US Dollar Index (DXY) progressing toward final stages of wave five [Video]

![US Dollar Index (DXY) progressing toward final stages of wave five [Video]](https://editorial.fxsstatic.com/images/i/DXY-neutral-object-1_XtraLarge.png)

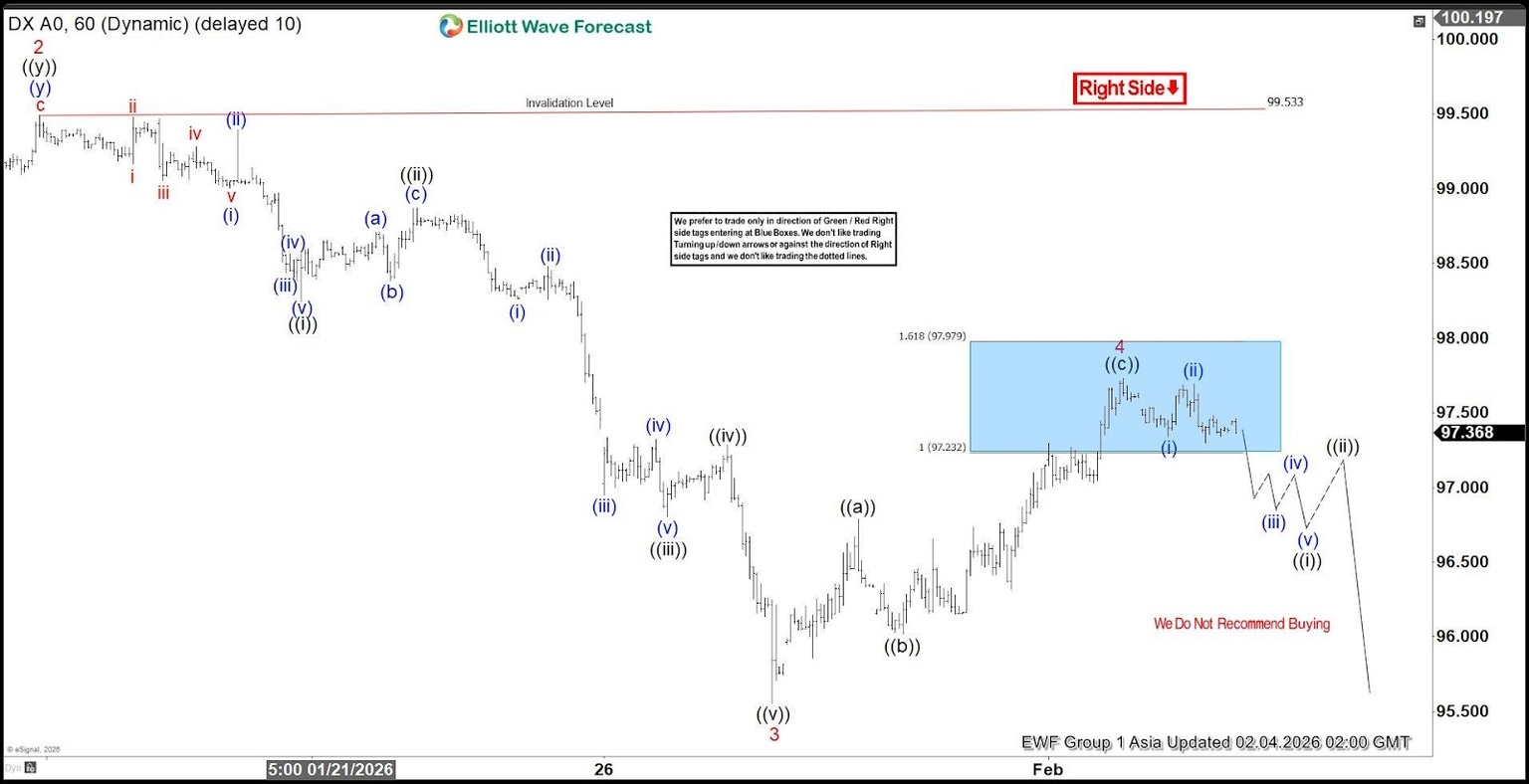

The Dollar Index (DXY) continues to unfold from the September 2022 peak as a five‑wave cycle, with the structure now approaching the conclusion of wave ((5)). Wave ((4)) of this impulse move ended at 100.395 on November 21, 2025, after which the Dollar resumed its decline. The Index currently displays only a clear three‑swing sequence down from the November 21 high, which strongly suggests that the downside remains incomplete. From wave ((4)), wave 1 terminated at 97.75, while wave 2 retraced higher to 99.53, as reflected in the one‑hour chart. The Index then resumed lower in wave 3.

Within wave 3, wave ((i)) ended at 98.24, followed by a rally in wave ((ii)) that peaked at 98.86. The decline continued with wave ((iii)) reaching 96.8, while wave ((iv)) recovered modestly to 97.28. Wave ((v)) then pushed lower to 95.55, completing wave 3 at a higher degree. The Index corrected in wave 4, which unfolded as a zigzag structure. From the wave 3 low, wave ((a)) advanced to 96.78, wave ((b)) pulled back to 96.01, and wave ((c)) rose to 97.73, completing wave 4. The Dollar has since resumed its decline in wave 5.

Near term, as long as the pivot at 99.53 remains intact, the expectation is for the Dollar to extend lower. The potential target lies within the 123.6% to 161.8% external retracement zone, which aligns at 94.2–95.5. This projection reinforces the view that the bearish cycle is still in progress and that further weakness is likely before the larger structure completes.

Dollar Index (DXY) 60 minute chart

DXY Elliott Wave [Video]

Author

Elliott Wave Forecast Team

ElliottWave-Forecast.com