US Consumer Price Index: Falling real wages and the Fed’s credibility problem

- The Consumer Price Index soars 6.2% in October, fastest since December 1990.

- Core prices, minus food and energy costs, climb 4.6%, the most since November 1990.

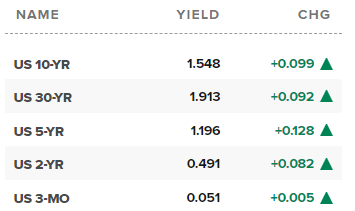

- Treasury yields and the dollar jump, fed funds futures move toward three hikes in 2022.

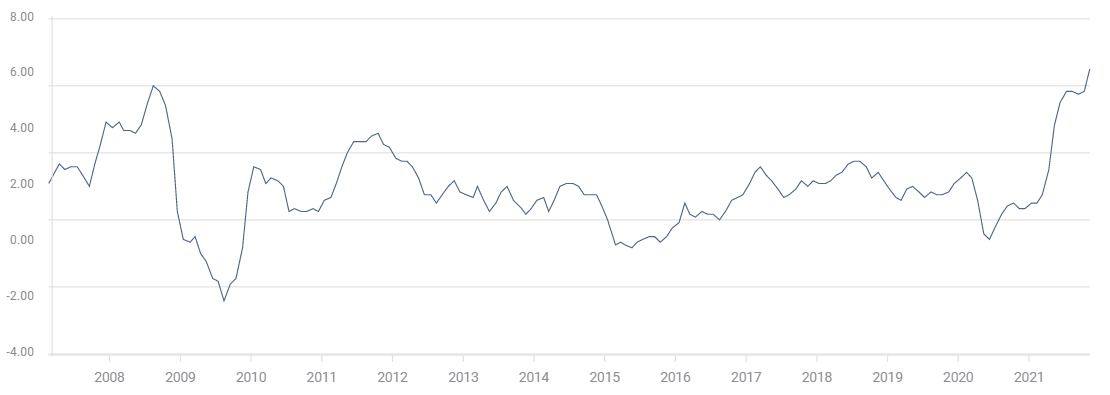

Inflation became more than a headache for American consumers as prices for a wide spectrum of everyday goods rose at their fastest pace in more than 30 years.

The Consumer Price Index Index (CPI) jumped 0.9% in October and was 6.2% higher than a year ago, reported the Labor Department on Wednesday. This compared to forecasts from the Reuters survey of economists of 0.6% and 5.8% and September’s increases of 0.4% and 5.4%.

CPI

Core inflation, which excludes food and energy prices on the logic that their volatility is often transitory, soared 0.6% for the month and 4.6% in the year, also the highest pace since 1990, following 0.2% and 4% increases in September.

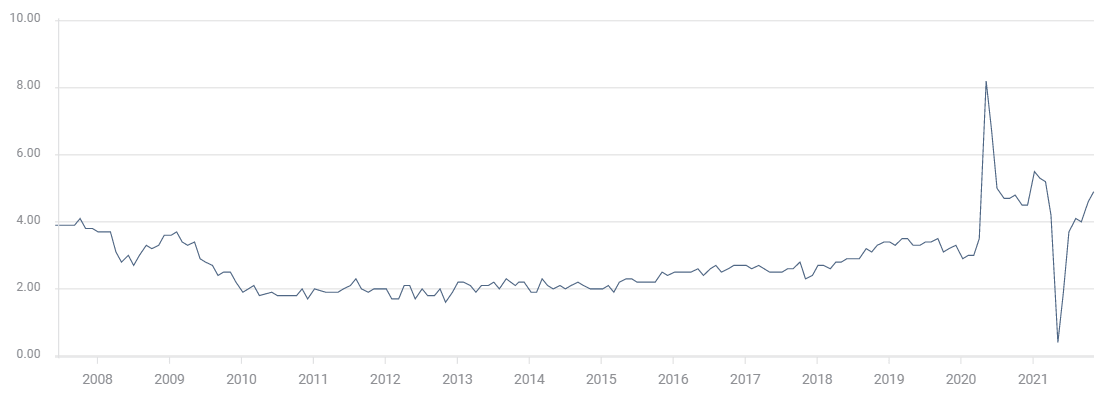

Analysis: Wages lose ground to inflation

Wherever consumers look, from gasoline and fuel oil with winter on the way, to food, cars and housing, everything is more expensive.

