US Consumer Price Index September Preview: Inflation averaging, what inflation averaging?

- CPI expected to be stable in September, core to rise slightly.

- September PPI forecast to continue sharp increases.

- Federal Reserve considering inflation despite official averaging.

- Treasury yields predict November taper and higher dollar.

The inflation-averaging vaccine is not working.

Last September the Federal Reserve dropped its 2% inflation target. Instead of trying to meet a monthly goal, Federal Reserve policy would take a longer view, judging inflation across a much wider but carefully unspecified period.

Unstated at the time was the desire to keep interest rate policy from becoming hostage to the annual inflation that was sure to rise after the collapse of consumer prices in the spring lockdowns. Fed policymakers wanted to keep interest rates low for as long as necessary to restore the labor market, their primary purpose, and did not want to be derailed by what they thought would be a transitory price increase.

A year later, and after six months of sharply rising prices, inflation again seems to be driving Fed policy.

In August, Fed Chairman Jerome Powell all but promised that the bond taper would begin before the end of the year.

Despite job creation in August and September that averaged a dismal 280,000, far below the 625,000 forecast, markets expect the Fed to follow through on its bond program reductions at the November 3 or December 15 Federal Reserve Open Market Committee (FOMC) meeting.

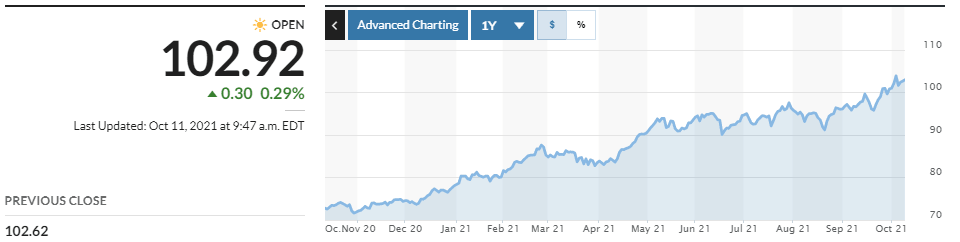

The evidence is plain. Since the September 22 FOMC the yield on the 10-year Treasury has soared 29 basis points to 1.612%. The 30-year has added 31 points to 2.166%.

US 10-year Treasury yield

CNBC

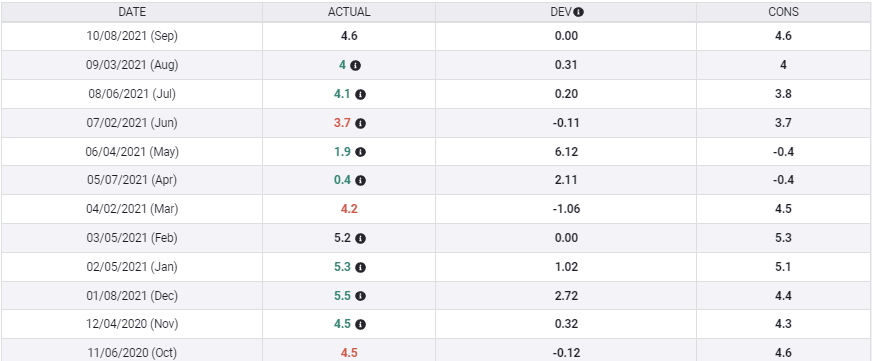

CPI

The Consumer Price index (CPI) is expected to rise 0.3% in September as it did in August. The annual gain is forecast to be 5.3% also as in August.

CPI

Core CPI is projected to rise 0.1%, after a 0.2% increase in August and the yearly rate is predicted to be unchanged at 4%.

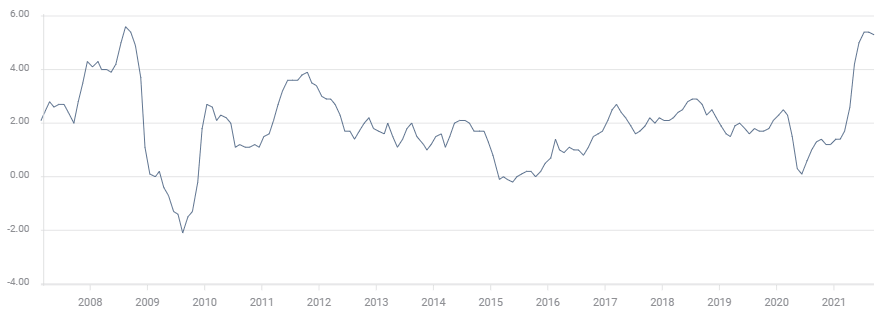

PPI

The Producer Price Index (PPI), which measures the cost to produce goods and commodities in the US, is considered a reliable indicator of future consumer prices. Retailers who buy goods for final sale, will normally pass some or all of their own increased acquisition cost to consumers.

Annual PPI was 8.3% in August. It is forecast to rise to 8.7% in September.

PPI

FXStreet

Many production inputs have risen sharply in the past year.

The Bloomberg Commodity Index (BCOM) has climbed 31.8% this year and 12.0% since August 20.

BCOM

Bloomberg/MarketWatch

Crude oil, the world’s basic industrial commodity, has been even more buoyant. West Texas Intermediate (WTI), the North American pricing standard, has jumped 71% this year and is higher by 27% since August 20.

WTI

A combination of pandemic restrictions, labor and shipping shortages, rising demand and for energy costs, government policies that have cut access, have all contributed to a price situation that is unlikely to ease in the coming months.

NFP and wages

The labor shortage in the US has taken many policy makers and analysts by surprise. There were just shy of 11 million unfilled positions in July and around five million workers missing from the Nonfarm Payroll in comparison to the total from before the pandemic.

Worker reluctance has been blamed on the continuing pandemic, vaccination mandates, excessive unemployment benefits and an underground shift in labor markets that has not registered in official statistics.

While the cause may be puzzling, the effect of the labor shortage is not. Employers in many fields have been forced to offer higher wages and in some cases signing bonuses, all inflationary, to find workers. In businesses from restaurants to automobiles the lack of workers has inhibited production, sales and profits.

Annual Average Hourly Wage increases have been rising steadily this year. From 0.4% in April to 4.6% in September. There is nothing on the labor horizon that predicts the increases will abate or reverse.

Average Hourly Earnings

FXStreet

Conclusion

Markets are keenly aware that price increases are again playing a part in Fed policy even if the rhetoric is muted.

The Federal Reserve may have thought its switch to inflation-averaging from inflation-targeting would alleviate potential policy pressures from inflation.

It has not. Inflation is a very public drag on consumption at a time when the economy needs all the spending families can muster.

Job creation in August and September was far weaker than expected. The economics of 11 million empty positions and five million unemployed are poorly understood.

After 18 months of citing the labor recovery as its chief goal, caution would seem to be the Fed’s logical choice.

Yet markets are convinced that the Fed will begin its bond reductions in short order, ignoring the faltering job market.

The credit markets tell the story. As inflation rises so should Treasury yields and the dollar.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Joseph Trevisani

FXStreet

Joseph Trevisani began his thirty-year career in the financial markets at Credit Suisse in New York and Singapore where he worked for 12 years as an interbank currency trader and trading desk manager.

-637695601265325708.png&w=1536&q=95)