum wanes even as inflation surges

The US dollar eased during the overnight session as investors reacted to strong US inflation numbers. According to the Labour Department, the headline consumer price index (CPI) rose by 5.4% in May while core CPI rose by 3.8%. The two were the biggest gains since 2008 and 1992, respectively. The data showed that the price of most items is rising as the economy recovers and supply backlogs continue. For example, the prices of cars rose by 7.3% because of the ongoing shortages of semiconductors. Still, analysts believe that the Federal Reserve will maintain its stand because it sees these numbers as being transitory.

The British pound rose ahead of the latest UK GDP data that will come out at 07:00 GMT. The final figure is expected to show that the economy contracted by 1.5% in the first quarter, leading to a 6.1% year-on-year decline. The Office of National Statistics (ONS) will also publish the latest manufacturing, industrial production, and construction output numbers. The pound is also reacting to the reportedly rising number of coronavirus cases in the UK. Analysts expect that the government will delay the lockdown easing to curb the new wave.

The euro is little changed after the European Central Bank (ECB) delivered its interest rate decision. The bank left the EU interest rate and quantitative easing unchanged. Analysts expect the bank to start tapering its asset purchases later this year since the EU economy has recorded a strong recovery. Later today, Spain will release its consumer price index data. Other key events scheduled for today are the G7 meetings and the Russian interest rate decision.

EUR/USD

The EURUSD pair rose to 1.2185 after the ECB decision and US inflation data. On the four-hour chart, the pair moved slightly above the upper line of the descending channel. It is above the 23.6% Fibonacci retracement level while the Relative Strength Index (RSI) has moved to the neutral level of 54. The pair will likely remain at the current range today.

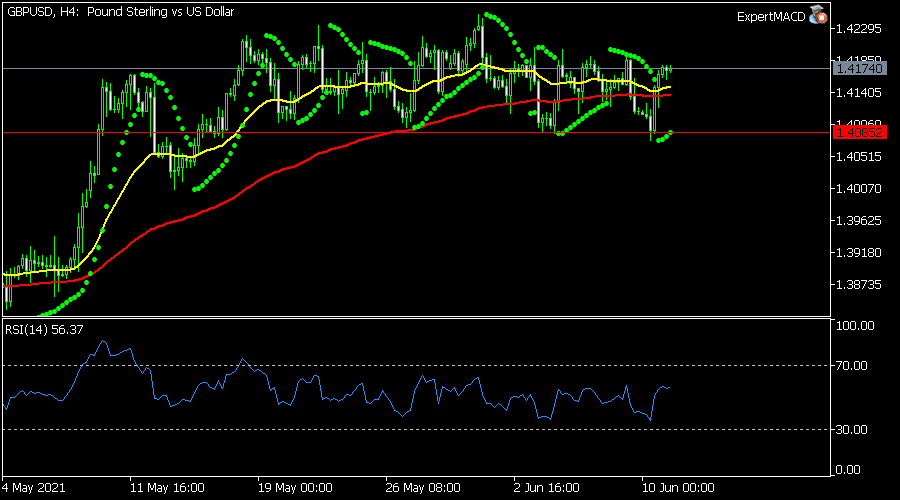

GBP/USD

The GBPUSD dropped to 1.4073 yesterday as fears of extended lockdowns in England rose. It then rose sharply after the latest US CPI data and is trading at 1.4173. The pair is slightly above the 25-day and 15-day moving averages while the Relative Strength Index (RSI) has moved to 56. It is also above the dots of the Parabolic SAR. The pair will likely remain at this range for the next few sessions.

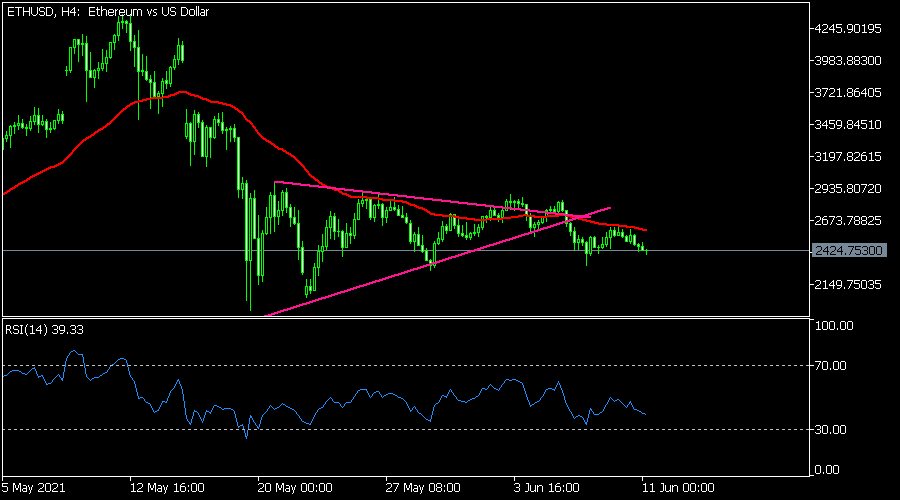

ETH/USD

The ETHUSD retreated after the US inflation numbers. The pair dropped to 2,420, which was slightly below yesterday’s high of 2,627. On the four-hour chart, the pair is slightly below the lower line of the bearish pennant pattern while the Relative Strength Index (RSI) kept falling. The pair is also below the 25-day moving average. Therefore, the pair will likely keep falling as bears target the next key support at 2,350.

Author

OctaFx Analyst Team

OctaFX

OctaFX is a market-leading forex broker, providing personalised forex brokerage services to customers in over 100 countries worldwide.