Food costs climbed 0.9% in October and are up 5.3% since last October. Staples like meat, poultry and eggs are 1.7% more costly on the month and 11.9% on the year.

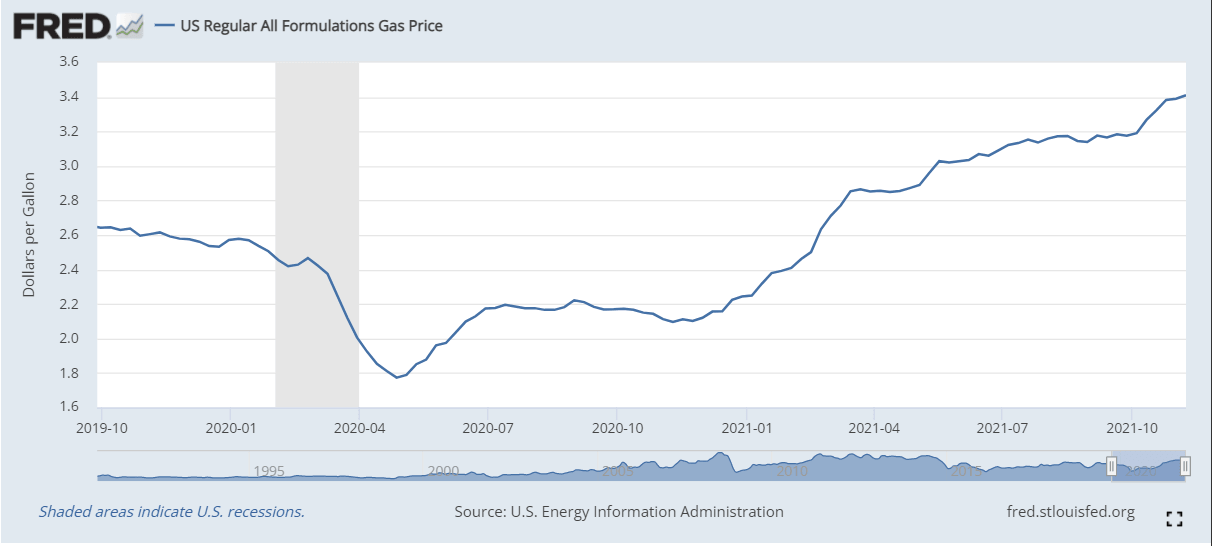

Fuel oil for heating, used mainly in older homes in the Northeast, rose 12.3% in October and is up 59.1% year over year. Gasoline, a necessity for the vast majority of Americans, soared 6.8% last month and is 60% higher since October 2020.

New automobile prices were 1.4% higher for the month and 9.8% over the year. Used car prices climbed 2.5% and 26.4% respectively, driven higher by a scarcity of many new models due to the computer chip shortage.

Housing expenses, including home and rental costs, rose 0.5% in October and are 3.5% higher on the year. These prices comprise about one-third of the CPI calculation. Because rental and mortgages are long term contracts, increases in this category become permanent additions to household expenses.

Average Hourly Earnings rose 4.9% for the year in October and 0.4% in the month. At a 6.2% annual inflation rate and 0.9% monthly, the purchasing power of wages fell 1.3% and 0.5% in the respective periods.

Average Hourly Earnings

When consumers see their real income (wages minus inflation) drop month after month as inflation erodes buying power, the demand for compensatory wage increases can rise proportionally. When combined with the higher salaries already offered by many employers in an effort to secure scarce workers, the wage side of a wage-price spiral can become much more emphatic.

Market response

Treasury yields were sharply higher after the CPI data and continued to rise throughout the day.

US Treasury yields

CNBC

By early afternoon the 10-year yield had added 10 basis points to 1.546%. The 5-year yield had climbed 12 points to 1.188% and the 30-year was trading at a 1.908% yield, up 9 basis points.

