US Consumer Price Index January Preview: Can consumer demand spur prices?

- Inflation to remain muted with little change in January.

- Headline annual CPI to rise, core to fall.

- Fed inflation averaging policy has obviated market interest.

Inflation is expected to remain quiescent in January with consumer prices moving in the narrow range of the last six months.

The Consumer Price index (CPI) s forecast to rise 0.3% on the month and 1.5% on the year after December's 0.3% and 1.4% gains. Core CPI is projected to add 0.2% and 1.5% following 0.1% and 1.6% prior.

Core CPI

In the half-year from July CPI has averaged 1.25% with a range of 1% to 1.4% but after July's low reading the variation has been from 1.2% to 1.4%.

The core rate has been even more restricted with an average of 1.63% and a choice of either 1.6% or 1.7%.

The pandemic lockdown of the US economy in March and April collapsed annual CPI from 2.3% in February and 1.5% in March to a low of 0.1% In May. Core CPI dropped from 2.4% in February to 1.2% in May and June.

Since the recovery from the depths of the economic shutdown inflation, as above, has remained substantially below the rates in the second half of 2020, 2.3% for annual Core CPI and and 1.9% for CPI.

Shutdown support

The extraordinary Fed rate and quantitative easing policies, fed funds at a 0.25%% upper target and $120 billion in monthly asset purchases instituted in March, were designed to support the economy and provide the best financial conditions for recovery. They have not excited a surge in inflation. Considering the experience of the financial crisis none should have been expected.

Financial crisis and inflation

Its been more that decade since inflation has been a serious instigator for US monetary policy. The slow recovery from the 2008 financial crisis kept the Federal Reserve liquidity spigots wide open for almost six years. Although the Fed paid rhetorical attention to inflation in those years, its return was forever just over the horizon, the main purpose of monetary policy, as in the current economy, was to backstop growth and employment.

When the Fed Governors ended quantitative easing purchases in October 2014 after accumulating $4.5 trillion in assets it was not because inflation was threatening the economy but because the Fed desperately wanted to normalize rates.

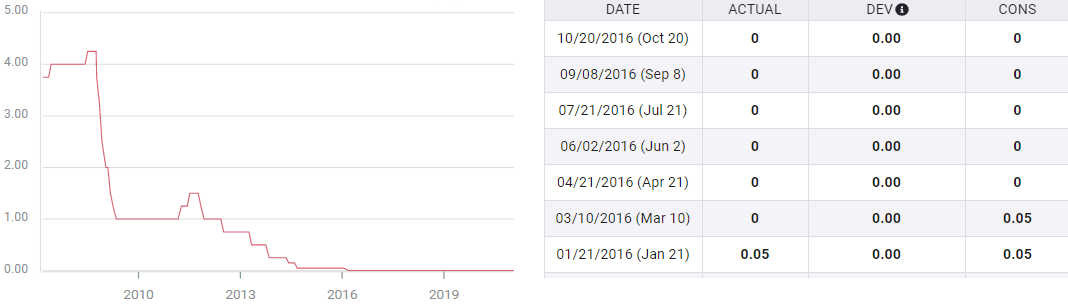

Fed funds rate

FXStreet

It was the achievement of the Fed under Janet Yellen and Jerome Powell to have brought the base rate back to 2.5% by December 2018, despite lacking the standard triggers for an tightening policy, inflation and an overheating economy. The wisdom of their efforts took barely a year to become obvious. When the pandemic struck the Fed cut 225 basis points. The ECB could do nothing. The main-refinance rate had been at zero for four years.

Main-refinance rate

Inflation averaging

The Fed's official adoption of inflation averaging has a dual purpose.

First it takes dilutes the credit market focus on inflation. If the central bank is not going to increase rates in respond to a rise in inflation, then the bond market will not be so eager to get the jump on a potential Fed policy shift. Treasury and commercial rate will be more stable and easier to control with the purchase program.

Second, averaging acknowledges the Fed's primary interest in economic growth and the labor recovery. Inflation is a secondary goal, but it will not be allowed to jeopardize the primary purpose of monetary policy, to help restore the economy.

Conclusion

Inflation and its two US measures, CPI and PCE, have become the dead letters of monetary policy. Although no change is expected in consumer prices, there would be no market impact even if there were. For the forseeable inflation will tell us more about consumer demand than Federal Reserve policy.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Joseph Trevisani

FXStreet

Joseph Trevisani began his thirty-year career in the financial markets at Credit Suisse in New York and Singapore where he worked for 12 years as an interbank currency trader and trading desk manager.