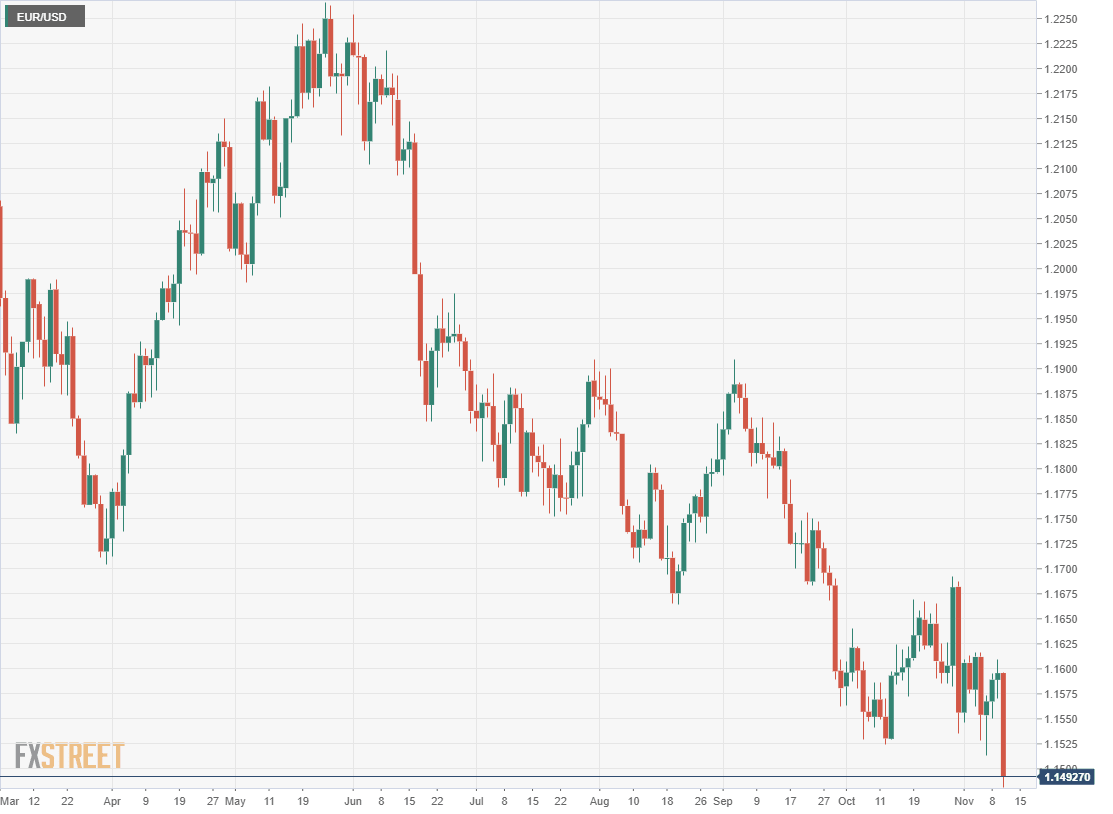

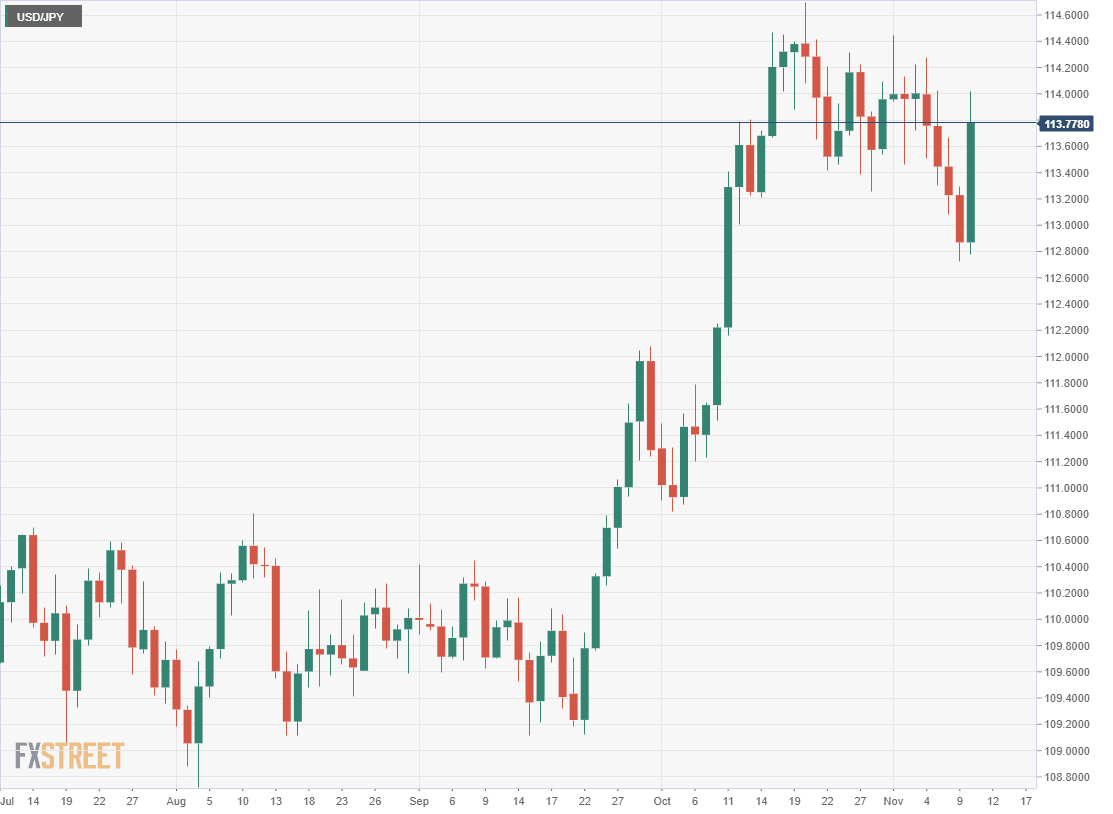

The dollar was higher in every major pair. The euro dropped below 1.1500 for the first time since July 2020 and the USD/JPY briefly rose above 114.00 while the sterling fell more than a figure to 1.3432.

All three major equity averages lost ground, with the Dow down 254.54 points, 0.70% to 36,065.54 in the late afternoon and the S&P 500 off 0.97% 45.51points to 4,6439.74. The NASDAQ was lower by 304.05 points, 1.91% to 15,582.50.

Fed policy

The October CPI data, which presages the Personal Consumption Expenditure (PCE) Price Index data at the end of the month complicates Fed policy enormously. The Core PCE Price Index, the Fed's preferred measure, has mirrored the gains in CPI. The September PCE rates of 4.4% in headline and 3.6% for core were the highest on record and should increase when the October data is released by the Bureau of Economic Analysis on November 24.

Central bank and government policymakers have maintained for several months that price gains will be limited and temporary. That assertion has become increasingly hard to credit when CPI has more than quadrupled from 1.4% in January to October’s 6.2% and has averaged 5.5% for six months. It is even more difficult to believe when one of the major factors in the surge in CPI is the increase in costs for the long term contracts in the housing market.

When the Fed announced its long-awaited bond taper at this month's Federal Open Market Committee (FOMC) meeting, the $15 billion monthly reduction was specified for November and December only.

The FOMC statement said that while the committee expected that the cuts would continue, the decisions for next year would be determined by economic conditions.

Chair Jerome Powell has been at pains over the last several months to assure that a reduction in the bond program, even to its demise this coming June, does not mean a fed funds rate hike is imminent.

That condition has become harder to believe. In the September Projection Materials the Fed governors estimated that the fed funds would likely get one 0.25% hike next year.

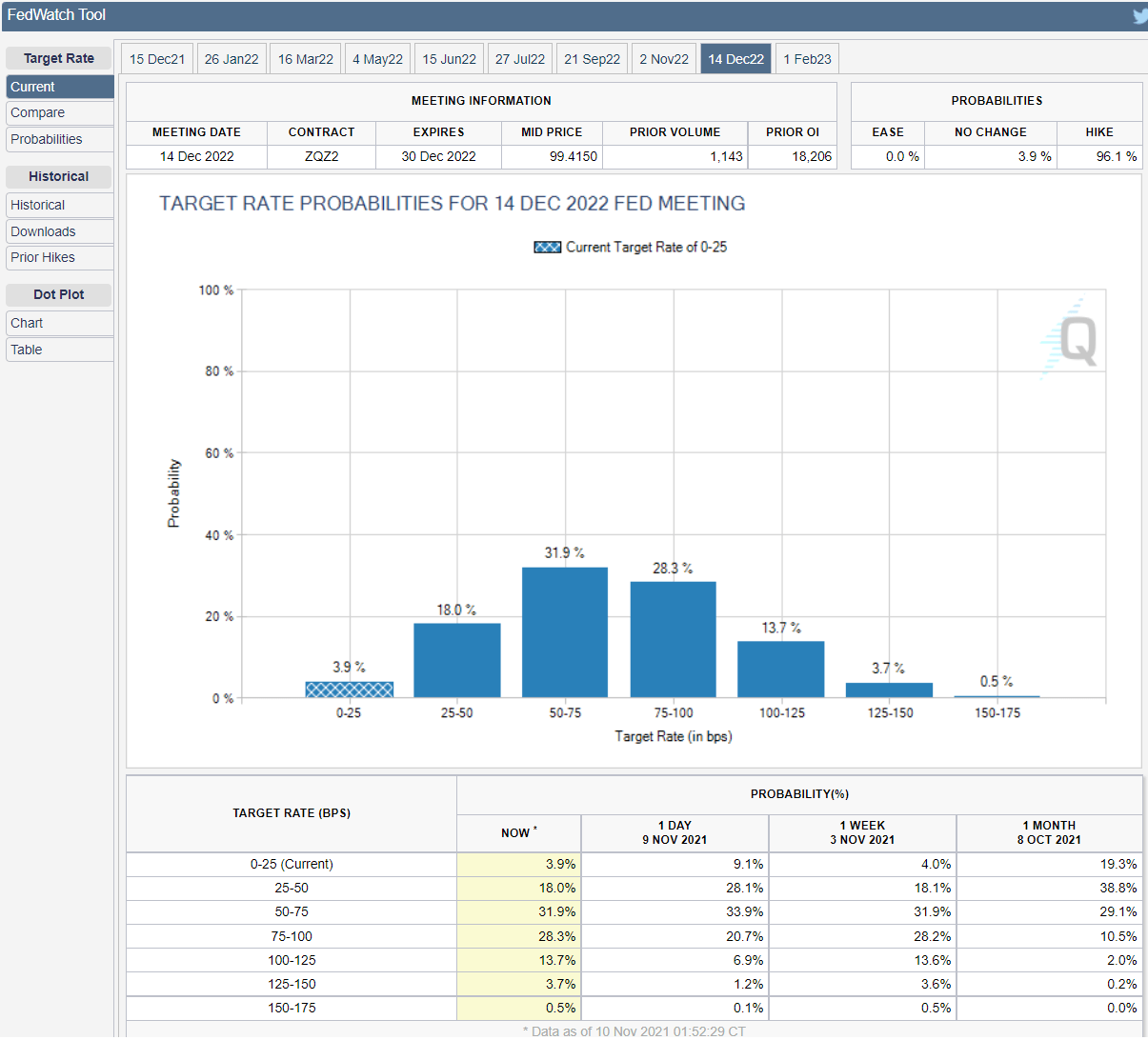

Predictions from the Chicago Board Options Exchange (CBOE) compiled from futures accounts in the fed funds show a very different picture.

The first 0.25% increase is expected at the June 15 meeting. A second hike is expected at the November 22 FOMC and the final meeting of the year on December 14 currently has a 49% chance of a third hike.

CBOE

The Federal Reserve has spent almost two years focusing its monetary policy on the US labor market. Even though US payrolls remain several million below their pre-pandemic levels, the Fed now finds that its rate policy is being set by its old nemesis, inflation.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Joseph Trevisani

FXStreet

Joseph Trevisani began his thirty-year career in the financial markets at Credit Suisse in New York and Singapore where he worked for 12 years as an interbank currency trader and trading desk manager.